Can I File Taxes If I Have No Income

You can also still file to get back any taxes withheld from your pay or to claim certain refundable tax credits. However there are income thresholds and other factors to consider first.

Can I File An Income Tax Return If I Don T Have Any Income Turbotax Tax Tips Videos

Can I File An Income Tax Return If I Don T Have Any Income Turbotax Tax Tips Videos

For example if youre single and were under 65 as of the end of 2020 you wont have to file a tax return if your income was under 12400.

Can i file taxes if i have no income. If you have to file income this year the good news is that there are some tax credits that may cover your balance completely. Theres nothing illegal about filing a Federal tax return displaying zero income. If your income during the tax year falls below the IRS minimum requirements youre not required to file a tax return.

If you are in doubt I would suggest talking to a local CPA or find other local tax help. If you had very low or no income last year and are not required to file you may wish to file anyway to claim certain refundable tax credits. Some people are not required to file returns but choose to file so they have a tax return on record for personal andor legal reasons.

This is because it will read it as an empty tax return. At some point the business needs to show a profit. Can I file taxes with a 1098 TE and have no income.

But if it was higher youll have to file. If you have no taxable income at all you will have to list at least 1 of taxable income in order to e-file your return. Do I have to file taxes for an LLC with no income.

Yes if the 1098-T shows more tax-free education assistance like scholarships received than what the school received as payments if there is an amount in Box 5 you may need to report the excess as income. The Goods and Services Tax or Harmonized Sales Tax GSTHST Credit is one such example. The bad news is the IRS will not allow the deductions indefinitely.

If you earn little or no income during the tax year you may not need to file a tax return. If you made no income of any sort whatsoever youre not required to file. Even if you wont owe taxes you may want to file an income tax return to claim a refund of taxes overpaid or claim the benefit or any deductions or credits including the Child Tax Credit.

Thats what youre going to have to do. You must always file your LLC taxes when you have business activity. If you are someone who has little to no income youre under no obligation to file a Federal tax return.

It may seem counter-intuitive that you may still be eligible for a tax refund even if you did not earn any money. You can always file an income tax return. If it does not the IRS views it as a hobby and does not allow deductions.

Protect yourself from future audits. If you have zero income it is likely that you did not pay any taxes during the taxable year. Many people believe that there is no benefit to filing a tax return if there is no income to report.

The Earned Income Tax Credit is worth up to 14000 for a single filer. In some cases this is a smart idea. On the other hand if you owe taxes and dont file the IRS can assess penalties and interest seize US.

You cant claim them if you have no income but you need to file your taxes to claim them in a future year when you do have income. When it comes to deducting expenses for a business with no income the good news is the Internal Revenue Service IRS allows the deductions. Can i file tax 2020 even i dont have any income or W2 to claim my Recovery Rebate credit.

For example you may qualify for the Earned Income Tax Credit or the Additional Child Tax Credit which are refundable tax credits. If you have a child the EIC can be worth up to 39296. Assets and impose immigration consequences.

As a result you can always file a tax return and claim your child as a dependent even if your taxable income is zero before even claiming the exemption. The IRS allows you to file a tax return even if your gross income is below the income threshold requiring you to file one. Although you can file tax returns with no income you dont always have to.

If it exceeds the minimum you must file. However there are actually several benefits available to those who file zero income tax returns. There are some limited circumstances when you may be able to get money back from filing your taxes even when you had no income.

Revenues deductions and credits. If you dont have any income the school loan interest would not matter. If you are eligible then the benefit will automatically be applied to your tax return.

If you do not have any form of taxable income on your tax return the IRS E-file system may reject your return. Refundable tax credits can provide you with a tax refund even when you do not work. However if you had no income you may not have to and I would have to know a little more about your financial situation to determine whether you should file one or not.

On the other hand you can still file your taxes if you want to. You can list 1 of other income or of bank interest income.

Reasons To File A Tax Return Even If You Had No Income Accounting Plus Financial Services

Reasons To File A Tax Return Even If You Had No Income Accounting Plus Financial Services

