Should My Business Be An Llc

An S corporation isnt a business entity like an LLC. Another benefit of registering your consulting business as an LLC is the taxation on.

When And Why You Should Form An Llc

When And Why You Should Form An Llc

An LLC offers a more formal business structure than a sole proprietorship or.

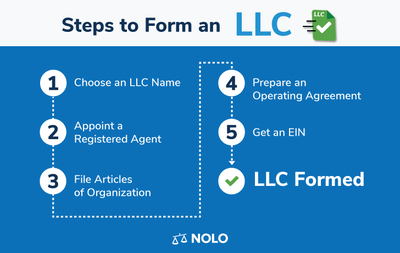

Should my business be an llc. Create and file Articles of Organization. If the answer is yes set up a new LLC. As a pro and con of getting an LLC you will need to hire a Registered Agent whose job is to receive correspondence or legal notices on behalf of your business and relay them to you.

LLC owners must pay self-employment taxes for all income. A major advantage of organizing your business as an LLC or an S corp is that you can protect your personal assets from the creditors of your business. Its an elected tax status.

Limited liability means you cant be. Forming an LLC takes about the same effort and cost as properly setting up a sole proprietorship or partnership yet provides owners with the same level of protection as a corporate business structure. An LLC lets you take advantage of the benefits of both the corporation and partnership business structures.

The first thing an LLC does for your business is peace of mind. An LLC combines many of the best features of all types of business organization. Should your restaurant business be an LLC- Limited Liability Company.

Setting Up an LLC Choose a business name. It protects those things you hold dear if anything goes wrong. They have a favorable pass-through tax status and with the dual liability protection that LLCs offer corporations and limited partnerships cant compare.

There are two considerations here the first being to choose a name that doesnt duplicate that. Create and file an Articles of Organization. It was designed to promote business by offering business owners protection from personal liability for business obligations combined with a structure that is simple and easy to operate.

The primary benefit of an LLC business structure is that the owners enjoy the same personal protection from responsibility for business debts as owners of incorporated businesses. They will act as a permanent address for the state your business is located in. While the name of the document and number of required signatures vary by.

The next question to talk with your attorney about is will the new business have risks that I dont want to expose the old business to. Or will the old business have risks that I dont want to expose the new business to. The reason businesses become LLCs and corporations are for the legalese concept of limited liability What limited liability does is erect a fence between your business and personal life.

Personal asset protection through the limited liability claims of your. An LLC offers the same tax structure as a sole proprietorship for most LLCs with a single owner but there are some big legal benefits that a sole proprietorship doesnt offer. The name of this document may be slightly different from one state to another.

Appoint a Registered Agent. Limited Liability Companies LLCs are flexible you can use them for practically any purpose and they offer more benefits than any other entity type. The real value of becoming an LLC is peace of mind and a changed perspective on your business.

So when problems crop up they stay on their side of the fence. But this fence only exists in certain circumstances. The next logical progression and a very popular option among freelancers and other small businesses is a limited liability company or LLC.

