Rocket Mortgage Credit Requirements

Nontraditional mortgage loans are usually characterized by the following traits. And credit score is over 720 or in the case of certain Jumbo products we assume a credit score over 740.

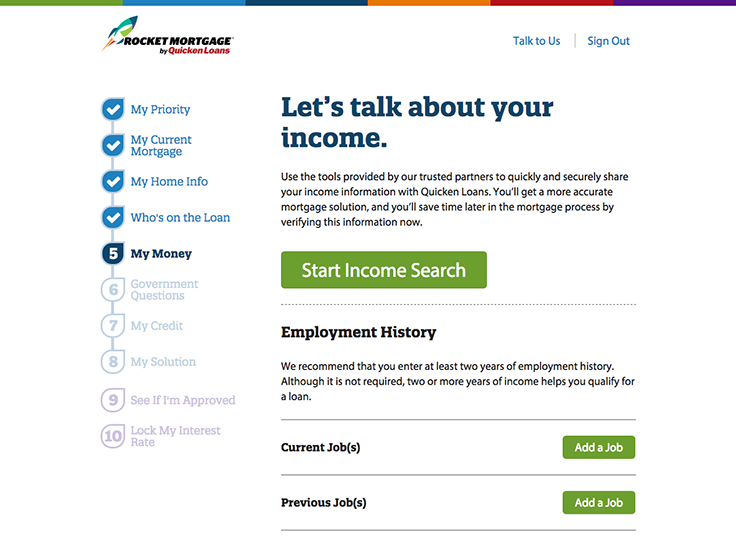

Rocket Mortgage Review Full Approval In Just 8 Minutes The Truth About Mortgage

Rocket Mortgage Review Full Approval In Just 8 Minutes The Truth About Mortgage

Rocket Mortgage requires a minimum credit score of 580 for FHA loans.

Rocket mortgage credit requirements. Debt-to-income ratio is less than 30. USDA Loan Requirements USDA loans are only for homes in eligible rural areas as determined by the US. They typically have a nonstandard amortization schedule.

Rocket Mortgage requires a minimum 620 credit score to proceed with a VA IRRRL. Rocket Mortgage allows credit scores starting at 580 for FHA loans. The credit requirement for VA loans depends on your lender.

What is the minimum credit score. There is no minimum FICO Score though to qualify for an FHA loan that requires a down payment of 10 or more. Other loan types have higher credit score requirements.

The first is your credit score. We assumed unless otherwise noted that. Youll need a minimum credit score of 580 to qualify for an FHA loan that requires a down payment of just 35.

Rocket Mortgage Application Requirements. If youre worried about qualifying for a refinance with your current credit there are strategies for. If you use Rocket Mortgage by Quicken Loans youll need a minimum credit score of 620.

Rocket Mortgage requires a minimum credit score of 580 to qualify. Power 2010 2020 tied in 2017 Primary Mortgage Origination and 2014 2020 Primary Mortgage Servicer Studies of customers satisfaction with their mortgage sales experience and mortgage servicer company respectively. How Does a Home Equity Loan Work.

