Capital One Platinum Max Credit Limit

The Capital One Platinum credit limit is 300 or more depending on your creditworthiness. But if your credit score and income exceed what Capital One is looking for you could definitely start off with a higher limit.

How And Why To Request A Credit Limit Increase With Capital One

How And Why To Request A Credit Limit Increase With Capital One

The card also reports your activity to all 3 credit bureaus on a monthly basis making it an appropriate option for building or re-building credit.

Capital one platinum max credit limit. If you have a balance of 3000 across all of your credit cards and a total available credit the credit limits of all your credit cards added up of 10000 your credit utilization rate is 30. With the Platinum Mastercard youll automatically be considered for a higher credit limit in as little as six months. It provides the longest possible grace period 25 days and max late fee amounts to 35.

Just got approved for a Capital On Platinum Card with a 5000 dollar limit. Capital One Secured Credit Card. As an entry-level card for those just coming into the prime credit card market the Capital One Platinum Credit Card isnt going to have the biggest credit limits on the block.

When you make payments your available credit goes back upminus any fees or other charges. Here are our favorite features. Ive had a Capital One platinum card for 12 years.

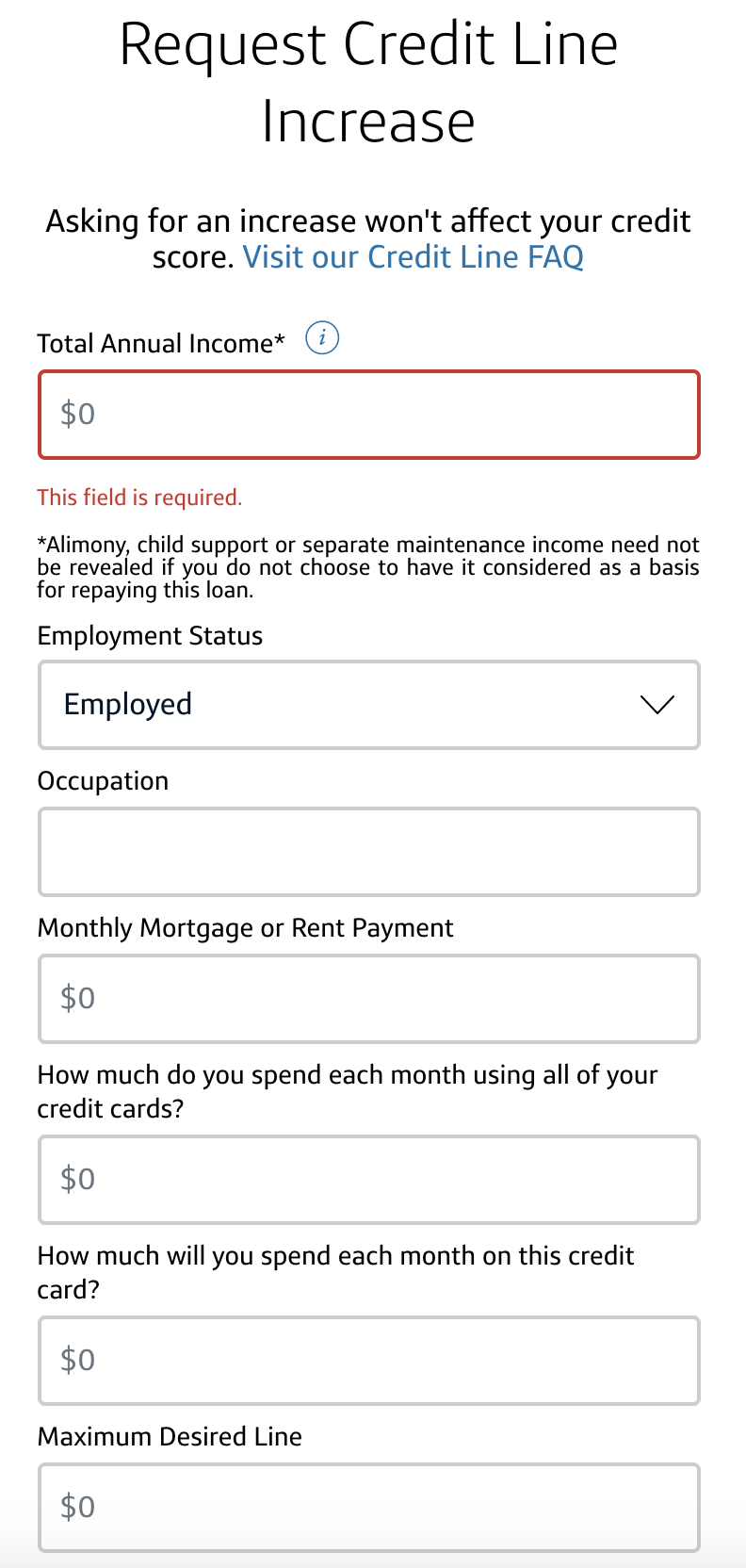

Will the Capital One Platinum increase my credit limit. So if your current credit limit is 5000 but you desire a 10000 dollars credit line then you will input 10000. And there are a variety of factors that could determine your credit limit.

On the surface the Capital One Platinum Credit Card looks like a simple no-frills credit card but theres plenty to like about this card. As long as you make your monthly payments on time you can be automatically considered for a higher credit line in as little as 6 months. The ongoing APR is 2699 Variable APR.

-Why now is the best time for a limit increase. Just wanted to share lol. Researching capital one secured credit card.

