High Risk Etf

The term high-yield funds generally refers to mutual funds or exchange-traded funds ETFs that hold stocks that pay above-average dividends bonds with above-average interest payments or a combination of both. ETFs auf Short oder Leveraged Indizes sind als kurzfristiges Handelsprodukt konzipiert und eignen sich nicht für langfristig orientierte Anleger.

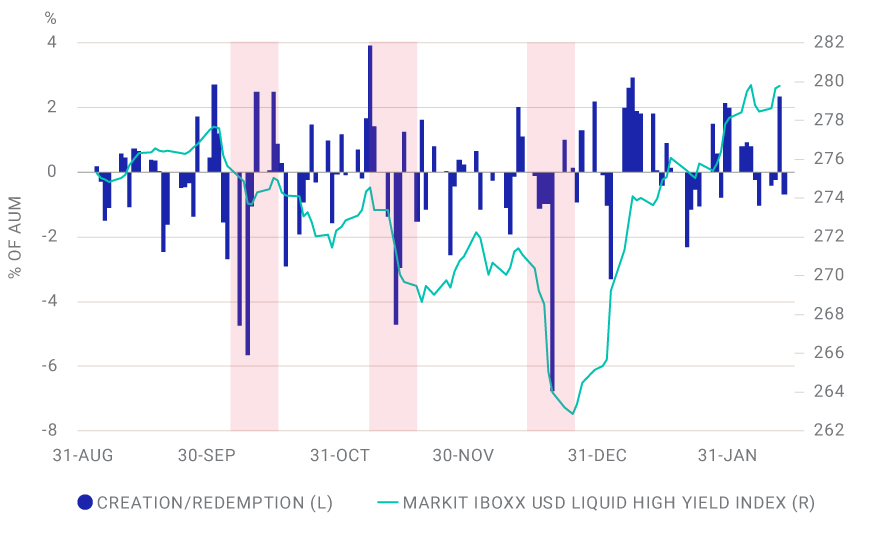

Have High Yield Etfs Created Liquidity Risk Msci

Have High Yield Etfs Created Liquidity Risk Msci

Eine wesentliche Einflussgröße stellt der jeweilige Leitzins der Zentralbank dar.

High risk etf. The ETF pays monthly and its distribution yield over the past 12 months has been 1128 according to FactSet which rates QYLD five stars. But it has to be understood that QYLD is an income play. US dollar exchange rate.

Another High Yield High Risk ETF ALTY facts and portfolio. While certain ETFs such as a US. The single biggest risk in ETFs is market risk.

Tax efficiency is one of the most promoted advantages of an ETF. In November 2020 the US. And international stocks large cap and small cap and value and growth for starters.

Gold miners are quite inexpensive today versus an overvalued stock market condition. High-riskhigh-return ETF portfolios are made up mostly of stock ETFs. Securities and Exchange Commission passed new regulations.

Was beeinflusst den Wert eines High Yield ETF. The distribution rate 66 as of writing is very attractive for income-seeking investors. Like a mutual fund or a closed-end fund ETFs are only an investment vehiclea wrapper for their underlying investment.

Das hat einen einfachen Grund. High Yield Bonds bedeuten auch high risk. An alternative solution to.

Wir alle wissen schmerzlich wenn der Leitzins niedrig ist dann gibt es auch kaum Zinsen auf dem Konto. Consider these high-risk high-reward investments carefully. Global X SuperDividend Alternatives ETF ALTY is a high yield fund paying monthly.

High-yield ETFs help you defray that risk somewhat by investing across dozens if not hundreds of individual issues. This iShares ETF is the largest low-volatility offering on Wall Street with almost 34 billion in assets under management and daily trading volume of about 4 million shares. NUGT is for aggressive accounts and capital allocators only.

Der Leitzins beeinflusst wie viel man auf risikolose Anlagen bekommt. If you have a higher tolerance for risk the Vanguard Information Technology ETF NYSEMKTVGT may be the right investment for you. Nonetheless its always important to.

As you can see 8 of the currency risk is against the yen. Possible high-yield ETFs to buy so that youre balancing risk with reward have less to do with corporate debt and stocks and more to do with consumer-related. After all stocks have a very long history of clobbering most other investments if you give them enough time.

Consider these high-risk high-reward investments carefully. Risk Parity ETF RPAR RPAR doesnt necessarily invest to produce gains in bear markets like the other choices above but invests in a diversified portfolio of assets - equities commodities. This income can be received in the form of dividends from stocks or by interest payments from bonds.

Any portfolio that is mostly stocks should have both US. This investment can be. So if you buy an SP 500 ETF and the SP 500 goes down 50 nothing about how cheap tax efficient or.

Equities priced in pounds make up 58 of the index so your overall currency risk is 94. Click on the tabs below to see more information on Aggressive Growth ETFs including historical performance dividends holdings expense ratios technical indicators analysts reports and more. The Biggest ETF Risks Tax Risk.

