Types Of Home Loans With No Down Payment

VA loans are guaranteed by the VA and offered by VA-approved. You only need 3 percent down.

Mortgages That Require No Down Payment Or A Small One Bankrate

Mortgages That Require No Down Payment Or A Small One Bankrate

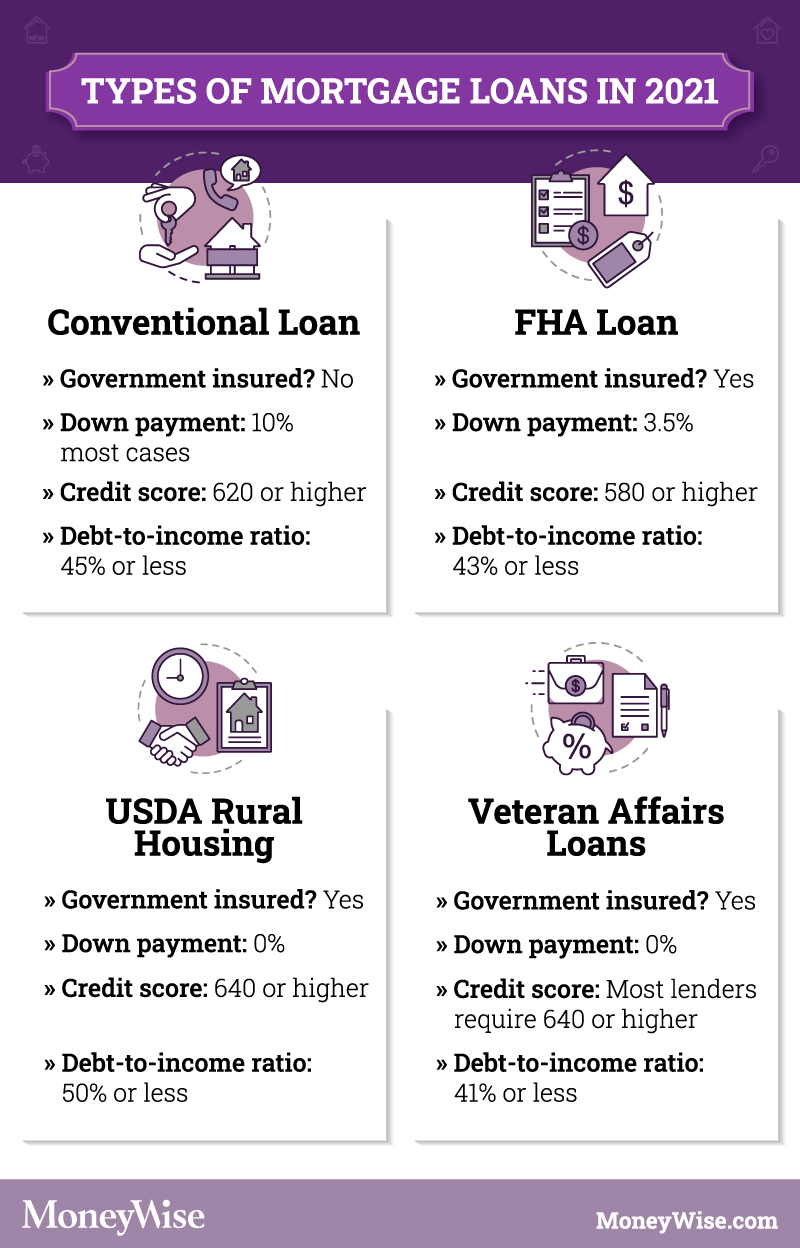

There are four major types of mortgages and none of them require 20 down or even close to it.

Types of home loans with no down payment. If you have a 500 FICO score you can qualify with a 10 down payment. Lets look at a brief overview of the eight types of mortgages. The FHA does not offer a no-money down loan.

USDA Loan or The United States Department of Agriculture Loan helps low-income home buyers in rural areas purchase a property with no money down and it can even take care of closing costs. Understanding the different types of mortgage loans will help you choose the option thats best suited for you. 6 Zeilen No-down-payment USDA loans are available including a Single Family Housing Guaranteed.

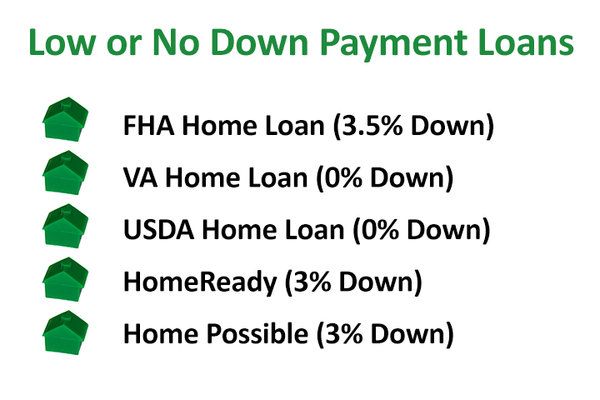

Each loan has a very specific set of criteria you. There are types of home loans with no down payment that almost every individual can settle for. A no-down-payment mortgage allows first-time home buyers and repeat home buyers to purchase property with no money required at closing except.

