Income Driven Repayment

On an income-driven plan your payment would be capped at 10 15 or 20 of that total or between 1127 and 2253. If youre looking for the lowest monthly payment PAYE or REPAYE could be your best options since they cap your bills at 10 of your income.

A Better Way To Provide Relief To Student Loan Borrowers

A Better Way To Provide Relief To Student Loan Borrowers

The term income-driven repayment describes a collection of plans that calculate a.

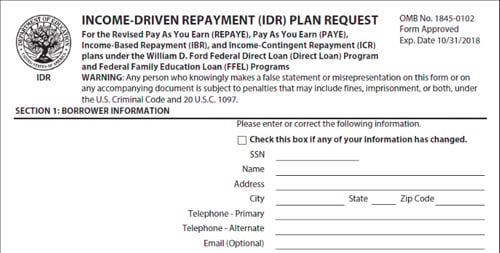

Income driven repayment. 1 If you fail to do so your monthly payment could increase and you might lose the option to make payments based on your income. You also must demonstrate financial need based on your income. For the Revised Pay As You Earn REPAYE Pay As You Earn PAYE Income-Based Repayment IBR and Income-Contingent Repayment ICR plans under the William D.

INCOME-DRIVEN REPAYMENT IDR PLAN REQUEST. There are four IDR Plans available all of which come with different features based on your needs. Payments are recalculated each year and are based on.

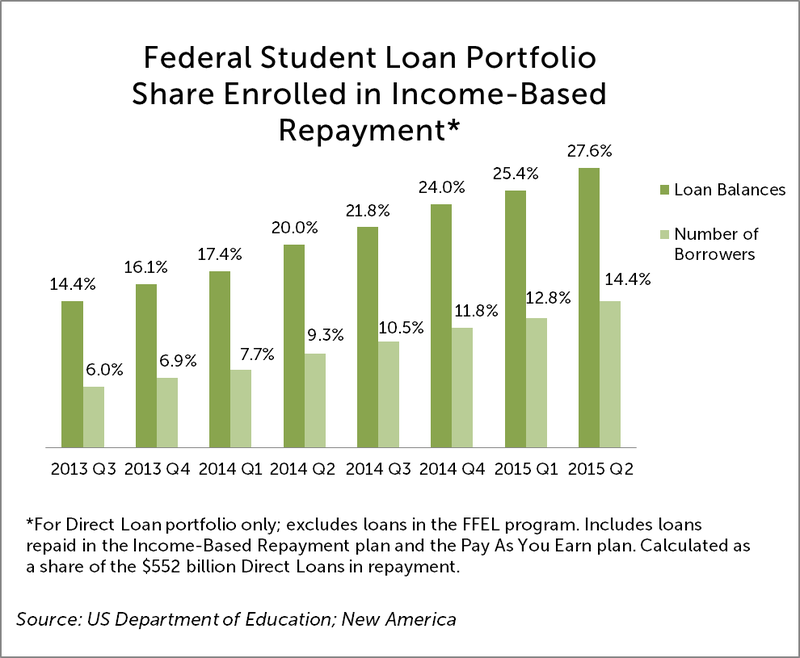

Income-driven repayment programs are a lifeline to millions of federal student loan borrowers. At the end of your required payment period as long as youve fulfilled all of the requirements of your program any remaining balance will be forgiven. To qualify for IBR your prospective payments must be lower than theyd be on the Standard Repayment Plan.

These plans can make payments more manageable help you make progress on your loan and provide flexibility as your income changes. Income-Driven Repayment IDR Plans are a great option if your monthly payment feels high compared to your income. Your monthly payments will be either 10 or 15 percent of discretionary income depending on when you received your first loans but never more than you would have paid under the 10-year Standard Repayment Plan.

Also any unpaid interest may be capitalized or added to your loan balance. These plans use your income location and family size to determine your monthly payment. But many factors may affect how servicers calculate payments under Income-Based Repayment.

Income Sensitive Repayment is right for you if youre worried about your monthly payments your loans dont qualify for a more beneficial repayment plan and you need temporary relief to fit your budget. Income-Based Repayment IBR is an option regardless of when you received your loans. Its similar to Pay As You Earn PAYE but offers more flexibility.

Income-Based Repayment IBR is a repayment plan available to federal student loan borrowers. 1845-0102 Form Approved Expiration. Income-Based Repayment Calculator This calculator determines the monthly payment and estimates the total payments under the income-based repayment plan IBR.

Income-driven repayment plans require that you recertify your income and family size each year with your loan servicer. Federal Student Aid. Ford Federal Direct Loan Direct Loan Program and Federal Family Education Loan FFEL Programs.

When applying for IBR the government looks at your income family size and state of residence to calculate your monthly payments. 1 What Is Income-Driven Repayment Plan Forgiveness. Income-driven repayment IDR plans are available for borrowers with federal student loans.

An income-driven repayment plan allows you to make payments based on your earnings for 20 to 25 years depending on your plan. The phrase income-based repayment sounds descriptive enough payment amounts are based on your income. Its based on the idea that how much you pay each month should be based on your ability to pay not how much you owe.

Switch Now Pay Less How Borrowers In Icr Can Reach Student Loan Forgiveness Sooner Student Loan Borrowers Assistance

Switch Now Pay Less How Borrowers In Icr Can Reach Student Loan Forgiveness Sooner Student Loan Borrowers Assistance

Federal Student Aid On Twitter Income Driven Repayment Plans Can Make Your Student Loan Debt More Manageable Learn More Https T Co Dlamwu6tda Https T Co Z1aqazag8t

Federal Student Aid On Twitter Income Driven Repayment Plans Can Make Your Student Loan Debt More Manageable Learn More Https T Co Dlamwu6tda Https T Co Z1aqazag8t

Ibrinfo What Are These Programs

Fact Sheet Income Driven Repayment Plans Generation Progress Generation Progress

How To Decide Which Income Driven Repayment Plan To Choose Ed Gov Blog

How To Decide Which Income Driven Repayment Plan To Choose Ed Gov Blog

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Student Loan Planning Using Income Driven Repayment Idr Plans

Student Loan Planning Using Income Driven Repayment Idr Plans

What Does Income Based Repayment For Student Loans Cost

What Does Income Based Repayment For Student Loans Cost

What Is The Best Income Driven Repayment Plan Student Loan Hero

What Is The Best Income Driven Repayment Plan Student Loan Hero

Income Driven Repayment Options

Income Driven Repayment Idr Plan Requests Cfnc

Income Driven Repayment Idr Plan Requests Cfnc

Which Income Driven Repayment Plan Is Right For You Ed Gov Blog

Which Income Driven Repayment Plan Is Right For You Ed Gov Blog

Federal Student Aid A Twitter Yes Income Driven Repayment Plans Usually Lower Your Payments However Whenever You Make Lower Payments Or Extend Your Repayment Period You Will Likely Pay More In Interest Over

Federal Student Aid A Twitter Yes Income Driven Repayment Plans Usually Lower Your Payments However Whenever You Make Lower Payments Or Extend Your Repayment Period You Will Likely Pay More In Interest Over

How To Decide Which Income Driven Repayment Plan To Choose Ed Gov Blog

How To Decide Which Income Driven Repayment Plan To Choose Ed Gov Blog

Comments

Post a Comment