Bank Account Interest Tax

If you receive more than 10 during the year then the bank is required to send you a Form 1099-INT showing the amount of interest that you have accumulated for the year. Income Tax on Saving Bank Interest.

Which Interest Income Is Taxable Rupakumar Pradhan Cfp Cm Cwm

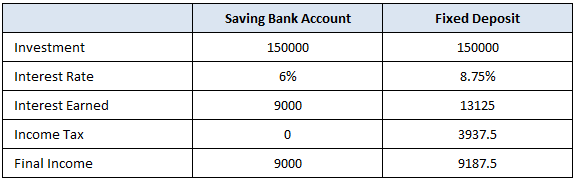

Just like any other source of income interest you earn from a savings account is subject to income tax.

Bank account interest tax. You can claim through your. 8 rânduri To calculate their bank account interest tax theyd simply multiply 200 by 012 which would. Saving account interest is taxable at your slab rate.

Savings Account interest is taxable at your slab rate. However interest up to Rs 10000 is exempt from tax under Section 80TTA. According to Section 19A of the Income Tax Act 1961 TDS is not applicable to savings accounts.

Interest earned up to Rs 10000 is exempted from tax under Section 80TTA. You must reclaim your tax within 4 years of the end of the relevant tax year. Your bank reports the interest you received directly to the ATO.

Banks deduct tax on fixed deposit income ie. The tax-exempt limit given for senior citizens is Rs 50000 as per Section 80TTB. Is savings account interest taxable.

It also relies on tenure. You would need to pay tax on savings account interest income as per the tax slab. Paying tax on interest from a savings account Just like any other source of income interest earned from a savings account is subject to tax at your marginal tax rate in Australia.

Any interest earned on a savings account is taxable income. Interest income Tax withheld Big Bank. EQ Bank Savings Plus Account Interest rate of 125.

If you are getting interest but it is less than 10 you are still required to report it even though you probably will not receive a Form 1099-INT showing the amount. TDS on Interest only after a specified limit of Rs10000 normally and Rs50000 limit for senior citizens. Generally you report your share of interest from a joint bank account based on how much you contributed to it.

If the interest of a connected joint account and fixed deposit is more than Rs10000 per year the primary account holder is subject to TDS. Joint account of two non-related persons is not accountable to deduction for withdrawals of up to Rs50000. You would then enter the total from Schedule B on line 10b of your Form 1040.

This tax-exempt limit is Rs 50000 for senior citizens under Section 80TTB. You can reclaim tax paid on your savings interest if it was below your allowance. Report interest paid or credited to you in 2020 even if you did not receive an information slip.

But NRIs have to pay 30 TDS on interest received on NRO accounts. On a general basis interest incomes are subject to tax under Section 194A at the rate of 10 at the time of payment. You may not receive a T5 slip for amounts under 50.

This is then included as income on your tax return. 3 rânduri Account number. TAX on Bank Account Interest TAX Applicable on Savings Account and Fixed Deposit Interest.

Joint accounts are basically regular bank. The fixed deposit interest rate varies from bank to bank but the average rate of interest is around 450 to 8 per cent pa. If you have a savings account you probably earned some bank interest.

Tax-exempt municipal bond interest is reported on Line 2a of the 2020 Form 1040. No TDS is deducted on savings account interest. When TDS Is Deducted On Savings Bank Interest.

For NRIs tax is deducted at source TDS at 30 on interest on Non-Resident ordinary accounts. Private activity bond interest is reported on Line 2g of Form 6251 as an adjustment for calculating the alternative minimum tax. Banks are required to report interest earned on a bank account in excess of 10 each year to the Internal Revenue Service IRS using Form 1099-INT.

On your tax return Gross Interest is income paid to you from a financial institution like a bank or building society. Essentially the IRS requires this so that. Your bank will send you a 1099-INT form for any interest earned over 10 but you should report any interest earned even if.

Taxable interest goes on Schedule B of the 2020 Form 1040. The ATO compares that information with your tax.

Rs 10 000 Income Tax Exemption On Saving Bank Interest Sec 80tta

Rs 10 000 Income Tax Exemption On Saving Bank Interest Sec 80tta

Savings Accounts In Germany Opening Interest Taxes

Savings Accounts In Germany Opening Interest Taxes

Income Tax On Savings Bank Interest Compare Apply Loans Credit Cards In India Paisabazaar Com

Income Tax On Savings Bank Interest Compare Apply Loans Credit Cards In India Paisabazaar Com

Have You Paid Tax On Your Interest Income Paying Taxes Financial Management Investing

Have You Paid Tax On Your Interest Income Paying Taxes Financial Management Investing

Saving Bank Account Do You Know How Interest Is Calculated And More

Saving Bank Account Do You Know How Interest Is Calculated And More

Interest Income Under Tax Scrutiny Here S What You Must Know To Stay Clear Of Taxman The Economic Times

Interest Income Under Tax Scrutiny Here S What You Must Know To Stay Clear Of Taxman The Economic Times

Taxation On Savings Bank Account Yadnya Investment Academy

Taxation On Savings Bank Account Yadnya Investment Academy

How Do Taxes Work On High Yield Savings And Cd Interest Business Insider

How Do Taxes Work On High Yield Savings And Cd Interest Business Insider

/FilingTaxesforInterestIncome-b6ac80f8297a426eb43b44b40915c0b4.jpg) How Interest Income Is Taxed And Reported On Your Return

How Interest Income Is Taxed And Reported On Your Return

Interest On Saving Bank Account Tax 80tta

Interest On Saving Bank Account Tax 80tta

Interest On Saving Bank Account Tax 80tta

Interest On Saving Bank Account Tax 80tta

Do You How To Calculate Tax On Your Interest Income

Do You How To Calculate Tax On Your Interest Income

Is Savings Account Interest Tax Deductible

Is Savings Account Interest Tax Deductible

Comments

Post a Comment