As a leveraged ETF TECL comes with a relatively high annual expense ratio of 108 or 108 for every 10000 invested. Bevor eine Handelsentscheidung getroffen wird sollten. One of the most advantageous aspects of investing in an ETF is the fact that you can buy it like a stock.

Aggressive Growth ETFs are aimed at providing growth using aggressive tactics meaning they have a high riskreward profile. In other words a UK based investors MSCI World ETF holding is 60 exposed to the pound.

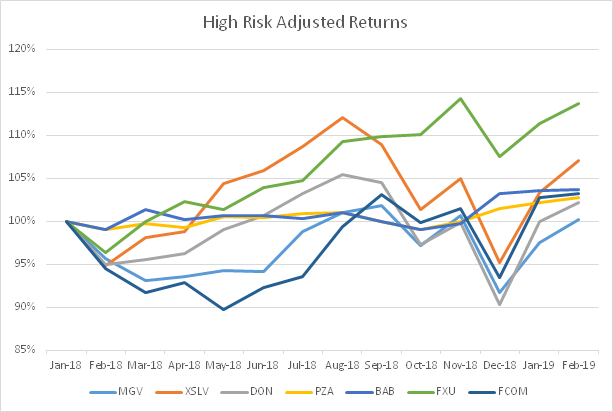

Lower Risk Etfs With High Risk Adjusted Returns Seeking Alpha

Lower Risk Etfs With High Risk Adjusted Returns Seeking Alpha

Direxion Launches High Risk Sustainable Investment Etf Financial Times

Direxion Launches High Risk Sustainable Investment Etf Financial Times

Etf Currency Risk How To Handle It Justetf

Etf Currency Risk How To Handle It Justetf

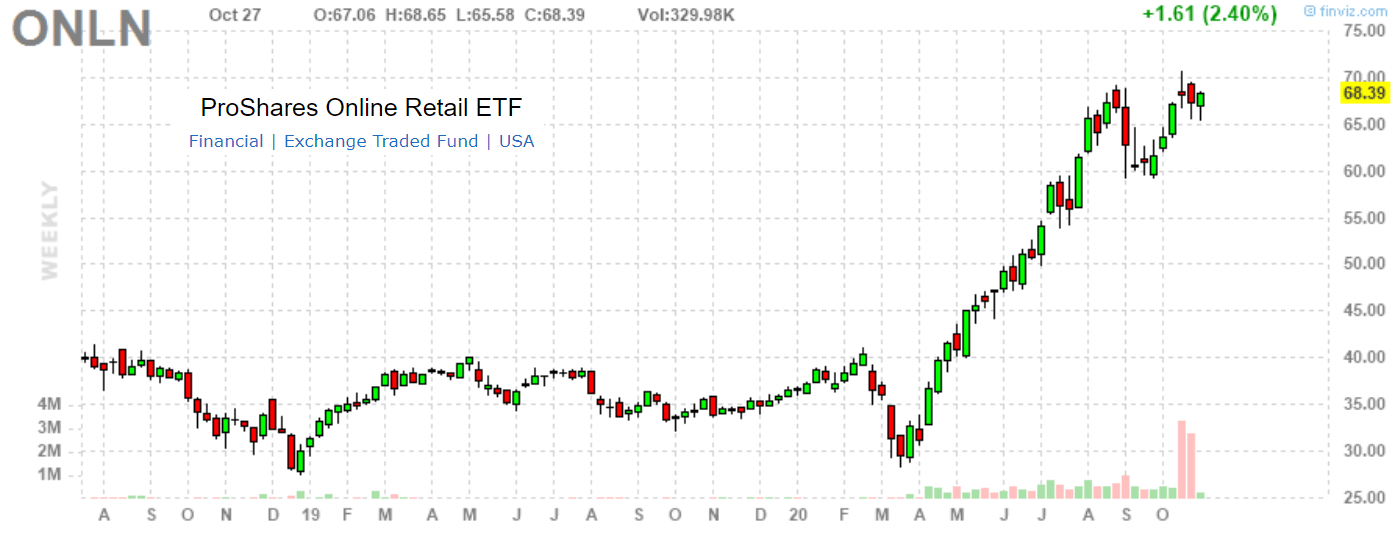

Proshares Online Retail Etf Big Winner 2020 Is High Risk As A Long Term Holding Nysearca Onln Seeking Alpha

Proshares Online Retail Etf Big Winner 2020 Is High Risk As A Long Term Holding Nysearca Onln Seeking Alpha

Purpose Investments Lanceert Ethereum Etf Beste Bank Kennisbank

Purpose Investments Lanceert Ethereum Etf Beste Bank Kennisbank

Etf Currency Risk How To Handle It Justetf

Etf Currency Risk How To Handle It Justetf

Currently Holding A Lot Of High Risk Investments But Have A Further 3 000 To Invest For Long Term Would Appreciate Suggestions On A Lower Risk Etf To Hold 10 Years That Could

Currently Holding A Lot Of High Risk Investments But Have A Further 3 000 To Invest For Long Term Would Appreciate Suggestions On A Lower Risk Etf To Hold 10 Years That Could