FHA loans are one of the most popular types of mortgage loans used by first-time homebuyers. Department of Veterans Affairs loan program is specifically for military borrowers while the US. These are widely available programs available at virtually every lender.

Looking for low down payment home loans. Nearly all home buyers in todays market opt for VA USDA FHA or conventional financing. Hud 1 settlement statement hud-1 settlement.

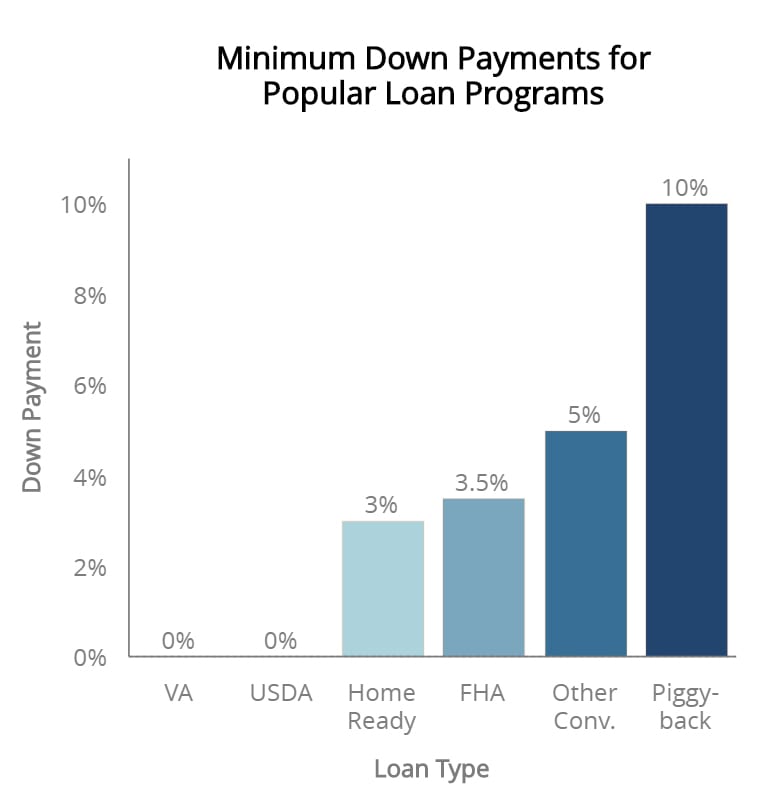

Some of the most common loan products that require you to put less than 20 percent down on a homes sales price include. There are two 0-down-payment loan options and both are backed by the government. Department of Agriculture guarantees USDA loans for homes in designated rural areas.

The 8 Types of Mortgage Loans Available. Home loans do not really need down payments as well as mortgages which you can be able to get with a small down payment. Types Of Home Loans With No Down Payment httpsifttt2W1eClu.

Going into the home buying process informed could help you save a lot of money on your down payment interest and fees. USDA loans and VA loans. You can take advantage of the HomeReady mortgage which is backed by Fannie Mae.

