Traditional Ira Income Limits 2020

For 2020 6000 or 7000 if youre age 50 or older by the end of the year. Your deduction is allowed in full if you and your spouse if you are married arent covered by a retirement plan at work.

The 2020 Irs And Social Security Changes You Need To Know For Retirement Great Waters Financial

The 2020 Irs And Social Security Changes You Need To Know For Retirement Great Waters Financial

Disbursement help free help.

Traditional ira income limits 2020. 6000 7000 if youre age 50 or older or. Disbursement help free help. For tax years 2020 and 2021.

The maximum amount you can contribute to a traditional IRA or a Roth IRA in 2020 is 6000 or 100 of your earned income if less unchanged from 2019. Anzeige Non Resident Alien from the US Retirement Withdrawal 401k US. For 2021 2020 and 2019 the total contributions you make each year to all of your traditional IRAs and Roth IRAs cant be more than.

Married filing jointly or qualifying widow er. The 2020 Roth IRA income phaseout limits are as follows. The most you can contribute to all of your traditional and Roth IRAs is the smaller of.

Traditional IRAs Retirement plan at work. Traditional IRA contribution rules Having earned income is a requirement for contributing to a traditional IRA and your annual contributions to an IRA cannot exceed what you earned that year. Also a taxpayers IRA contributions cannot exceed that taxpayers income in a given year.

A taxpayer must earn qualified income in order to make a contribution. If less your taxable compensation for the year. IRA FAQs - Contributions How much can I contribute to an IRA.

Single head of household or married filing separately and you did not live with your spouse at any time during the. You can contribute to both a traditional IRA and. The maximum amount you can contribute to a traditional IRA for 2020 is 6000 if youre younger than age 50.

The maximum catch-up contribution for those age 50 or older remains at 1000. Workers age 50 and older can add an extra 1000 per year as a catch-up contribution. The extra 1000 is a catch-up contribution designed to help people save more as they get closer to retirement age.

If youre 49 and younger you can put a combined total of 6000 into your traditional and Roth IRAs. Traditional IRA Contribution Limits for 2020 and 2021 The annual contribution limit for a traditional IRA in 2020 is 6000 or your taxable income whichever is lower. Anzeige Non Resident Alien from the US Retirement Withdrawal 401k US.

10 Zeilen more than 65000 but less than 75000. 3 These limits dont apply to rollover contributions or. 3 Zeilen No there is no maximum traditional IRA income limit.

If your modified gross adjusted income MAGI is 196000 up from. The annual contribution limit for 2019 2020 and 2021 is 6000 or 7000 if youre age 50 or older. Your taxable compensation for the year.

No retirement plan at work. If you will be 50 or older by. If youre 50 and older you can put a combined total of 7000 into your traditional and Roth IRAs.

12 Zeilen For the 2020 2021 tax years filed in 202122 the combined annual contribution limit for. The annual contribution limit for 2015 2016 2017 and 2018 is 5500 or 6500 if youre age 50 or older. For example if a taxpayer make a total of 2000 in taxable compensation in a given year then the maximum IRA contribution is 2000.

IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax. Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income exceeds certain levels. In 2020 and 2021 you can contribute up to 6000 to a traditional IRA or 7000 if youre 50 or older as long as your taxable compensation is at least that much.

Anyone can contribute to a. For 2019 6000 or 7000 if youre age 50 or older by the end of the year. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Your 2020 Annual Contribution Limits Midatlantic Ira

Your 2020 Annual Contribution Limits Midatlantic Ira

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Why Most Pharmacists Should Do A Backdoor Roth Ira

