How To Figure Out Tax On An Item

Your math would be simply. Tax 20000 times 5 20000 times 005.

How To Figure Out And Calculate Sales Tax Math Wonderhowto

How To Figure Out And Calculate Sales Tax Math Wonderhowto

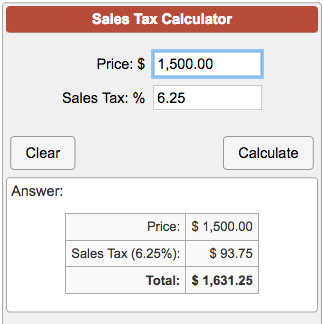

To calculate sales tax of an item simply multiply the cost of the item by the tax rate.

How to figure out tax on an item. So thats a 7 sales tax. You buy a car for 20000 dollars and pay 5 in tax. Some states exempt certain items from sales tax.

Subtract the Tax Paid From the Total Subtract the amount of tax you paid from the total post-tax price of the item. Do not collect tax on tax-free items during a sales tax holiday. Convert the Tax Rate to a.

The item is exempt from sales tax. How to calculate tax. Explanation of the calculation.

So say your final sale cost 107 and the item you bought was 100. You do this by taking the final post-tax sales price of an item subtracting the pre-tax price of the item from it and dividing the whole thing by the pre-tax price of the item. For example the UK has three VAT rates.

In the case of shipping a womans T-shirt to the UK its 20 because clothing for adults falls under the standard VAT. Thats 107 100 which is 7 divided by 100 which is 007. 0 5 and 20 which is the standard rate for most goods and services.

Divide the Tax Paid by the Pre-Tax Price Divide the amount of tax you paid by the pre-tax price of the books. First we take the price of the product 75 And we add the calculation of the amount of tax for this product 7516 Of course you have noticed that you have 2 times the value 75 in the formula. Dont confuse this with a companys provision for income taxes which is a balance sheet account.

Thats 100 x 05 5. When you calculate the sales tax amount for a single taxable item the total sales price is the price listed on the product. Cost of the item x percentage as a decimal sales tax.

2675 175 25 Divide the tax paid by the price of the item before tax The result you would get is the tax rate of the item youve paid and its expressed as a decimal value. The cost with tax is 20000 1000 21000. First you need to find out the sales tax VAT rates of the country youre shipping to.

Since youve figured out the sales tax is 5 that means the total youll pay is 105. Take your state or municipalitys current sales tax rate and write it down. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate.

You can find your sales tax rate with a sales tax calculator or by contacting your state taxing authority. If your local sales tax rate is 85 then you would charge 85 sales tax on all transactions. How to Figure Sales Tax When its Included in Price Step 1.

For example you may have sold an. How much is tax. Total Sales Tax Cost of the Item 100 Sales Tax Percentage from Total If you knew you sold a 50 item with 505 in sales tax you would use.

Calculating the Tax Rate 1. Many states provide a day or weekend where consumers can shop without paying sales tax. For example a typical rate could be.

Tax 20000 times 005 1000 dollars. Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage. Generally your state will designate certain items that are tax free.

Figure your total sales writing down the total price of the item or items. There is a sales tax holiday. When you calculate the amount of sales tax a customer owes for the purchase of several goods or services add the listed sales price of each taxable item together to find.

This is as long as the item youre selling is subject to sales tax. You can find this income tax expense on the income statement. Therefore you can calculate the amount of the item before the tax or the pre-tax cost.

In other words if the sales tax rate is 6 divide the sales taxable receipts by 106. Its usually labelled income tax or income tax expense Its listed directly after pre-tax income.