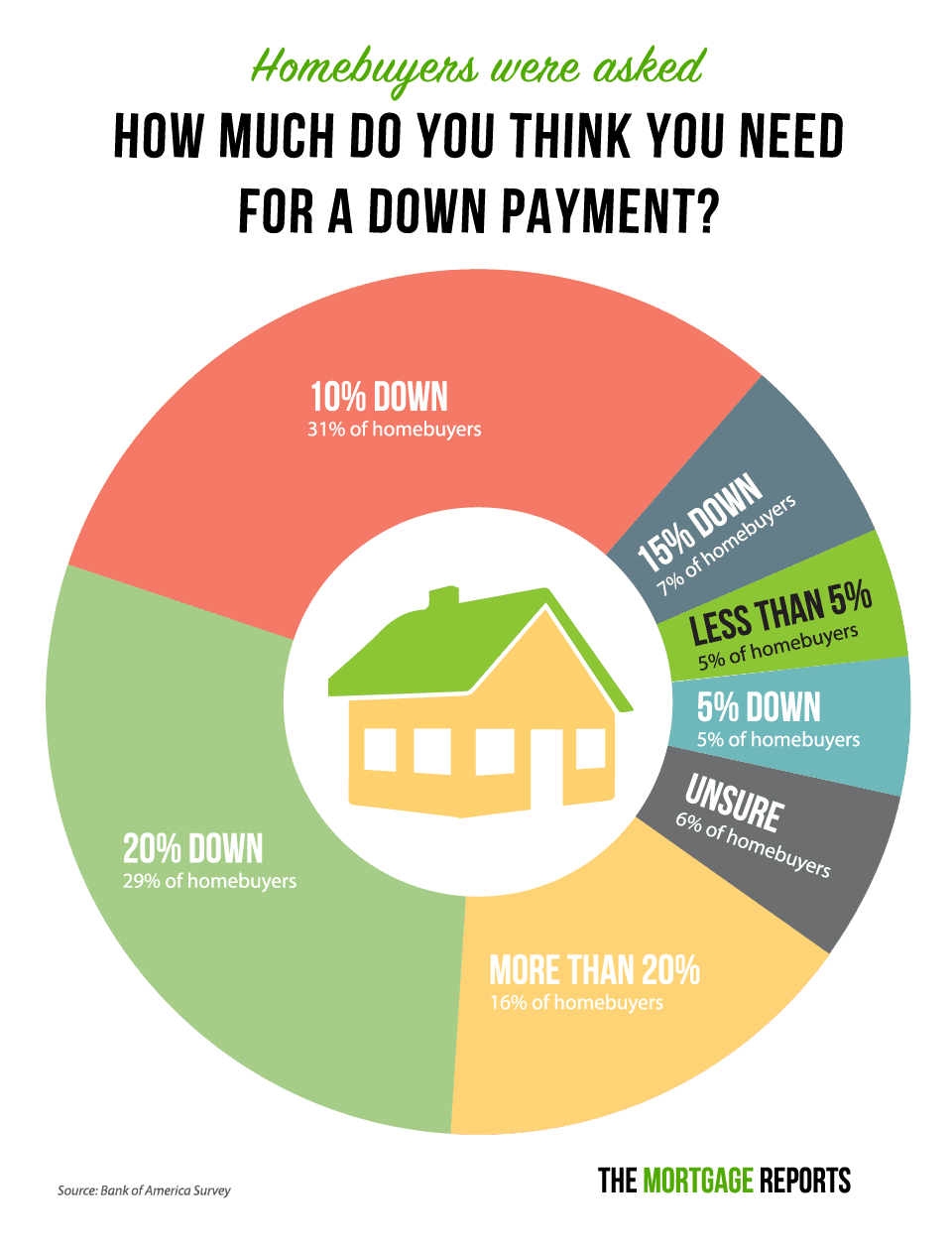

However before you make up your mind to buy a house you need to first have a proper understanding of the pros and cons in terms of low down payments. Types of no-down-payment home loans. Interest rates are typically lower than with other loans and you dont have to be a first-time buyer to qualify.

There are currently two types of government-sponsored loans that allow you to buy a home without a down payment. Commonly lenders require 5 percent. Or is the no-money-down strategy so attractive that a down payment never makes sense.

Depending on your status with the military and other factors you might be able to get a mortgage without any money down. But there is a somewhat obscure FHA rule that allows you to get around this requirement in a way. If coming up with a down payment is a struggle an alternative to buying a house with no money down is an FHA loan.

Borrowers with a 580 or higher FICO score may be eligible for an FHA loan with just 35 down. VA loans backed by the Department of Veterans Affairs and USDA loans guaranteed by the US. Department of Agriculture require no down payment to.

The single-family guaranteed homeownership loan helps those with incomes that are below 115 percent of the median income for the area buy modest homes in rural areas. VA loans which require no down payment at all USDA Rural Development loans which dont require a down payment FHA loans which require at least a 35 percent down payment. On a 300000 home purchase thats 10500.

1 Not making a down payment could save you at least 11000 upfront on the average 2020 home for sale in the US. This is another program designed to help you get home loans with no down payment. If you qualify for a mortgage with no down payment you wont have to produce a down payment on closing day.

They have the lowest credit score requirements of any mortgage type. A VA loan down payment isnt required but borrowers can still make one. Down payments for conventional mortgages tend to start at 3 of the purchase price.

An FHA Home Loan Can Be a Zero Down Mortgage Federal Housing Administration or FHA loans require a 35 down payment which can be quite a lot of money. If you are considering buying a home with little or no downpayment you are not alone.

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Buy A House With 0 Down In 2021 First Time Buyer

First Time Home Buyer Programs In 2021

First Time Home Buyer Programs In 2021

All You Need To Know About Zero Down Payment Mortgages Their Benefits By Community Lending Group Issuu

All You Need To Know About Zero Down Payment Mortgages Their Benefits By Community Lending Group Issuu

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Take Out A Loan 6 Common Loan Types

How To Take Out A Loan 6 Common Loan Types

How Much Should You Put Down On A House Not 20

How Much Should You Put Down On A House Not 20

What Is A Conventional Loan 2021 Rates And Requirements

What Is A Conventional Loan 2021 Rates And Requirements

How To Buy A House With No Money Down Rocket Mortgage

How To Buy A House With No Money Down Rocket Mortgage

Get A Mortgage With No Down Payment Or A Low Down Payment

Get A Mortgage With No Down Payment Or A Low Down Payment

/how-much-do-we-need-as-a-down-payment-to-buy-a-home-1798252_FINAL-d436ccb9c27f4ced9c60c70eb01a4fdb.png) How Much Do We Need As A Down Payment To Buy A Home

How Much Do We Need As A Down Payment To Buy A Home

Home Loan Depending On Credit Score The Phenix Group

Home Loan Depending On Credit Score The Phenix Group

Low Down Payment Mortgage Options You Ve Never Heard Of Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Low Down Payment Mortgage Options You Ve Never Heard Of Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Comments

Post a Comment