Can You File State Taxes Without Filing Federal

Individual Tax Returns by State. Although state returns can be e-filed with your federal return or after your federal return has already been accepted its no longer possible to e-file state returns before the federal.

When Can You File Your Taxes This Year Hint It S Very Soon Kiplinger

When Can You File Your Taxes This Year Hint It S Very Soon Kiplinger

If you have already filed a federal return elsewhere it is recommended that you file your state returns with that provider as well.

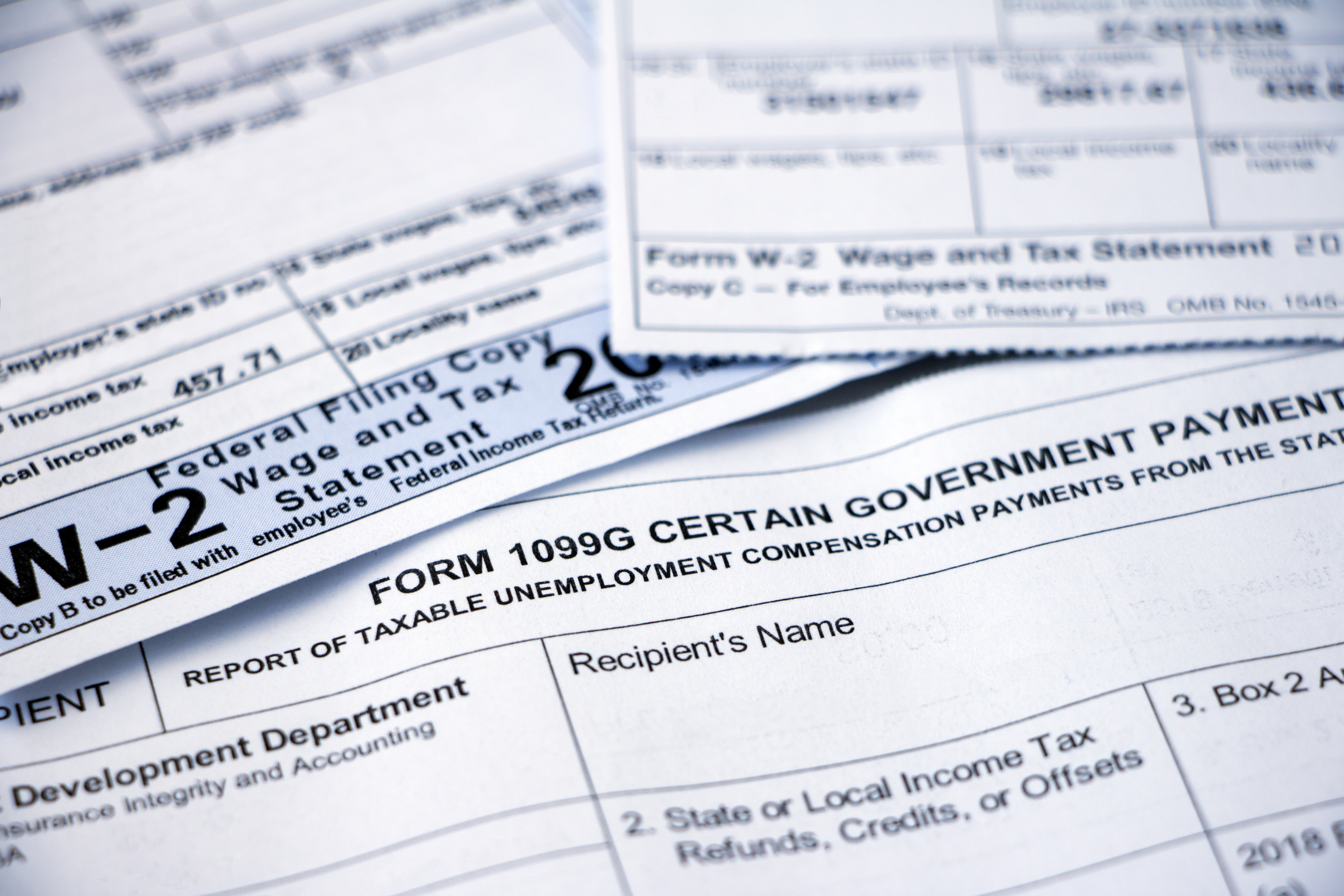

Can you file state taxes without filing federal. Addresses by state for Form 1040 1040-SR 1040ES 1040V amended returns and extensions also addresses for taxpayers in foreign countries US. However its perfectly legal to file a tax return showing zero income and this might be a good idea for a number of reasons. Tax Deadlines Changed The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021.

However if youre wondering if you can file your state taxes before your federal taxes we can help you understand your options. If you want to file just a federal return and not file a state returns you need to make sure that your state returns are not selected for electronic filing at the time of filing your return. Usually federal and any state returns should be filed at the same time.

