In Service Rollover From 401k Before 59

Instead typically the only way to access employee 401k salary deferrals pretax or via a Roth and employers safe harbor contributions match andor non-elective and employer-qualified non-elective and matching contribution accounts. Many of these only allow plan rollovers when a worker reaches a triggering event such as reaching retirement age disability plan termination or reaching the age of 59 ½ years.

How To Roll Over Your 401 K In 5 Easy Steps Bankrate

How To Roll Over Your 401 K In 5 Easy Steps Bankrate

The administrator may issue your distribution in the form of a check made payable to your new account.

In service rollover from 401k before 59. The law doesnt allow it. Can in-service distributions be rolled over into an IRA. An in-service rollover allows a current employee to move all or some of the assets in their employer-sponsored 401 k plan into an IRA without taking the money as a distribution.

I was excited to share with him that he in fact could do this and that the procedure was called an in-service distribution. Youre retiring between the ages of 55 and 595 You can take money out of a 401 k without incurring an early withdrawal penalty once youve reached 55 years of age. If you need money before 59-12 you can always withdraw up to the sum of your regular contributions.

Direct rollover If youre getting a distribution from a retirement plan you can ask your plan administrator to make the payment directly to another retirement plan or to an IRA. That penalty can be waived under certain specific IRS hardship provisions for. This may include a minimum age restriction usually age 59 12 a length-of-service requirement often two or five years or both maybe required.

However if you havent been able to contribute directly to Roth IRA due to the income limit this amount may not be much. No matter how much you dislike your current plan and you want to withdrawal it all its not. Some plans allow employees age 59.

