Federal Tax Filing Requirements

For taxpayers due a refund there is no penalty for filing. Make sure you have the forms you need to file your taxes including Form W-2 from your employer and your previous tax transcripts.

When Should You File A U S Federal Income Tax Return Aylett Grant Tax Llp

When Should You File A U S Federal Income Tax Return Aylett Grant Tax Llp

Married dependents who are not age 65 or older or blind are subject to these filing requirements plus one more.

Federal tax filing requirements. You are required to file a federal income tax return. Different filing rules apply to children and even small amounts of income may require a return. They must file if their gross income was at least 5 and their spouse files a separate return and itemizes deductions.

To find these limits refer to Dependents under Who Must File in Publication 501 Dependents Standard Deduction and Filing Information. Whether you received a specific credit or owe a tax liability see Additional Filing Requirements below. If your earned income was 700.

You had at least 400 in self-employment income. And when filing is desirable but not required. Your filing requirements to prepare and eFile a 2020 federal income tax return by April 15 2021 depends on the following factors.

Tax Return Filing Requirements. Your Federal Income Tax for Individuals. The deadline for filing federal income taxes was extended by the IRS from April 15 to May 17 2021.

Federal income tax returns are due on May 17 2021. Government Entities Find filing information for Federal state local and Indian tribal governments and for governmental liaisons. To make sure you file those on time find out the tax filing due dates in your state.

This will also extend to freelancers people with side businesses and anyone who engages in gig work. How filing requirements depend on income tax liability or the need to report information to the federal government. Social Security and Medicare taxes owed on unreported tip income.

An overview of filing requirements for taxes for taxpayers and for their dependents. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. At any age if you are a dependent on another persons tax return and you are filing your own tax return you standard deduction can not exceed the greater of 1100 or the sum of 350 and your individual earned income.

Your dependent children must submit tax returns if they earn certain amounts of income during the year. General Filing Requirements when an individual is NOT claimed as a dependent on another individuals income tax return. The filing levels also apply to nonresident taxpayers who are required to file a Maryland return.

Review the following to learn about your requirements for filing income tax payroll tax sales and use tax and more. Filing Status Taxable Income and your Dependency Status. Visit Reporting Your Taxes to find out what types of business taxes apply to you.

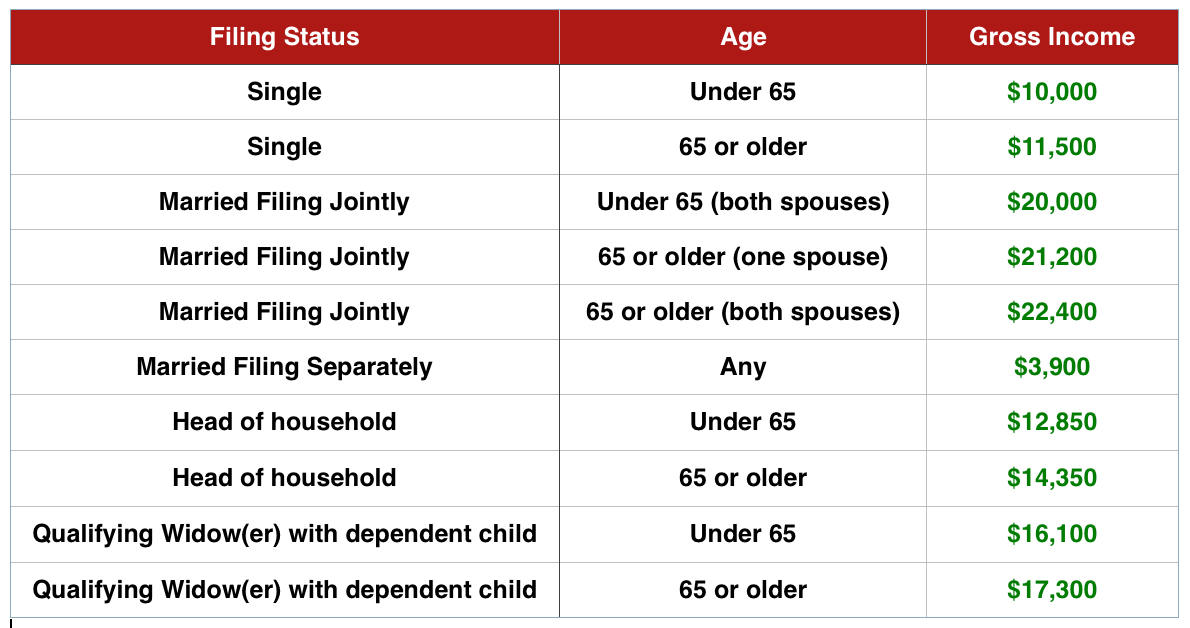

The filing requirements for a federal tax return depend on factors such as the taxpayers income the taxpayers age and filing status the age of the spouse on joint returns if the taxpayer is claimed as a dependent on someone elses return earnings from self-employment and more. Type of federal return filed is based on your personal tax situation and IRS rules. Had income greater than the standard deduction see below.