Why Most Pharmacists Should Do A Backdoor Roth Ira

2020 Roth Ira Contribution And Income Limits Your Go To Guide

2020 Roth Ira Contribution And Income Limits Your Go To Guide

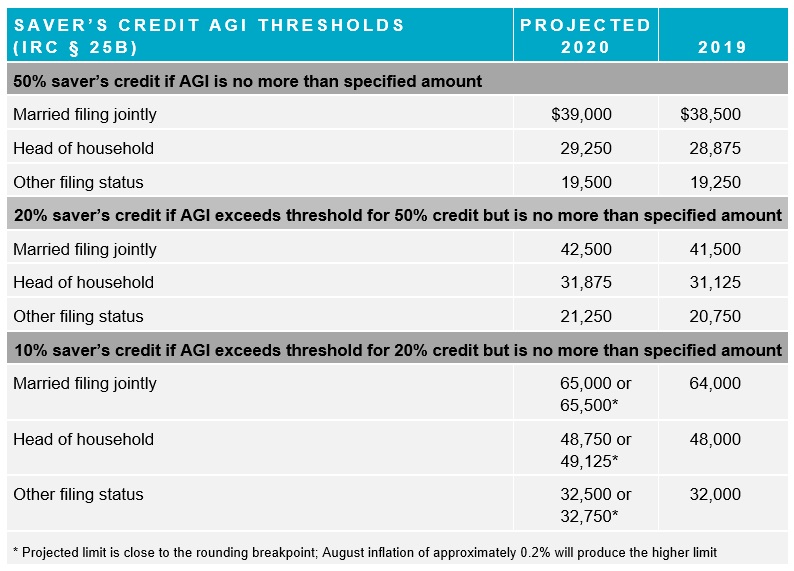

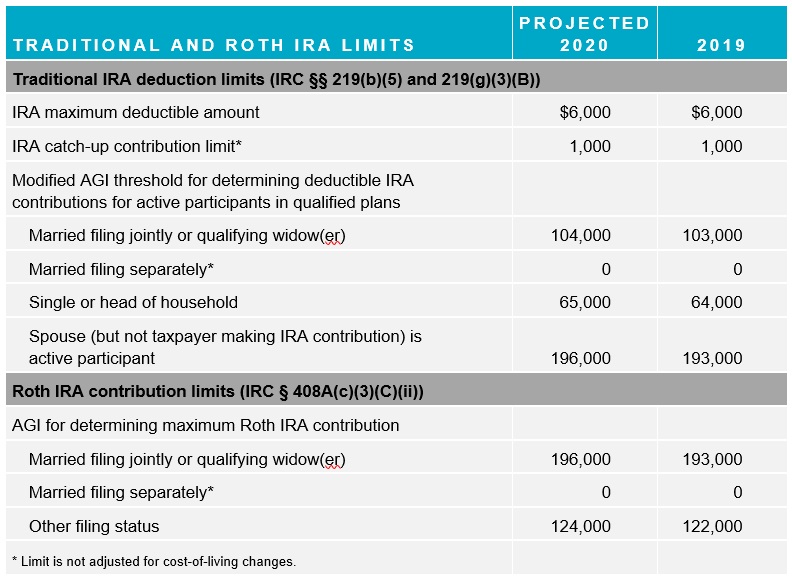

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

Retirement Contribution Limits For 2020 Retirement News

Retirement Contribution Limits For 2020 Retirement News

2020 2021 Ira Contribution Limits Catch Up Provisions Equity Trust Company

2020 2021 Ira Contribution Limits Catch Up Provisions Equity Trust Company

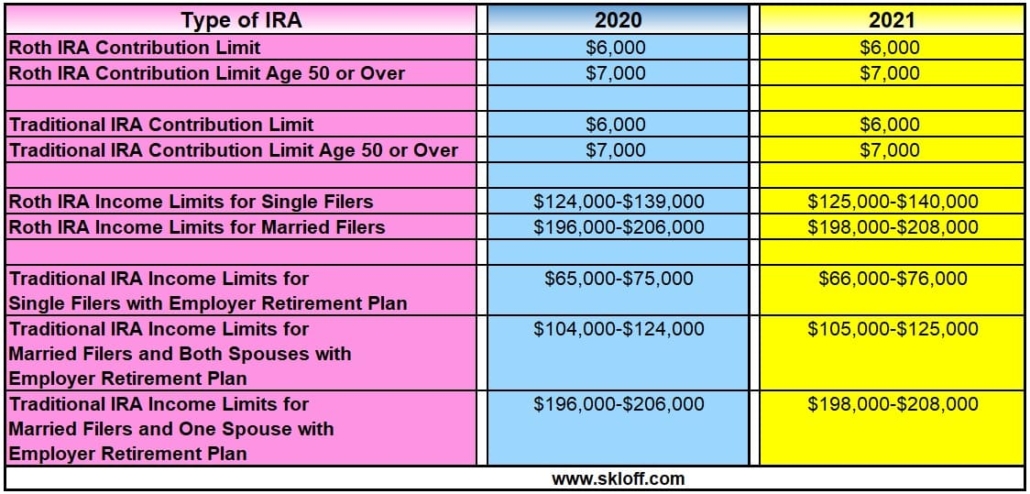

Ira Contribution And Income Limits For 2020 And 2021 Skloff Financial Group

Ira Contribution And Income Limits For 2020 And 2021 Skloff Financial Group

Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra

Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

401 K Contribution Limits 2020 What Employers Need To Know

401 K Contribution Limits 2020 What Employers Need To Know

Comments

Post a Comment