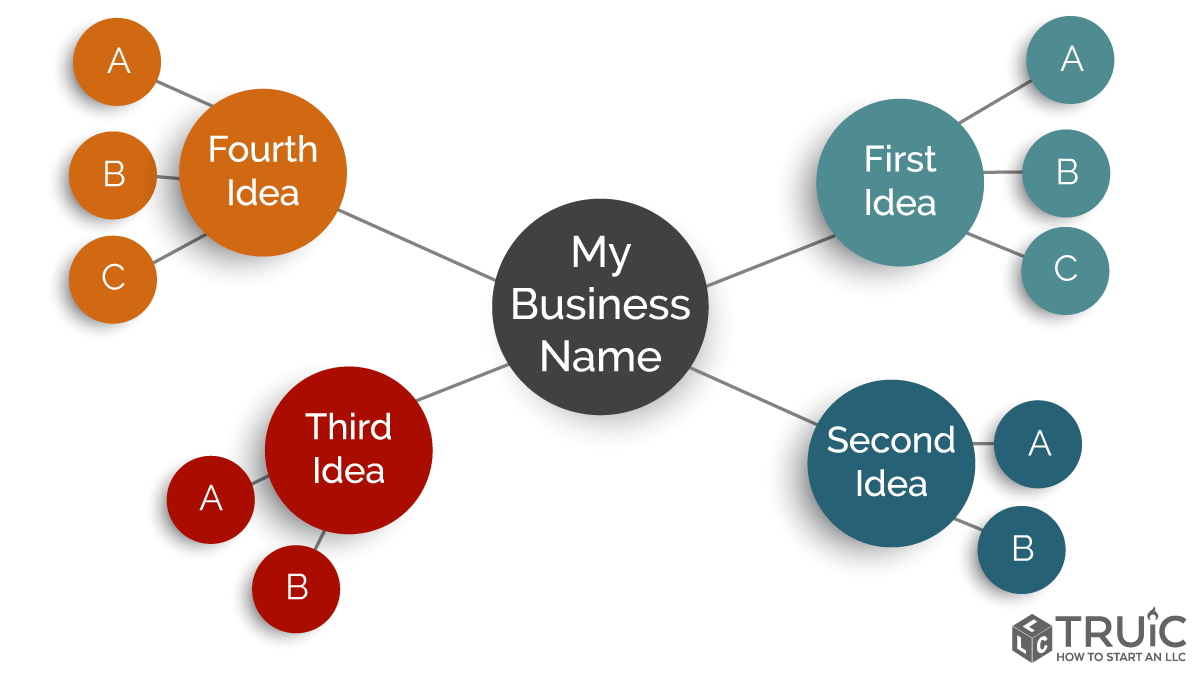

LLCs protect you from personal liability in most instances your personal assets like your vehicle house and savings accounts wont be at risk in case your LLC faces bankruptcy or lawsuits. So if youre a business owner youre successful you have one business doing well. Your LLC should have a unique business name that isnt already registered in your state.

What an LLC is and What it Does to Help Your Consulting Business Personal Asset Protection- Limited Liability. Yes an LLC provides a restaurant business owner personal asset protection- a lawsuit only puts the businesss assets at risk. An LLC is a limited liability company which is a type of legal entity that can be used when forming a business.

How to set up an LLC Choose a business name. And her practice covers a lot of different areas but primarily she does transactional work and corporate work. In the event that someone feels particularly litigious they would sue the LLC not you.

Its an insurance policy. Should I Form an LLC for My Texas Business. All business owners including farmers should strongly consider the use of an LLC.

Open and maintain bank accounts own property sue and of course be sued. Summary of the Should I Form an LLC Video Philip Hundl Hi Im Philip HundlIm an attorney with Wadler Perches Hundl and Kerlick and Id like to introduce Kari WittigShes an attorney here at Wadler Perches Hundl and Kerlick. Forming an LLC means that in the eyes of the law your business is a separate entity that can do things people can do.

This is an.

Llc Vs Inc What Are The Differences And Benefits Bizfilings

Llc Vs Inc What Are The Differences And Benefits Bizfilings

Should My Business Be An S Corp Or Llc Legal Entity Vs Tax Status Walker Law Pc

Should My Business Be An S Corp Or Llc Legal Entity Vs Tax Status Walker Law Pc

When And Why You Should Form An Llc

When And Why You Should Form An Llc

I Should Just Start An Llc For My New Business Right They Re The Best Tresquire Legal Services

Should I Register My Business As An Llc

Should I Register My Business As An Llc

Do I Need To Trademark My Business Name

Do I Need To Trademark My Business Name

Should My Fitness Business Be An Llc Fitlegally

Should My Fitness Business Be An Llc Fitlegally

What Is An Llc Llc Pros And Cons Nolo

What Is An Llc Llc Pros And Cons Nolo

Should My Fitness Business Be An Llc Fitlegally

Should My Fitness Business Be An Llc Fitlegally

Should My Photography Business Be An Llc Thelawtog

Should My Photography Business Be An Llc Thelawtog

Do I Need To Put Llc On My Business Cards Silkcards Blogs

Do I Need To Put Llc On My Business Cards Silkcards Blogs

Should My Business Be A Sole Proprietorship Or An Llc Bryant Taylor Law

Should My Business Be A Sole Proprietorship Or An Llc Bryant Taylor Law

Should I Start An Llc For My Small Business Landmark

Should I Start An Llc For My Small Business Landmark

Business Name How To Name A Business

Business Name How To Name A Business

Comments

Post a Comment