File Taxes With No Income Internal Tax Resolution

File Taxes With No Income Internal Tax Resolution

Do I Need To File A Form 1120 If The Business Had No Income Quora

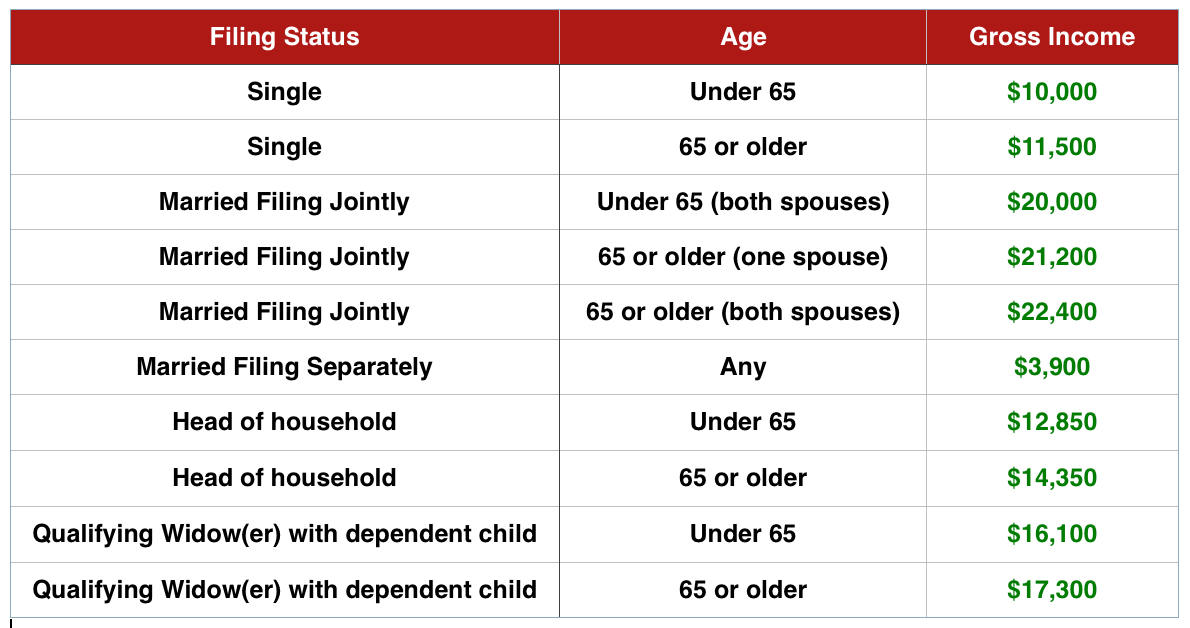

Do You Need To File A Tax Return In 2014

Do You Need To File A Tax Return In 2014

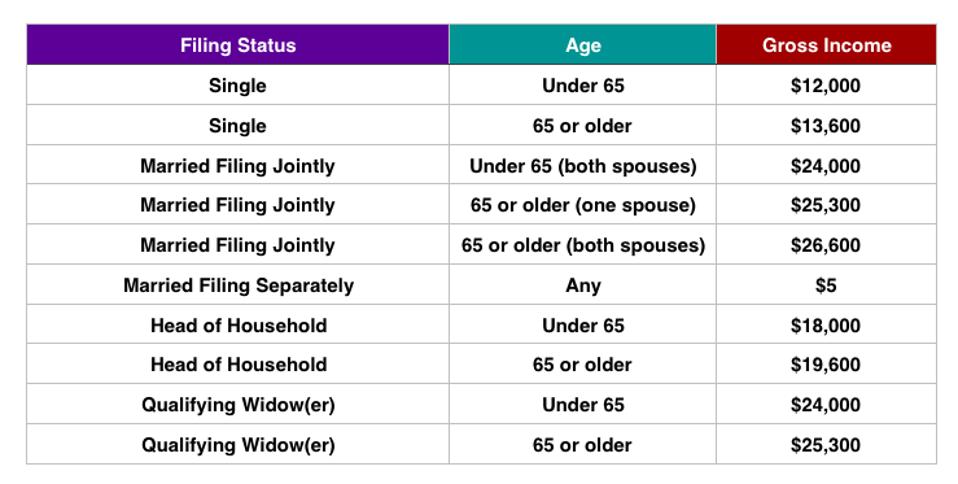

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

You Don T Have To Pay Federal Income Tax If You Make This Much Money Marketwatch

You Don T Have To Pay Federal Income Tax If You Make This Much Money Marketwatch

Do I File A Tax Return If I Don T Earn An Income E File Com

Do I File A Tax Return If I Don T Earn An Income E File Com

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/doyouhavetofiletaxeswhenyouhavenoincome-aef1d4aa68f74125829eb1dcd1107cc9.jpg) Do You Have To File Taxes If You Have No Income

Do You Have To File Taxes If You Have No Income

States That Do Not Tax Earned Income

States That Do Not Tax Earned Income

No Income Do You Still Need To File Your Taxes Refresh Financial

No Income Do You Still Need To File Your Taxes Refresh Financial

How To File A Zero Income Tax Return 11 Steps With Pictures

How To File A Zero Income Tax Return 11 Steps With Pictures

How To File A Zero Income Tax Return 11 Steps With Pictures

How To File A Zero Income Tax Return 11 Steps With Pictures

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

Comments

Post a Comment