It can be done people. Credit limits are set by lenders. The Capital One QuicksilverOne Cash Rewards Credit Card has an average credit limit around 2000 and top applicants may be assigned a limit of up to 5000.

Get 5 cash back on all eligible purchases in the first three months of card membership up to max. So as long as youre approved for the card youre guaranteed at least a 300 spending limit. Then it was stuck at 4000 until recently as I used my other card since the limit grew much faster.

The Secured Mastercard from Capital One has an annual fee of 0 and no foreign transaction fees. As you grow financially consider choosing a credit card that. The first 9-10 years I used it once a month just to keep the account active and the credit limit grew from less than 1000 to 4000 in one or two years.

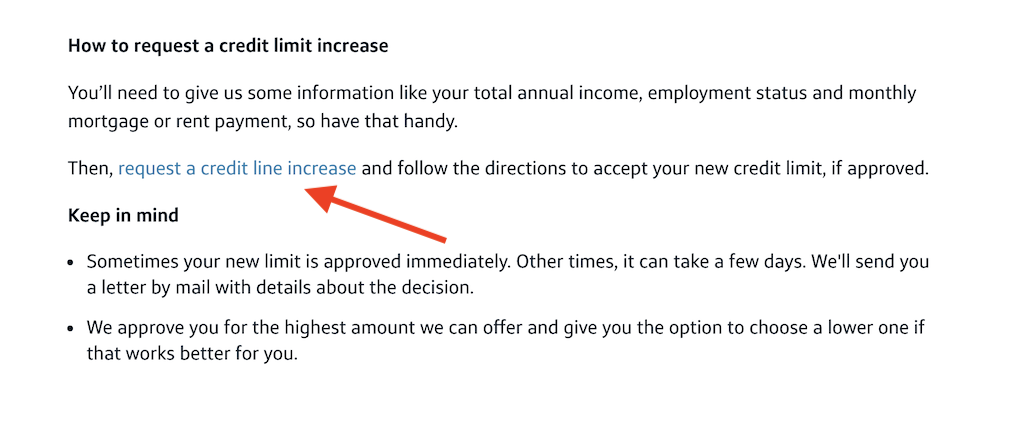

Capital One will review your account and notify you if youve been approved for additional credit. The maximum credit line is 1000. Cash advance fee amounts to 3 min 10 and cash advance rate to 249.

So as long as youre approved for the card youre guaranteed at least a 300 spending limit. Given your 300 limit it sounds like you applied and got approved for the unsecured credit card. Platinum Credit Card Details There is no annual fee max over-limit fee max penalty APR and foreign transaction fee.

Capital One QuicksilverOne Cash Rewards Credit Card. Everything we like about the Capital One Platinum Credit Card card. The cards APR is high.

This is where you will enter your maximum desired credit line. 5000 Credit Limit Increase from Capital One. The Capital One Platinum credit limit is 300 or more depending on your creditworthiness.

The capital one secured credit card may be the best budget friendly secured cre. Plus get a rate of 199 on balance transfers with a 1 balance transfer fee for nine months. Capital One will approve you for the maximum amount of credit that they can and then you will have an opportunity to choose a lower credit limit if you wish.

But if your credit score and income exceed what Capital One is looking for you could definitely start off with a higher limit. As you use your card your available credit goes down. The Capital One Platinum Credit Card is designed for average fair or limited credit so you may need a FICO credit score of at least 580 to qualify.

My credit was 480 3 years ago now its 705 and Ive got 10000 in credit from various cards. Your credit limit is the maximum amount of money a lender allows you to spend on a credit card. The CapOne Platinum card is a normal unsecured credit card with an assigned credit limit credit management tools and benefits you can use.

Indeed unless your credit score is in the good range or better 670 FICO youll probably start out with a credit limit around 300 to 500. The website says the secured card has an initial limit of 200 that they will raise after the first five months of on time payments are made.

Platinum Credit Card Capital One

Platinum Credit Card Capital One

Classic Credit Card Capital One

Classic Credit Card Capital One

How To Raise Capital One Credit Limit Arxiusarquitectura

How To Raise Capital One Credit Limit Arxiusarquitectura

How To Get A Capital One Credit Line Increase Tips 2020 Uponarriving

How To Get A Capital One Credit Line Increase Tips 2020 Uponarriving

Capital One Quicksilver Vs Capital One Platinum Which Is Best Creditcards Com

Capital One Quicksilver Vs Capital One Platinum Which Is Best Creditcards Com

Capital One Platinum Credit Card Reviews April 2021 Credit Karma

Capital One Platinum Credit Card Reviews April 2021 Credit Karma

Credit One Bank Platinum Rewards Visa Forbes Advisor

Credit One Bank Platinum Rewards Visa Forbes Advisor

Capital One Classic Platinum Mastercard Review

Capital One Classic Platinum Mastercard Review

Capital One Platinum Vs Capital One Quicksilverone Creditcards Com

Capital One Platinum Vs Capital One Quicksilverone Creditcards Com

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

Capital One Credit Line Increase Credit Karma

Capital One Credit Line Increase Credit Karma

How And Why To Request A Credit Limit Increase With Capital One

How And Why To Request A Credit Limit Increase With Capital One

How To Get A Capital One Credit Line Increase Tips 2020 Uponarriving

How To Get A Capital One Credit Line Increase Tips 2020 Uponarriving

6 Expert Tips How To Increase Credit Limit Capital One Cardrates Com

6 Expert Tips How To Increase Credit Limit Capital One Cardrates Com

Comments

Post a Comment