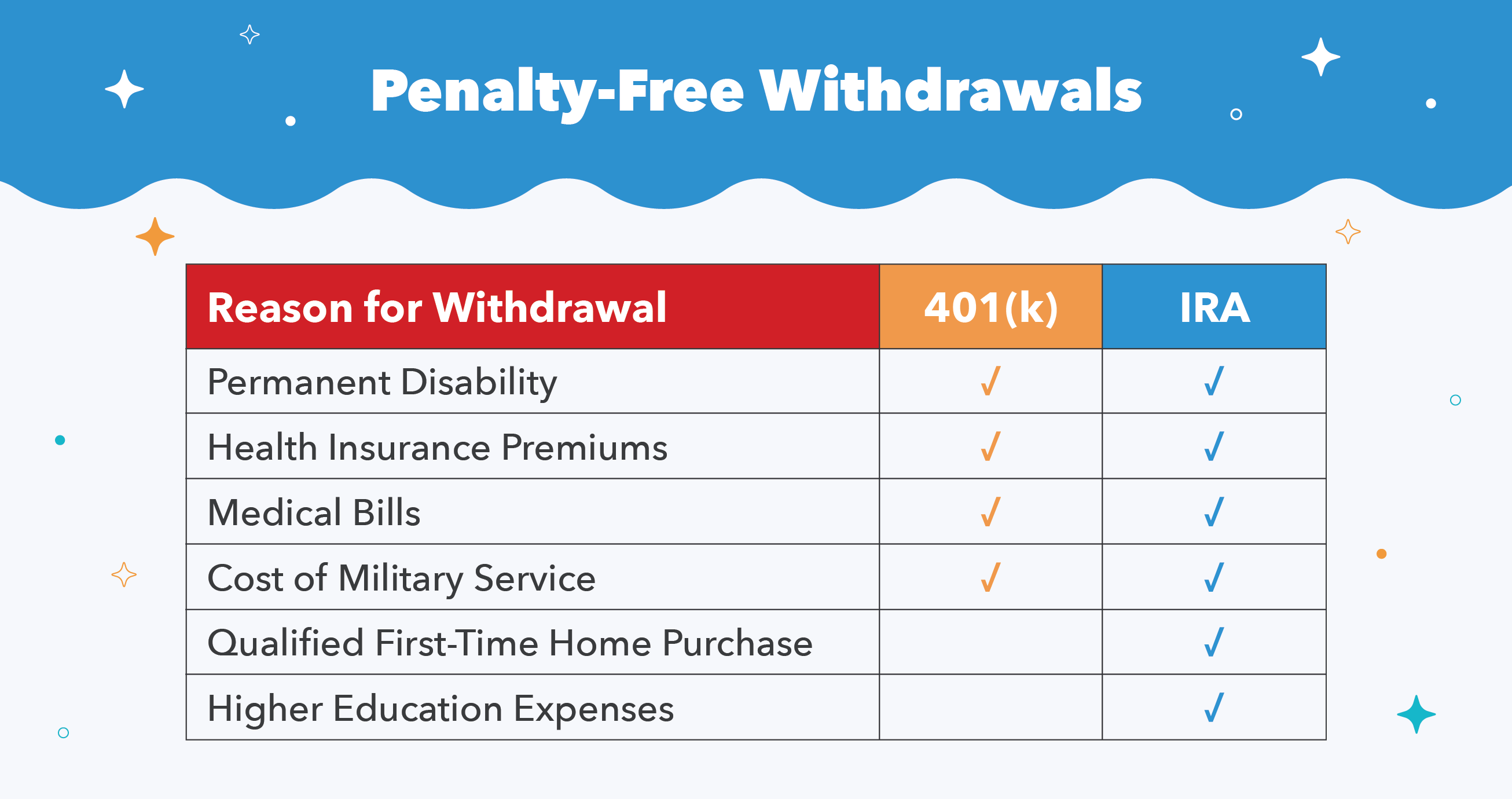

If you make withdrawals prior to turning age 59 ½ you will also have to pay a 10 early withdrawal penalty. When the 5-Year Rule Applies. He is over 59 12 and had heard that he might be able to rollover his 401k to an IRA and also continue to fund his 401k.

For further information about rollovers and transfers refer to Publication 575 Pension and Annuity Income and Publication 560 Retirement Plans for Small Business SEP SIMPLE and Qualified Plans. First things first you HAVE to be 59 12. If youve reached Financial Independence and you retire in your 30s or 40s you cant actually withdraw from your 401k because you get hit with an additional 10 penalty for any withdrawal you take before the strangely-precise age of 59 12.

Expect certain requirements if your retirement plan permits in-service non-hardship employee withdrawals. Contact your plan administrator for instructions. No taxes will be withheld from your transfer amount.

A direct rollover would avoid the 10 early withdrawal penalty as well as the mandatory 20. The availability of in-service distributions is what is known as a protected benefit. The age limit for penalty-free withdrawals from an IRA account is 595.

Second everything is forgiven after. That is the holding period for. According to the Profit Sharing Council of America up to 77 of 401K plans include a provision for in-service 401K rollovers.

That means once the provision is allowed at a specified age you cannot remove it or increase. Employer-sponsored retirement plans often limit these withdrawals to vested employer matching contributions plus earnings as well as rollovers and earnings from previous employer plans. As long as the participant is younger than age 70 ½ an in-service distribution can be rolled over to an IRA.

If you are under age 59 ½ at the time of the distribution any taxable portion not rolled over may be subject to a 10 additional tax on early distributions described below. Rules on 401k In-Service Distribution. An employee who is at least 59½ years old will avoid the 10 penalty on the money moved and will not be immediately required to pay the deferred taxes on the money.

While the law allows for it you must be sure that your plan document permits it. There are a few important caveats to keep in mind when considering offering in-service withdrawals prior to age 59 ½. If funds are rolled over from a Roth 401 k to an existing Roth IRA the rolled-over funds inherit the same timing as the Roth IRA.

In-service Distributions from 401k Plans A 401k plan cannot permit in-service distributions of employee elective deferral accounts prior to age 59½. It is important to note that if the participant is under age 59 ½ at the time of the in-service distribution it will be subject to the 10 early withdrawal penalty. Employee pre-tax or Roth contributions before reaching age 59-12.

Employee pre-tax or Roth contributions before the employee reaches age 59-12 Unfortunately most people are going after the last category. For example rolling over savings from a 401k plan to a traditional IRA is allowed by law if the money being moved is from employer contributions either matched money or profit-sharing. If not a plan amendment is required.

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

The Complete 401k Rollover To Ira Guide Good Financial Cents

The Right Way To Roll Over Your 401 K And Ira Money Marketwatch

The Right Way To Roll Over Your 401 K And Ira Money Marketwatch

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png) Can I Withdraw Money From My 401 K Before I Retire

Can I Withdraw Money From My 401 K Before I Retire

Rollover Ira How To Rollover A 401 K To An Ira Nerdwallet

Rollover Ira How To Rollover A 401 K To An Ira Nerdwallet

How To Rollover 401 K Funds While Still Working For Employer Titan Financial

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

Can In Service Distributions Be Taken Prior To Age 59 1 2

Can In Service Distributions Be Taken Prior To Age 59 1 2

What Is An In Service 401k Rollover 401krollover

What Is An In Service 401k Rollover 401krollover

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

401 K Withdrawal Rules Early No Penalty Options

401 K Withdrawal Rules Early No Penalty Options

Comments

Post a Comment