3 High Risk High Reward Stocks To Add To Your Watch List The Motley Fool

3 High Risk High Reward Stocks To Add To Your Watch List The Motley Fool

High Flying Tech Sector Too Volatile 2 Etfs To Mute The Risk Investing Com

High Flying Tech Sector Too Volatile 2 Etfs To Mute The Risk Investing Com

3 Dws Etfs Enjoying Strong 2021 Inflows Etf Trends

3 Dws Etfs Enjoying Strong 2021 Inflows Etf Trends

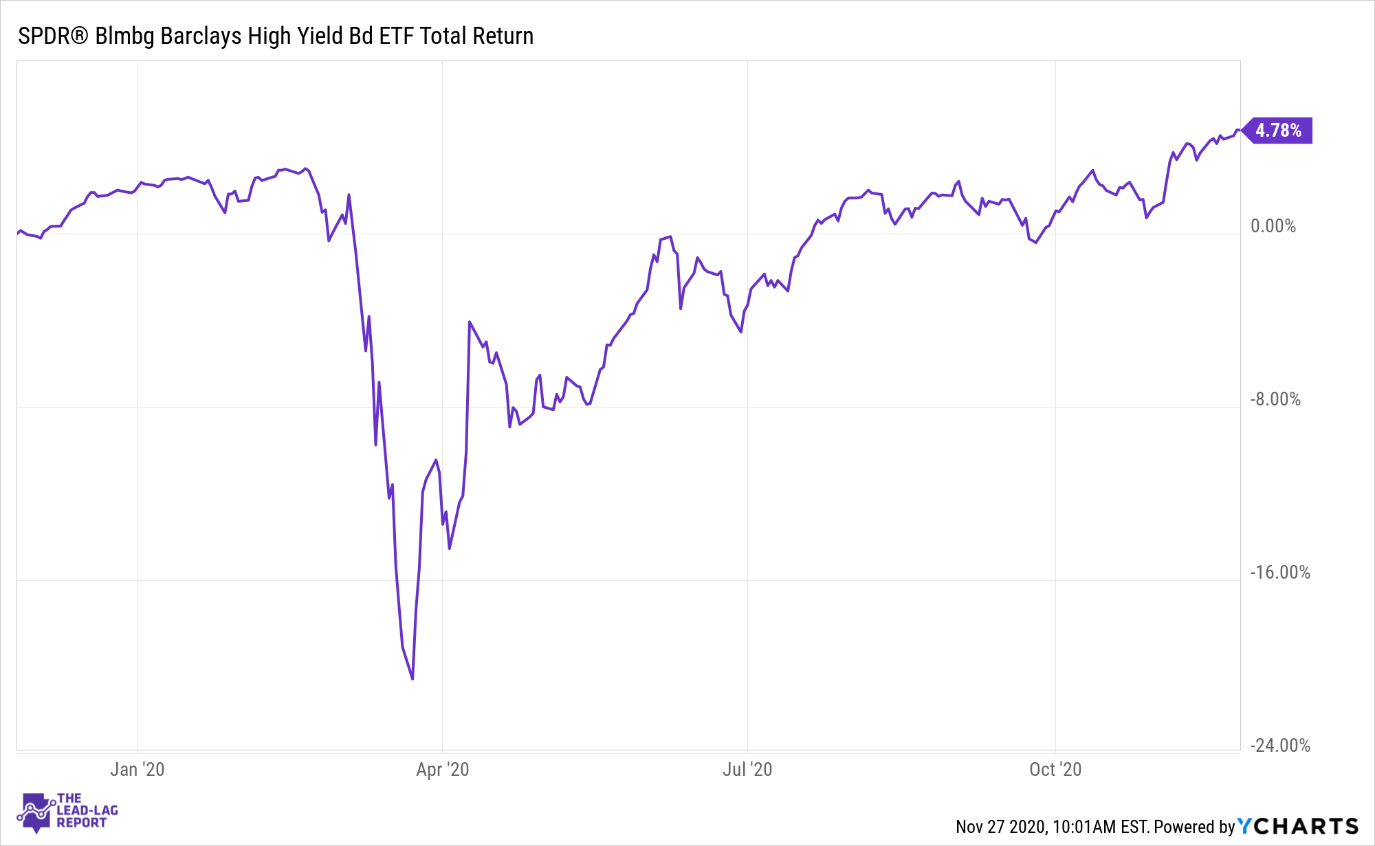

Spdr Bloomberg Barclays High Yield Bond Etf High Risk High Reward Proposition Nysearca Jnk Seeking Alpha

Spdr Bloomberg Barclays High Yield Bond Etf High Risk High Reward Proposition Nysearca Jnk Seeking Alpha

The Investment Risk Pyramid The Tortoise Mindset

The Investment Risk Pyramid The Tortoise Mindset

/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg) The Hidden Differences Between Index Funds

The Hidden Differences Between Index Funds

Comments

Post a Comment