How To Figure Out The Sales Tax Rate Rating Walls

How To Figure Out The Sales Tax Rate Rating Walls

4 Ways To Calculate Sales Tax Wikihow

4 Ways To Calculate Sales Tax Wikihow

How To Calculate Sales Tax From Total

How To Calculate Sales Tax From Total

4 Ways To Calculate Sales Tax Wikihow

4 Ways To Calculate Sales Tax Wikihow

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

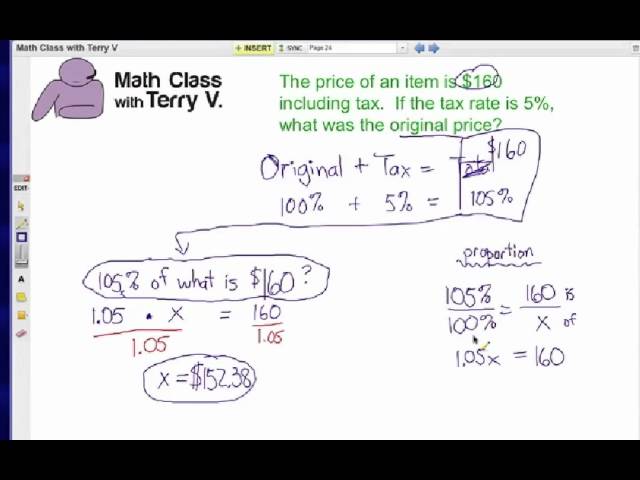

How To Find Original Price Tax 1 Youtube

How To Find Original Price Tax 1 Youtube

How To Figure Out And Calculate Sales Tax Math Wonderhowto

How To Figure Out And Calculate Sales Tax Math Wonderhowto

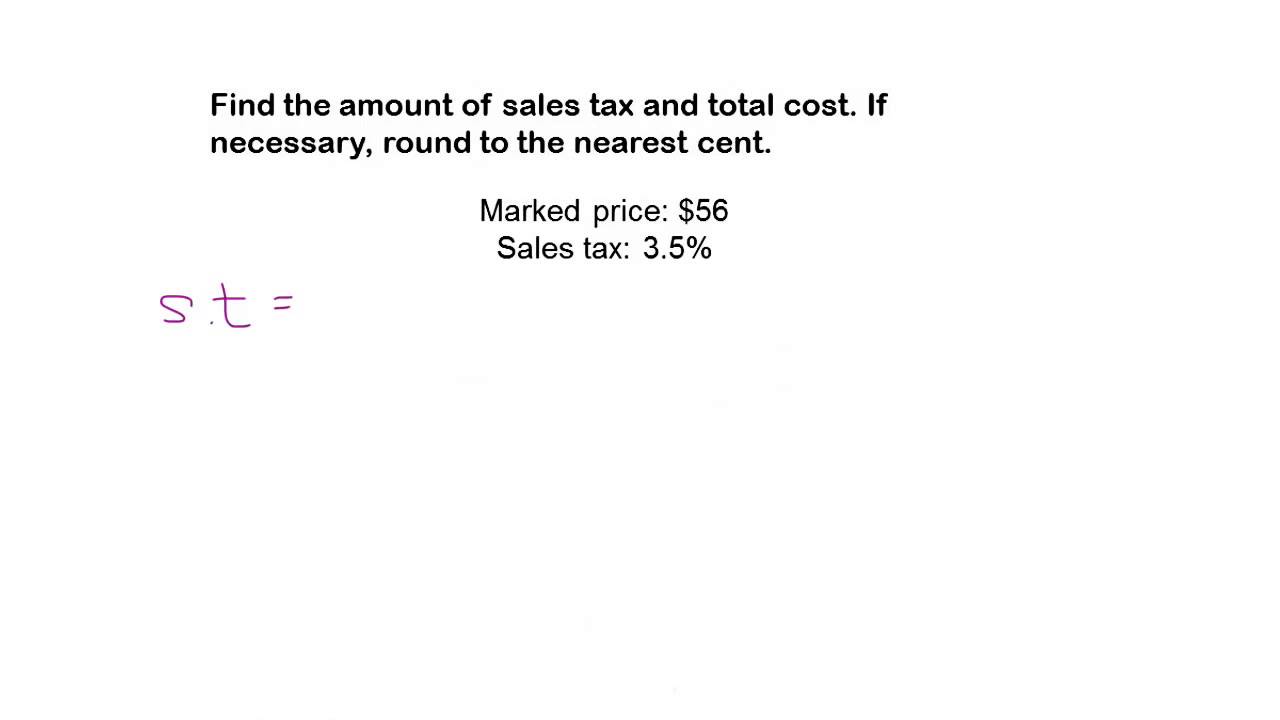

I Can Find The Discount And Sale Price Of An Item And Find The Tax And Total Price Of An Item After Taxes Ppt Download

I Can Find The Discount And Sale Price Of An Item And Find The Tax And Total Price Of An Item After Taxes Ppt Download

Figure Out Sales Tax Rate From Total Rating Walls

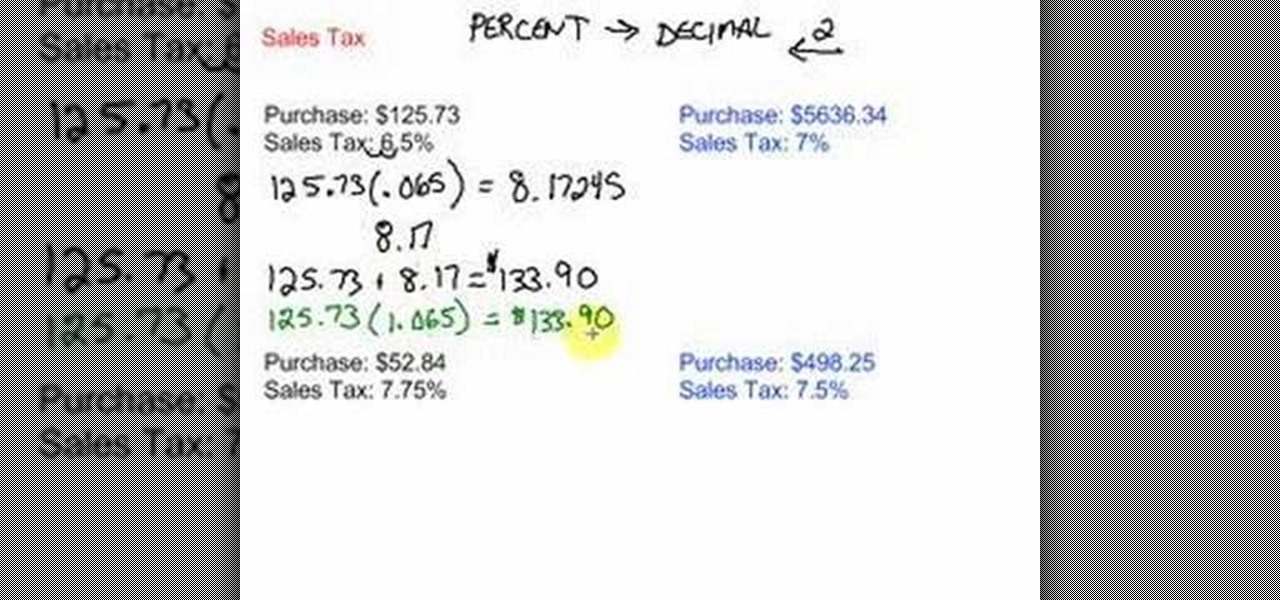

Consumer Math How To Compute Tax On An Item Youtube

Consumer Math How To Compute Tax On An Item Youtube

How To Calculate The Tax Of An Item Youtube

How To Calculate The Tax Of An Item Youtube

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

Ex Find The Sale Tax Percentage Youtube

Ex Find The Sale Tax Percentage Youtube

Comments

Post a Comment