Us Income Tax Brackets

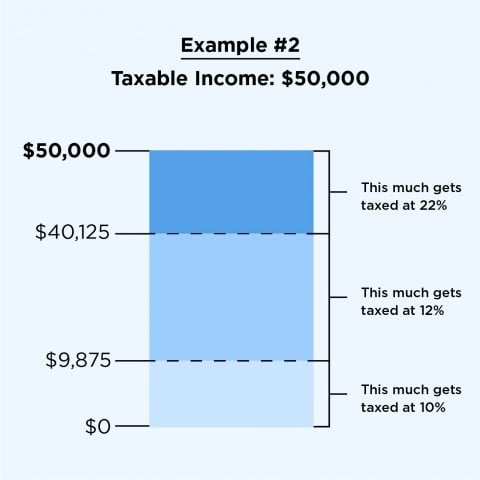

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. If youre one of the lucky few to earn enough to fall into the 37 bracket that doesnt mean that the entirety of your taxable income will be subject to a 37 tax.

How Many Taxpayers Fall Into Each Income Tax Bracket Tax Foundation

How Many Taxpayers Fall Into Each Income Tax Bracket Tax Foundation

115-97 reduced both the individual tax rates and the number of tax brackets.

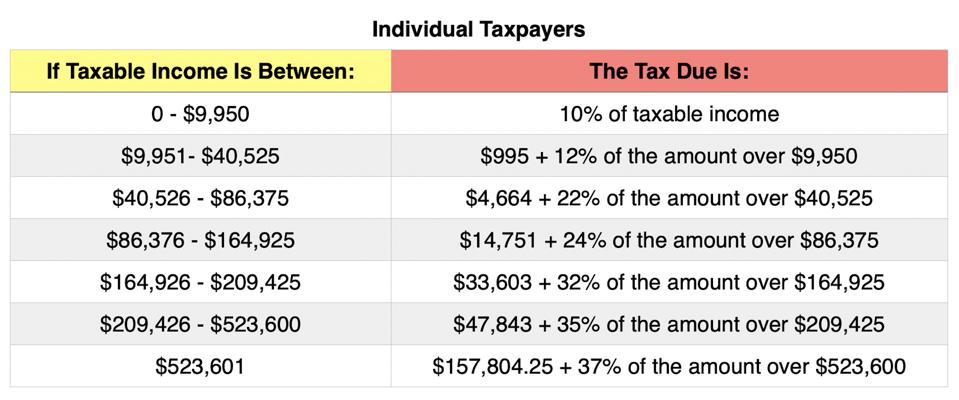

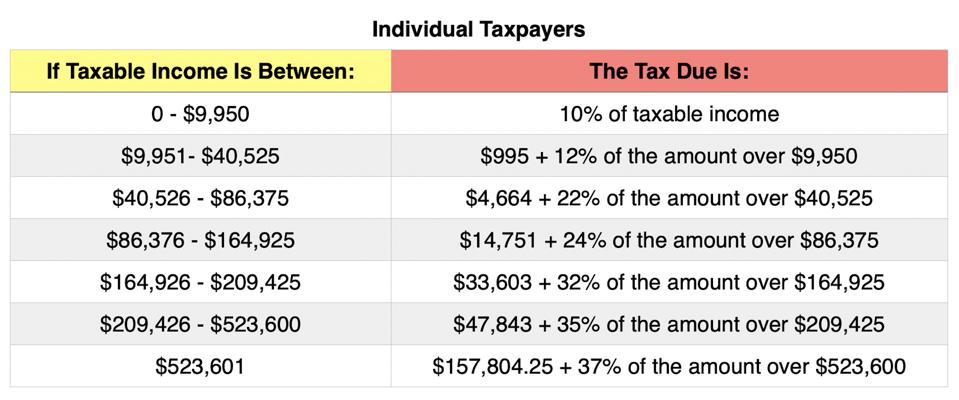

Us income tax brackets. Personal income tax rates. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. All of our bracket data and tax rates are updated yearly.

10 12 22 24 32 35 and 37. Income Tax Brackets and Rates In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Your bracket depends on your taxable income and.

Well visit that later Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. We keep our database updated with the latest tax brackets each year and aim to be the easiest and most comprehensive income tax resource available on the Internet. Under this system someone earning 10000 is taxed at 10 paying a total of 1000.

The 10 rate applies to income from 1 to 10000. If you are wondering how much tax youll owe when you go. Home Taxes Tax Brackets The United States operates under a progressive tax code which means all things being equal the more you earn the more income taxes you owe.

The tax rates for 2020 are. Includes 38 Net Investment Income Tax for individuals with income of. Your tax bracket depends on your taxable income and.

To clarify the 2021 tax brackets are the rates that will determine your income tax in 2021 which is the tax return youll file in 2022. The following table shows major changes in maximum income and capital gains tax rates through the years. And the 30 rate applies to all income above 20000.

There are seven marginal tax rates or brackets as of 2021. There are seven federal tax brackets for the 2020 tax year. The Federal Income Tax Brackets The US.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly. In 2020 the top three US marginal income tax brackets for a married couple filing jointly were 32 for taxable income between 325000 and 400000 35 for taxable income between 400000 and 600000 37 for taxable income above 600000 numbers rounded to nearest 25000 for mathematical convenience President Biden has proposed that the top marginal rate be raised to 396 for all. Are calculated based on tax rates that range from 10 to 37.

For individuals the top income tax rate for 2021 is 37 except for long-term capital gains and qualified dividends discussed below. This puts you in the 25 tax bracket since thats the highest rate applied to any of your income. 115-97 sunsets after 2025 many individual tax provisions including the lower rates and revised brackets in order to comply with US Senate budget rules.

10 12 22 24 32 35 and 37. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. A financial advisor can help you understand how taxes fit into your overall financial goals.

But as a percentage of the whole 100000 your tax is about 17. Income taxes in the US. Imposes an income tax using progressive rates.

2021 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households. An individuals tax liability gradually increases as their income increases. Rate For Single Individuals For Married Individuals Filing Joint Returns For Heads of Households.

There are seven tax brackets for most ordinary income. Where Tax Brackets Apply. Imagine that there are three tax brackets.

10 20 and 30. 10 12 22 24 32 35 and 37. The income that these rates apply to.

This next calculator lets you try it out with your own numbers. 2020 Individual Income Tax Brackets The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status. The 20 rate applies to income from 10001 to 20000.

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png) Federal Income Tax Rates For Tax Year 2016

Federal Income Tax Rates For Tax Year 2016

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Progressivity In United States Income Tax Wikipedia

Progressivity In United States Income Tax Wikipedia

Inkwiry Federal Income Tax Brackets

Inkwiry Federal Income Tax Brackets

How Much Do People Pay In Taxes Tax Foundation

How Much Do People Pay In Taxes Tax Foundation

Income Tax Rates In The Usa Download Table

Income Tax Rates In The Usa Download Table

Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More

Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More

New Federal Income Tax Brackets 2019 How Much Am I Paying In Taxes

Income Tax In The United States Tax Brackets 2016 Sawamia Denis

Income Tax In The United States Tax Brackets 2016 Sawamia Denis

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 Federal Tax Brackets What Is My Tax Bracket

2021 Federal Tax Brackets What Is My Tax Bracket

History Of Taxation In The United States Wikipedia

History Of Taxation In The United States Wikipedia

Comments

Post a Comment