Home Renovation Tax Credit

The amount of money they get back for these expenses is calculated as 10 of the eligible expenses claimed. Here are some key facts to know about home energy tax credits.

Some equal a home renovation tax credit which lowers your tax bill directly while others come with a tax deduction allowing you to reduce your taxable income accordingly.

Home renovation tax credit. Some of these credits are non-refundable so the tax credit can only be used to reduce taxes owing in the current taxation year. Claim certain credits your tax return and you may be able to get a larger refund while others. WCDA is the states leading resource for housing finance.

Business Credits and Deductions. Credits can reduce the amount of tax you owe. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through December 31 2021.

Find credits and deductions for businesses. The tax credits for residential renewable energy products are still available through December 31 2021. Eligible expenses include the cost of labour and professional services building materials fixtures equipment rentals and permits.

You must apply for this tax credit during the tax year that you have them installed. The new tax credit is estimated to cost 124 million over two years. Renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step.

For example if you spend 20000 on installing new solar panels you would get a credit for 6000. Seniors and their families would be eligible for up to 2500 in a tax credit if they spend 10000 on home improvements to make their living space. The 30 tax credit applies to both labor and installation costs.

Renovating your home can be an expensive endeavor especially since you cant claim a federal tax deduction to defray the costs. How do I apply for HRI. How to claim the HRI Tax Credit When can I claim Home Renovation Incentive HRI.

Seniors who qualify can claim up to 10000 worth of eligible home improvements on their tax return. When a tax credit is refundable if the amount exceeds the tax otherwise payable in the year a refund will be issued. Deductions can reduce the amount of your income before you calculate the tax you owe.

There are no maximum limits on the amount refunded other than for fuel cells. The federal home renovation tax credit sometimes abbreviated as HRTC was introduced for the 2009 tax filing year. You must make your claim through the HRI online system.

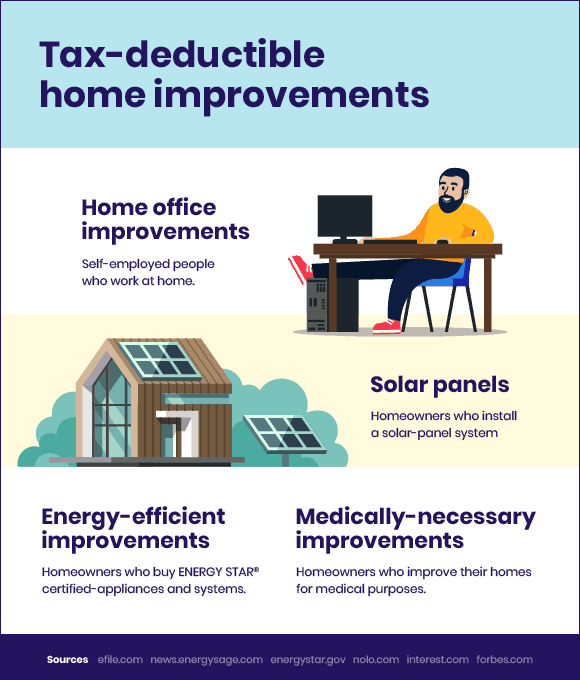

Home renovation tax credits allow homeowners a tax credit for eligible renovation costs. However home improvement tax deductions are available for making your home more energy efficient or making use of renewable energy resources such as solar panels. The New Brunswick Seniors Home Renovation Tax Credit is a refundable personal income tax credit for seniors and family members who live with them.

Homeowners who spent between 1000 and 10000 on eligible renovations between January 27 2009 and February 1 2010 received a 15 non-refundable tax credit on the portion of expenses exceeding 1000. However if your home-renovation projects include the installation of energy-generating equipment then you may get some relief by claiming a tax credit. You can claim for HRI from 1 January in the year after the qualifying work has been paid for.

The maximum amount of the credit is 1000 per tax year and is calculated as 10 of the qualifying renovation expense maximum 10000 in eligible expenses. For more information about the tax credit including more examples of eligible renovation expenses please visit wwwsaskatchewancahome-renovation-tax-credit or call 1-800-667-6102 toll free or email sasktaxinfogovskca-30-For more information contact. For over 40 years Wyoming Community Development Authority has been making it easier for people across Wyoming to finance their first home.

No you cannot deduct the expense of home improvement using a home renovation tax credit. Claim Federal Tax Credits and Deductions. Federal Home Renovation Tax Credits.

Because home renovations increase the basis in your home they can help reduce the amount of your sale price that is counted as profit and therefore can potentially help get you under the home sale exemption to avoid capital gains altogether. The credit is a refundable tax credit which means if the credit is higher than the taxes you owe youll receive the difference as a refund. Under this non-refundable tax credit Saskatchewan homeowners may save up to 2100 in provincial income tax by claiming a 105 per cent tax credit on up to 20000 of eligible home renovation expenses.

The claim must be within 4 years after the year the qualifying work was paid for. We provide low-interest single family mortgages and education to. IRS Tax Tip 2017-21 February 28 2017 Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

What Is The Home Renovation Tax Credit Millionacres

What Is The Home Renovation Tax Credit Millionacres

New Tax Credit Makes Home Renovations More Affordable News And Media Government Of Saskatchewan

New Tax Credit Makes Home Renovations More Affordable News And Media Government Of Saskatchewan

Home Renovation Tax Video Youtube

Home Renovation Tax Video Youtube

Home Renovation Tax Credit Canada Home Improvement Tax Credit

Home Renovation Tax Credit Canada Home Improvement Tax Credit

Tax Deductions And Home Improvement Projects Taxact Blog

Tax Deductions And Home Improvement Projects Taxact Blog

Sask Home Reno Credit Novo Water Conditioning Products

Sask Home Reno Credit Novo Water Conditioning Products

Saskatchewan Home Renovation Tax Credit The Ultimate Deck Shop

Saskatchewan Home Renovation Tax Credit The Ultimate Deck Shop

What Is The Home Renovation Tax Credit Renovations Tax Credits Home Renovation

What Is The Home Renovation Tax Credit Renovations Tax Credits Home Renovation

Home Renovation Tax Credit Information Youtube

Home Renovation Tax Credit Information Youtube

What Is The Home Renovation Tax Credit Dream Kitchens Design Flatpack Kitchen Home Renovation

What Is The Home Renovation Tax Credit Dream Kitchens Design Flatpack Kitchen Home Renovation

/https://www.thestar.com/content/dam/thestar/life/homes/opinion/2020/08/14/home-renovation-tax-credits-can-help-kick-start-our-post-pandemic-economy/wilkes.jpg) Home Renovation Tax Credits Can Help Kick Start Our Post Pandemic Economy The Star

Home Renovation Tax Credits Can Help Kick Start Our Post Pandemic Economy The Star

Legislation Introduced To Create Home Renovation Tax Credit 650 Ckom

Legislation Introduced To Create Home Renovation Tax Credit 650 Ckom

Paint And Save With The Home Renovation Tax Credit Certapro Painters

Paint And Save With The Home Renovation Tax Credit Certapro Painters

Comments

Post a Comment