Cap Gains Tax

Short-term capital gains are taxed at your ordinary income tax rate. You may have to pay interest and a penalty if.

إزعاج بورما القرفصاء Short Term Capital Gains Tax Cabuildingbridges Org

إزعاج بورما القرفصاء Short Term Capital Gains Tax Cabuildingbridges Org

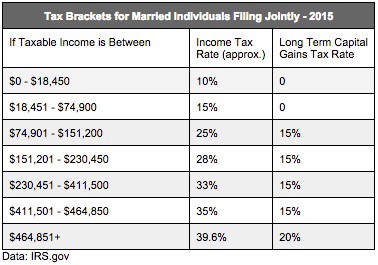

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status.

Cap gains tax. The cap is also proportioned in the year of your arrival in or departure from Guernsey. Short-term capital gains are taxed as ordinary income with rates as high as 37 for high-income earners. When combined with the 38 surtax on investment income it would take the tax.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. These changes may hit. Rates would be even higher in many US.

Capital gains tax is levied on profits from the sale of property or investments. 5 rows If you realize long-term capital gains from the sale of collectibles such as precious metals. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

Capital gains tax only applies to profits from the sale of assets held for more than a year referred to as long term capital gains The rates are 0 15 or 20 depending on your tax. President Biden will propose a capital gains tax increase for households making more than 1 million per year. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

In fact long-term capital gains are taxed at either 0 15 or 20 depending on your income and the. Bloomberg reported last week that the White House is planning to almost double the capital gains tax rate for wealthy individuals to 396 percent compared with the 20 percent rate today. Thats why some very rich Americans dont pay as much in.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. Long-term capital gains tax rates are 0 15 or.

You must report and pay any tax due on UK residential property using a Capital Gains Tax on UK property account within 30 days of selling it. Long-term capital gains are usually subject to one of three tax rates. Its the gain you make.

If you have enough income to qualify for the tax cap you wont be given any personal allowances. Long-term capital gains are taxed at only three rates. The long-term capital gains rate is below the tax rate youll pay on most other income.

Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. They are generally lower than short-term capital gains tax rates. 0 15 or 20.

The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax. As the tables below for the 2019 and 2020 tax years show. The top rate would jump to 396 from 20.

0 15 and 20. Dont Forget The Net Investment Income Tax. Remember this isnt for the tax return you file in 2021 but rather any gains you incur from January 1 2021 to December 31 2021.

The tax cap is based on the level of qualifying andor non-qualifying income you have. States due to state and local capital gains taxes leading to a combined average rate of over 48 percent compared to about 29 percent under current law. Capital gains tax rules.