Any year you have minimal or no income you may be able to skip filing your tax return and the related paperwork. You can but your e-filed federal return will need to be accepted before you can e-file your state or you can just paper-file your state return later. Find out whether you have to file how to file where to file how to get an extension of time to file and more.

If you make less than 69000 a year you can find free tax filing options at the IRS Free File webpage. There are options from TurboTax HR Block TaxSlayer and others. You can file them separately.

If you filed your federal return with us. You can only e-file a state return on FreeTaxUSA if you also e-file your federal return on FreeTaxUSA. Get details on the new tax deadlines and on coronavirus tax relief and Economic Impact Payments.

But there are a few ways to get your state tax return done for free. Also in an effort to combat tax return identity fraud theft in cooperation with the state revenue authorities it is not possible in TurboTax to e-file just a state tax return alone without an accompanying e-file federal tax return. Here are two ways to skip your state in TurboTax Online.

If you need additional time to file beyond the May 17 deadline you can request a filing extension until October 15. Possessions or with other international filing characteristics Alabama. Although state returns can be e-filed with your federal return or after your federal return has already been accepted its no longer possible to e-file state returns before the federal.

You may also go to the state website for assistance. Your account will still be charged the federal tax preparation fee if any when filing a State Only return. They are taking this measure to add an extra layer of security to all e.

This is because of the tax data on a Federal is to a great degree identical to that of a state tax return. Filing taxes for most taxpayers in most states means filing a federal and a state return. You can file any number of state returns with your federal return or after it has been accepted.

As you have probably noticed many places offer a free filing of a Federal return but dont offer free state filing. If your federal hasnt been accepted or you printed and mailed it you wont be able to e-file your state but you can print and mail a paper return. Thus despite New Yorks mandate for e-filing you are left with a couple of reasonable choices.

This adds an extra layer of security to all e-filed state returns. Delete your state return file your federal return now and then come back later to re-do your state return. The deadlines to file and pay most federal income taxes are extended to May 17 2021.

Although you can e-file your federal and state taxes together if you choose to e-file your federal first youll have to wait until that return has been accepted before you can e-file your state. If you live or earn money in one of the other 41 states or the District of Columbia you may need to file a state income tax return by the filing deadline. If you have already filed a federal return elsewhere it is recommended that you file your state return s with that provider as well.

From the My Account screen of your account click on the E-file tab located on the navigation bar. Yes to only file a state return you will need to mail your state return. If you did file your federal return previously using our program and it has been accepted you may file your state return at a later time.

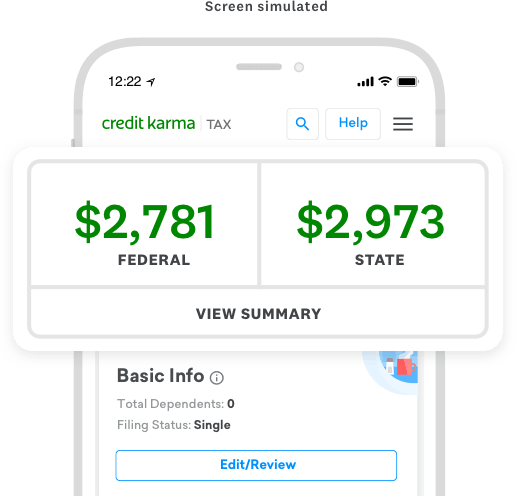

It is a separate and independent requirement from filing your federal tax return and failure to file it on time may result in interest and penalty charges. Credit Karma Tax My Top Pick. You may also go to the state website for assistance.

2020 State Income Tax Return Prepare Online On Efile Com

2020 State Income Tax Return Prepare Online On Efile Com

Do I Have To File State Taxes H R Block

Do I Have To File State Taxes H R Block

/tax-documents-to-the-irs-3973948-v1-c43621daf8d548328ec95b4f53fd75ff.png) How To Mail Your Taxes To The Irs

How To Mail Your Taxes To The Irs

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

2020 State Income Tax Return Prepare Online On Efile Com

2020 State Income Tax Return Prepare Online On Efile Com

Free Tax Filing Online 0 State Federal Credit Karma Tax

Free Tax Filing Online 0 State Federal Credit Karma Tax

When Can You File Taxes Where Is My Tax Refund Check Money

When Can You File Taxes Where Is My Tax Refund Check Money

Faqs On Tax Returns And The Coronavirus

Faqs On Tax Returns And The Coronavirus

How To Fill Out A Fafsa Without A Tax Return H R Block

How To Fill Out A Fafsa Without A Tax Return H R Block

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Do I Have To File Taxes In Multiple States

Do I Have To File Taxes In Multiple States

The Rules Requiring A Nonresident State Tax Return

The Rules Requiring A Nonresident State Tax Return

Comments

Post a Comment