Additional fees apply for Earned Income. Find tax filing requirements for international individuals and businesses. Your federal tax filing status.

1100 as the sum of 700 plus 350 is 1050 thus less than 1100. There are a few other special situations where you may need to file. Received the Premium Tax Credit Obamacare subsidy.

If you owe money and do not file and pay your taxes on time you will be charged interest and a late payment penalty. You will still need to file a tax return if any of the following apply. An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits.

Learn how to file a federal income tax return or how you can get an extension. Had self-employment income greater than 400. Guide for Corporations Starting Business in California.

Learn about business taxes and incentives. This deadline does not apply to state and local tax returns. Otherwise their obligation to file a tax return is the same as adults.

Your standard deduction would be. The tax rules allow you to claim a credit for a dependent for a child if they reside with. Whether you are claimed as a dependent on another individuals income tax return.

You owe household employment taxes. Had income tax withheld and want your refund. You probably need to file a tax return if you.

You must ensure that your child is eligible to be your dependent. Also includes the income limits for the federal tax brackets ranging from 0 to 396. Your Maryland gross income equals or exceeds the level listed below for your filing status.

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

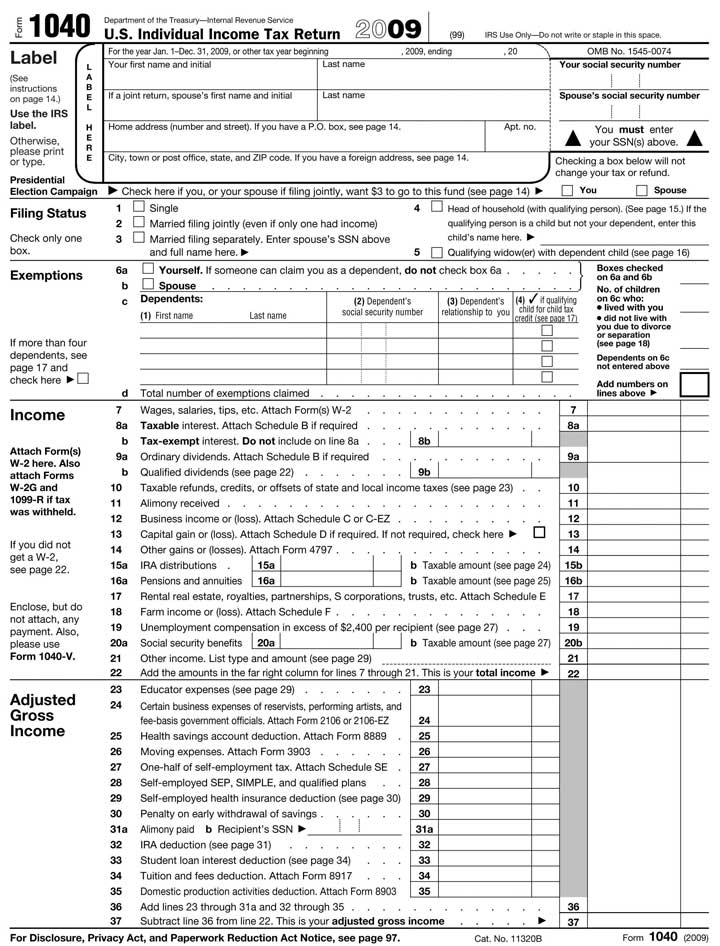

The U S Federal Income Tax Process

The U S Federal Income Tax Process

Faqs On Tax Returns And The Coronavirus

Faqs On Tax Returns And The Coronavirus

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

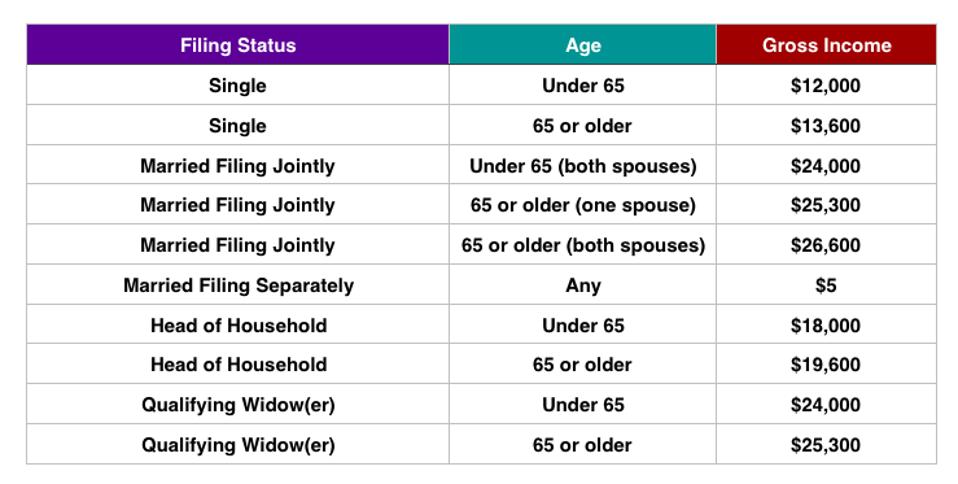

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

Irs Kicks Off 2020 Tax Filing Season With Returns Due April 15 Help Available On Irs Gov For Fastest Service Eagle Pass Business Journal

Irs Kicks Off 2020 Tax Filing Season With Returns Due April 15 Help Available On Irs Gov For Fastest Service Eagle Pass Business Journal

Free State Federal Tax Filing Available For 600k Idahoans Idaho Statesman

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

Do I Need To File A Tax Return Forbes Advisor

Do I Need To File A Tax Return Forbes Advisor

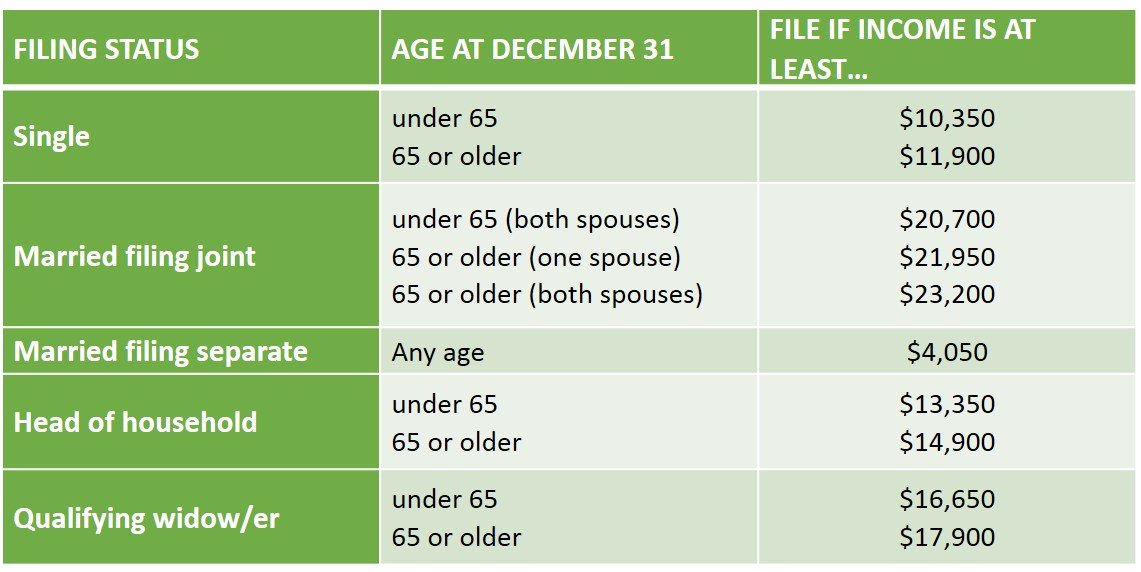

Do You Need To File A Tax Return In 2014

Do You Need To File A Tax Return In 2014

Statement Of Not Filing U S Federal Income Tax Return U S Embassy Consulate In The Republic Of Korea

Statement Of Not Filing U S Federal Income Tax Return U S Embassy Consulate In The Republic Of Korea

The Choice Is Yours 3 Ways For Llcs To File Federal Income Tax Xendoo

The Choice Is Yours 3 Ways For Llcs To File Federal Income Tax Xendoo

File An Extension For Your Federal Tax Return Raleigh Cpa

File An Extension For Your Federal Tax Return Raleigh Cpa

Comments

Post a Comment