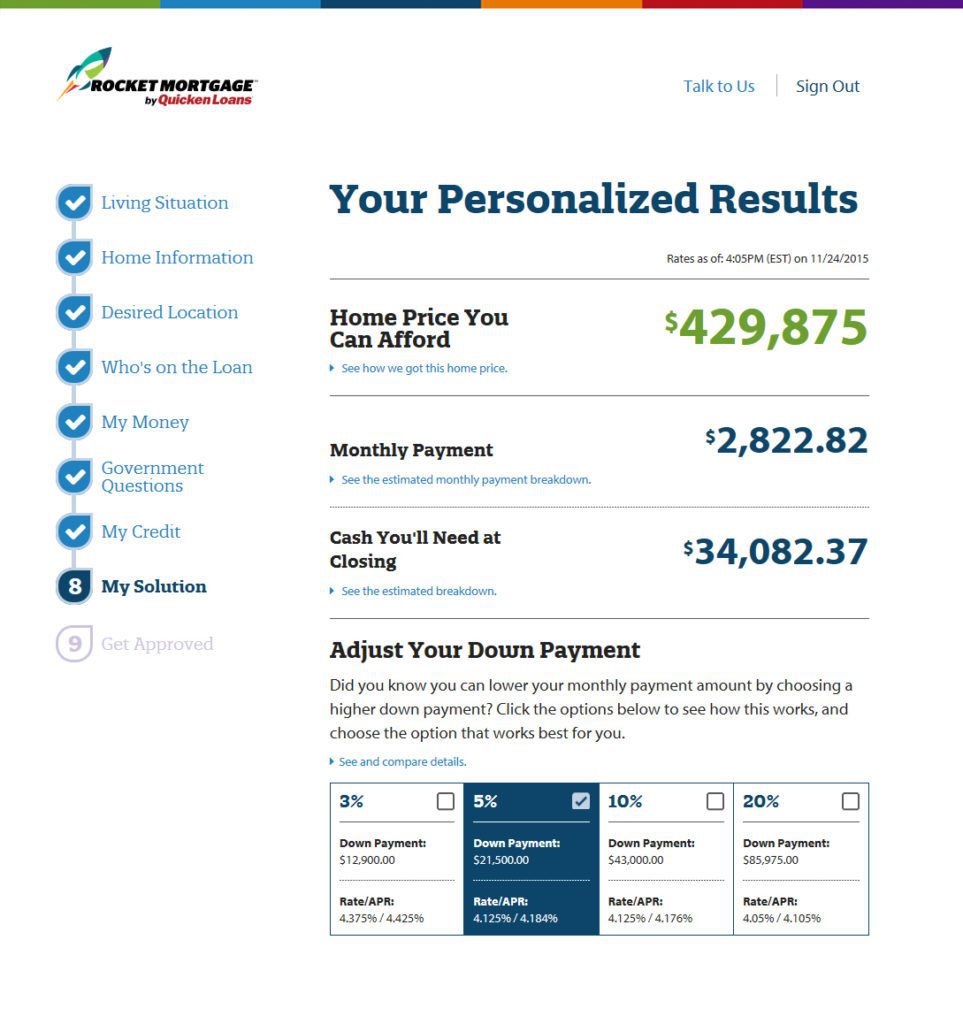

Power 2010 2020 tied in 2017 Primary Mortgage Origination and 2014 2020 Primary Mortgage Servicer Studies of customers satisfaction with their mortgage sales experience and mortgage servicer company respectively. Like any mortgage lender Rocket Mortgage makes a calculation based on the financial information you provide and import to determine the size of home loan you qualify for. Higher risk due to abnormal payment terms and lower credit score requirements.

There are a few basic application requirements to be aware of when considering a loan from Quicken Loans. Rockets minimum credit score is 620 for conventional and VA loans. Closing costs are paid out of pocket.

Any home owner can apply for a home equity loan. This is your primary residence and is a single family home. You only need to have a credit score of 580 in order to qualify for an FHA loan with Rocket Mortgage.

The maximum loan amount is based on where the property is located. This type of loan is available to anyone who owns their property. Rocket Mortgage Credit Requirements Applying for a home equity loan is similar but easier than applying for a new mortgage.

A mortgage calculator can help you estimate your monthly payments and you can see how your down payment amount affects them. You may be able to get an FHA loan with a score as low as 500 points if you can bring a down payment of at least 10 to your closing meeting. Good credit consistent income and plenty of savings will help.

Qualifications for Rocket Mortgage include a minimum credit score of 620 580 for FHA loans and borrowers would do well to keep in mind that they only look at credit scores and debt-to-income ratios not alternative credit data. Rocket Mortgage by Quicken Loans received the highest score in the JD. Minimum Credit Score Needed.

