Best Way To Leave Money In A Will

If you gift more than the excluded amount you are taxed on the amount over 15000 per person. In any event the child will still receive the full amount at legal age.

How To Leave Your Kids Or Spouse Money Without A Will

If you want to make sure your children use the money wisely consider putting it in trust with a few strings attached.

Best way to leave money in a will. A bequest is a sentence in either your will or trust stating the amount youd like to leave to the charity identifying the specific charity to receive the amount and stating the purpose for which. Aside from supporting a cause you believe in there can be tax advantages to giving your money away. If you leave more than 10 of your estate to charity then the inheritance tax rate on your remaining estate will fall from 40 to 36.

Next decide how you want your children to receive their inheritances. Two common kinds are incentive trusts which might say for instance that an heir must earn a degree or pass a drug test before inheriting or staggered trusts which let your estate be paid out over a certain time span. Second-to-die life insurance is one of easiest ways and most cost effective ways to supplement special needs trusts says Haddad.

Taking a systematic approach and giving yourself time to think it through is the best way to make bequests in your will. Many people choose to leave some of their estate to charity when they pass away. So if you gave your granddaughter 25000 you would owe taxes on 10000 of it.

You can also decide when your children will inherit. By the Solicitors Regulation Authority SRA will provide extra protection as they are required to act in your best interests. Review state law with your estate planner if creditor protection is a goal.

Retirement plans ask you to name a beneficiary. You pay a small amount in premiums and get a. You have several options from which to choose.

How to leave money to charity in your will. There are broadly five types of legacy you can leave. So if you want to leave money to your family and donate to charity talk to a.

Leave something that says I love you all equally. You might want the trust located in a state with stronger protection. Use a trust to eliminate uncertainty.

Putting a trustee in place. I leave my jewellery to my daughter this is. Finally make sure you talk to your solicitor when it comes time to draw up a legally valid will or estate plan.

How to leave money to who YOU want - with a cast-iron will after landmark court ruling that overturned wishes. As non-profits they wont pay taxes on any legacy you leave them. The purpose of a life insurance policy is to provide someone with money upon your death.

One of the best ways to ensure your money stays in the family is to simply give it to your heirs while youre alive. But if the amount is significant say 10000 or more court approval may be required. You may prefer to leave more to your grandchildren and future generations through a trust or make a generous contribution to a charity.

Think about how you want to split your money and property when making your will. Talk to the executor If youre not the executor of the estate find out who is and talk to them. Here is why I am doing the distributions the way I am 5.

This is called an annual exclusion. If you want to influence either the timing of the inheritance or the way it gets spent youll need to use a trust. Or you might just want to help local or national causes.

Historically couples would leave their estate equally between their children at a set age. When it comes to financial planning and wills parents are increasingly realising that leaving their entire estate to their children in one fell swoop might not be the wisest move. If you are married you and your spouse can each give a gift for a total of 30000 without taxation.

But if youve been left money in a will there are a few steps to take to get that money. As of 2020 the IRS allows individuals to give up to 15000 per person per year. I leave 2000 to my son this is called a pecuniary bequest.

Australian Seniors offers cost-effective insurance that is designed specifically for the needs of Australians. A better option is to set up a childrens trust in your will and name someone to manage the inheritance instead of the court. By Rosie Murray-west Financial Mail on Sunday.

At the very least write a note to go with the will she says. It means you leave a fixed sum of money. 5 ways to leave your family money outside of your will 1.

The money is safe as long as it is in the trust.