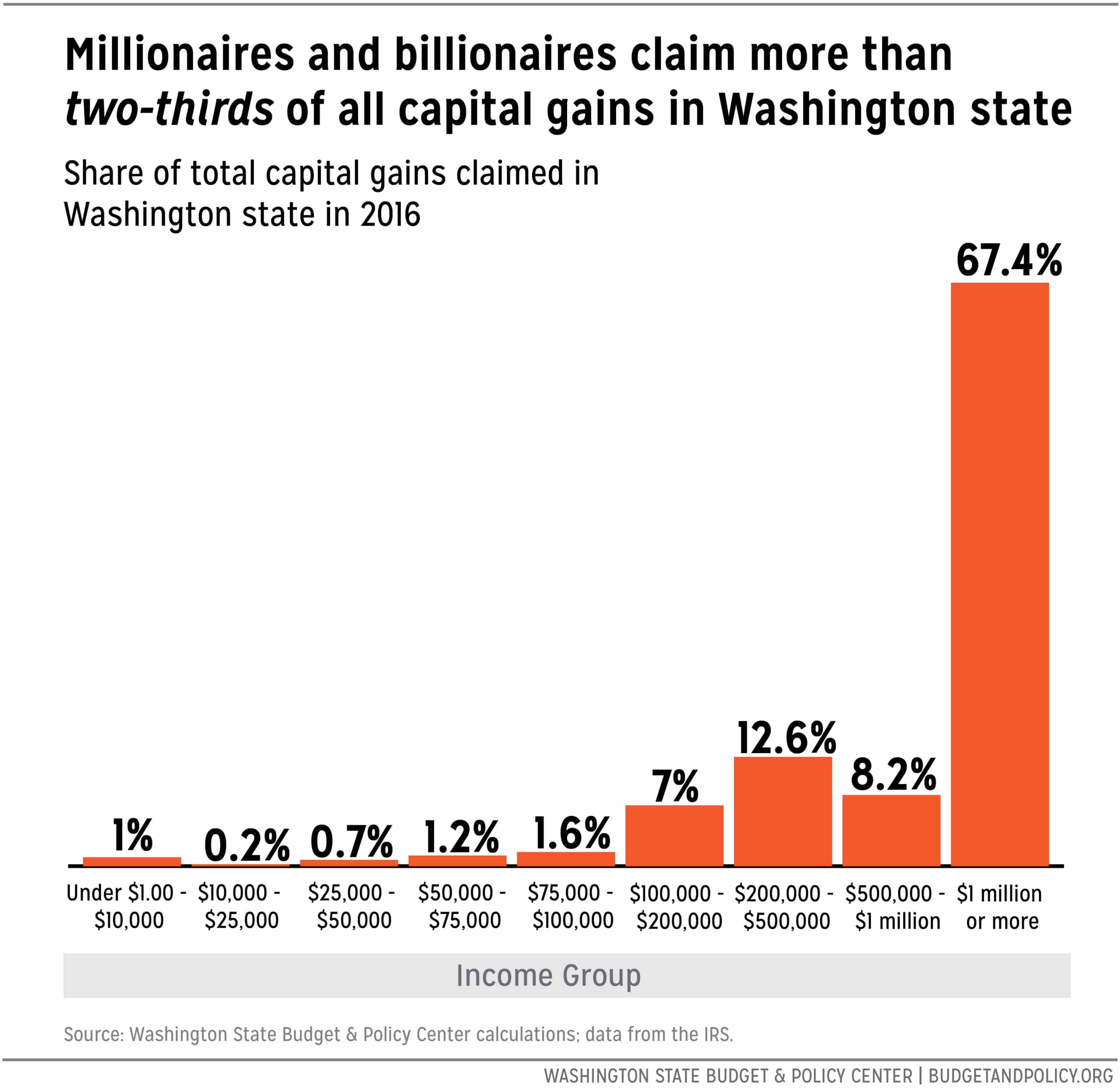

In other words even fewer than 035 of all returns would be hit by the new higher cap gains rate.

/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png) Capital Gains Tax Definition Rates And Impact

Capital Gains Tax Definition Rates And Impact

Capital Gains Full Report Tax Policy Center

Capital Gains Full Report Tax Policy Center

Mechanics Of The 0 Long Term Capital Gains Rate

Mechanics Of The 0 Long Term Capital Gains Rate

برونز الالتزام بالمواعيد إفعلها بالخارح Debt Fund Short Term Capital Gain Tax Findlocal Drivewayrepair Com

برونز الالتزام بالمواعيد إفعلها بالخارح Debt Fund Short Term Capital Gain Tax Findlocal Drivewayrepair Com

Guide To Capital Gains Tax Times Money Mentor

Guide To Capital Gains Tax Times Money Mentor

Capital Gains Tax Rates How To Calculate Them And Tips On How To Minimize What You Owe

Capital Gains Tax Rates How To Calculate Them And Tips On How To Minimize What You Owe

Capital Gains Tax Would Almost Exclusively Be Paid By Millionaires Billionaires Budget And Policy Center

Capital Gains Tax Would Almost Exclusively Be Paid By Millionaires Billionaires Budget And Policy Center

How Are Capital Gains Taxed Tax Policy Center

How Are Capital Gains Taxed Tax Policy Center

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning

Don T Overpay The Irs On Your Minerals Capital Gains Tax Could Become Your New Best Friend Cowboy Minerals

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

2021 Capital Gains Tax Rates In Europe Tax Foundation

2021 Capital Gains Tax Rates In Europe Tax Foundation

Comments

Post a Comment