This calculation is based on your income your credit report and the amount of money you have saved in bank accounts or other types of assets. Rocket Mortgage Credit Requirements It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. And an escrow account for the payment of taxes and insurance.

Repayment terms may be flexible. Rocket Mortgage by Quicken Loans received the highest score in the JD. Learn more about Rocket Mortgage by Quicken Loans and how you could qualify for a home loan with this mobile-friendly mortgage lender.

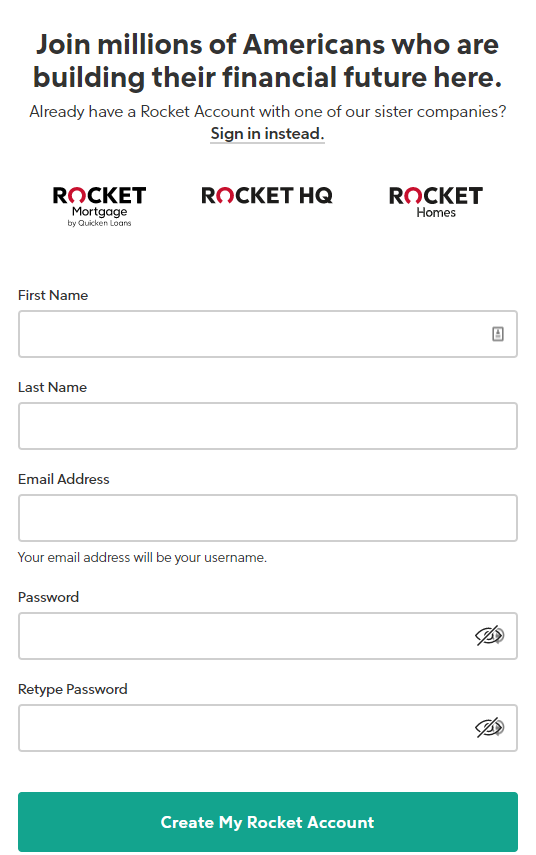

For rates customized to your situation create a Rocket Mortgage account and provide some information to get a personalized rate but remember viewing those rates may involve a hard credit. Its important to note that Rocket Mortgage does not offer these types of loans. Characteristics Of A Nontraditional Mortgage.

What Is Rocket Mortgage Quicken Loans

What Is Rocket Mortgage Quicken Loans

Get Approved To Buy A Home Rocket Mortgage Quicken Loans

Get Approved To Buy A Home Rocket Mortgage Quicken Loans

How To Get A Mortgage A Step By Step Guide Rocket Mortgage

How To Get A Mortgage A Step By Step Guide Rocket Mortgage

Rocket Mortgage Review 2020 Smartasset Com

Rocket Mortgage Review 2020 Smartasset Com

Fintech For Business Quicken Loans And Rocket Mortgage Review 2016

Fintech For Business Quicken Loans And Rocket Mortgage Review 2016

Fha Loans Requirements Limits And Rates Rocket Mortgage

Fha Loans Requirements Limits And Rates Rocket Mortgage

Rocket Mortgage Review Full Approval In Just 8 Minutes The Truth About Mortgage

Rocket Mortgage Review Full Approval In Just 8 Minutes The Truth About Mortgage

Rocket Mortgage Review 2020 Smartasset Com

Rocket Mortgage Review 2020 Smartasset Com

Frequently Asked Questions Rocket Mortgage

Rocket Mortgage Home Buyer Review Rethority

Rocket Mortgage Home Buyer Review Rethority

Quicken Loans Launches Rocket Mortgage Inman

Quicken Loans Launches Rocket Mortgage Inman

Quicken Loans Mortgage Review 2020 Smartasset Com

Quicken Loans Mortgage Review 2020 Smartasset Com

Product Review Rocket Mortgage S Instant Mortgages As I Learn

Product Review Rocket Mortgage S Instant Mortgages As I Learn

Comments

Post a Comment