The Best Way To Leave An Inheritance Mutual Funds Us News

The Best Way To Leave An Inheritance Mutual Funds Us News

Four Ways To Disinherit Family Members Kiplinger

Four Ways To Disinherit Family Members Kiplinger

Why You Need A Will And The Importance Of Estate Planning Ppt Download

Why You Need A Will And The Importance Of Estate Planning Ppt Download

Money Mistakes That Will Leave You Broke How To Get Money Money Mindset Money

Money Mistakes That Will Leave You Broke How To Get Money Money Mindset Money

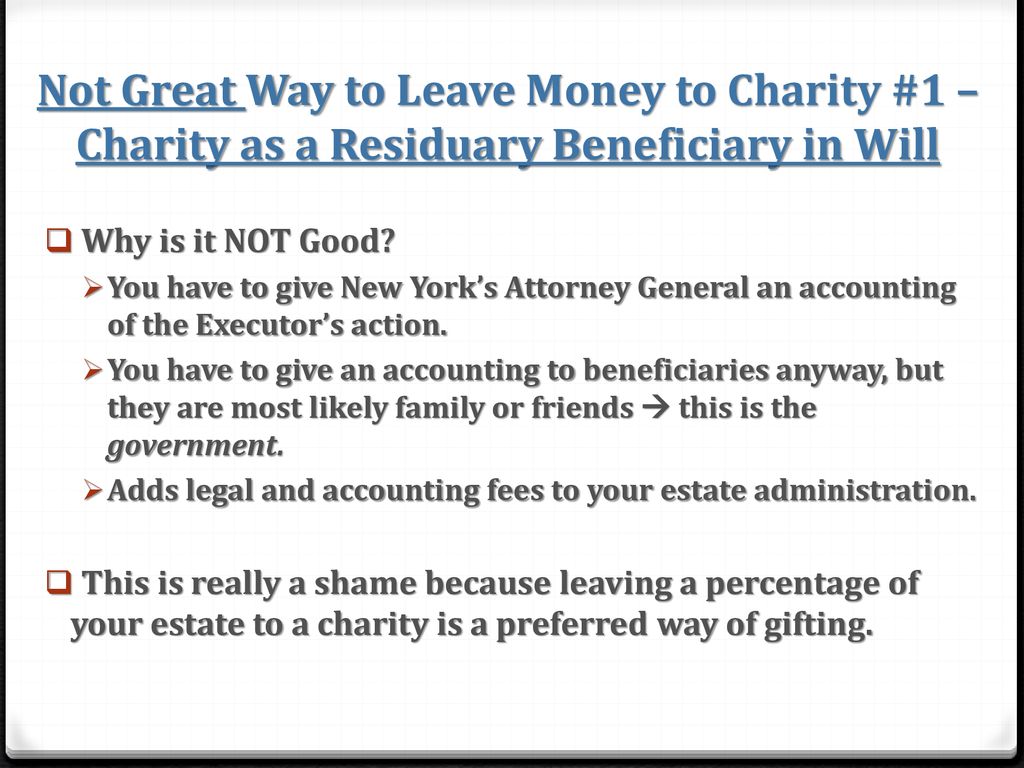

The 4 Ways And Best Way To Leave Property Using Your Will And Trust Law Offices Of Daniel Timins

The 4 Ways And Best Way To Leave Property Using Your Will And Trust Law Offices Of Daniel Timins

What S The Best Way To Leave Money To My Children And Grandchildren Wealth Preservation Solutions

What S The Best Way To Leave Money To My Children And Grandchildren Wealth Preservation Solutions

What S The Best Way To Leave A Legacy In A Will For Conservation Causes Environment The Guardian

What S The Best Way To Leave A Legacy In A Will For Conservation Causes Environment The Guardian

Why You Need A Will And The Importance Of Estate Planning Ppt Download

Why You Need A Will And The Importance Of Estate Planning Ppt Download

Estate Planning How To Leave Money To Your Kids Money

Estate Planning How To Leave Money To Your Kids Money

Money Mistakes To Avoid That Will Leave You Broke How To Get Money Money Mistakes

Money Mistakes To Avoid That Will Leave You Broke How To Get Money Money Mistakes

The Best Way To Pass On Your Inheritance

The Best Way To Pass On Your Inheritance

Writing A Will How To Leave Money With Strings Attached Lovemoney Com

Writing A Will How To Leave Money With Strings Attached Lovemoney Com

What Is The Cost Of Writing A Will

The Best Ways To Leave Your Wealth To Your Heirs Yield Hunting

The Best Ways To Leave Your Wealth To Your Heirs Yield Hunting

Comments

Post a Comment