Car Loan Requirements

With good credit credit scores above 660 youre considered a low-risk. Minimum 18 years of age.

Gtb Car Loan Requirements How To Apply Loanspot

Gtb Car Loan Requirements How To Apply Loanspot

Document Requirements for Car Loan in the Philippines Most banks require these supporting documents from borrowers.

Car loan requirements. Requirements Salaried Individual OFW In Business Pre-Approval. While Bank of America has a minimum loan amount of 7500 Capital One only requires minimum loans of 4000. Self-employed individuals who are eligible for a car loan.

The items lenders require vary but the basic car loan requirements tend to. Basic Bad Credit Car Loan Requirements. They may require a minimum annual income years of employment or company turnover before they can approve your loan.

SIRVI-CardACR with Official Receipt for Non-Filipino applicants Latest Income Tax Return ITR or certificate of employment with details on salary position and length of service with contact number of the companys HR Valid Government-issued ID. Individuals who are a minimum of 21 years of age at the time of applying for the loan and no older than 60 at the end of the loan tenure Individuals who have had a job for at least 2 years with a minimum of 1 year with the current employer Those who earn a minimum of Rs. Basic Car Loan Requirements Requirements Vary By Credit Situation.

Auto lenders also tend to be more forgiving of imperfect credit than other types of lenders and its often a matter of shopping until you find a lender who will work for. 21 - 65 years old Minimum monthly household or family income ranging from P30000 to P50000. For instance if you are a salaried person you may need to be employed for at least two years to be eligible for a car loan.

Maximum 65 years of age at loan maturity. If youre buying a new car these probably wont be a problem. When you apply for a car loan your credit score plays an important role just as it does when you apply for a credit card or a mortgage.

While your lender will check your credit as part of your application you dont necessarily need a good credit score to get a car loan. What are the physical requirements I need to apply for a car loan. Again requirements can vary by lender but in general a drivers license or other government-issued ID with your current address can satisfy both.

Many pre-approved car loans have specific requirements that the car you buy must meet. Valid government-issued IDs passport drivers license SSS IDUMID OFW ID Alien Certificate of Registration etc. If you have a bad credit history more documentation will be required than if your credit history is perfect.

300000 per year including the income of the spouseco-applicant. If you dont have that you can also provide a utility bill lease agreement or bank statement with your address on. Minimum 3 years of employment in the same line of business.

Depending on your past and present financial circumstances lenders will require different forms of documentation once the application proceeds. With signature and photo such as Drivers License Passport etc. For example some lenders limit you to a.

When you first apply for a car loan the only document you need is your drivers licence. HDFC Bank Car Loan Eligibility Axis Bank Car Loan Eligibility Axis Bank offers Car Loans at attractive interest rates to both salaried and self-employed individuals who meet our age and income eligibility criteria. Minimum Net Annual Business income of Rs.

Of borrower and co-maker if available. For selected models and Rs. Each bank has its own criteria for car loans.

Income eligibility based on latest Income Tax Returns. Income and Employment There are income and employment requirements you need to meet to qualify for an auto loan. Locally employed borrowers will have to present and submit the following items listed below.

That said the credit requirements for auto loans can vary considerably among different lenders. This is primarily because the lender wants to know where the car will be parked in case you default on payments and it needs to repossess the vehicle. To avail an SBI Car Loan you should be an individual aged 21 to 65 years belonging to one of the following 3 categories.

While Bank of America will finance cars. When youre struggling with credit issues your best chance at qualifying for a car loan is through a subprime lender and we have the inside scoop on what you need to prepare to meet standard income and employment requirements. Before applying for an auto loan make sure you a resident of the Philippines can meet the following requirements.

Duly accomplished application form.

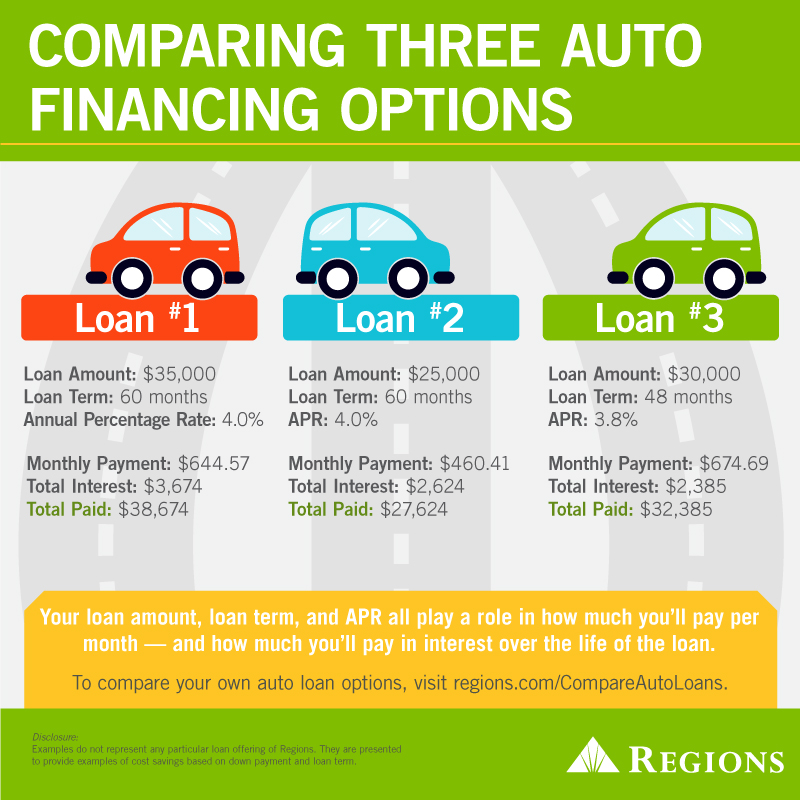

How To Get Auto Financing When Buying Your First Car Regions

How To Get Auto Financing When Buying Your First Car Regions

Asialink Car Loan How It Works And Latest Promos

Asialink Car Loan How It Works And Latest Promos

Sbi Car Loan 7 70 Calculate Emi Check Eligibility Apply Online

Sbi Car Loan 7 70 Calculate Emi Check Eligibility Apply Online

What Are The Requirements To Apply For A Car Loan

What Are The Requirements To Apply For A Car Loan

What Are The Car Loan Requirements For Ofws Autodeal

What Are The Car Loan Requirements For Ofws Autodeal

Car Loan Requirement Checklist For Nigerians Cheki Nigeria

Car Loan Requirement Checklist For Nigerians Cheki Nigeria

Requirements For Sangla Or Cr Car Loan New And Used Cars For Sale Philippines

Requirements For Sangla Or Cr Car Loan New And Used Cars For Sale Philippines

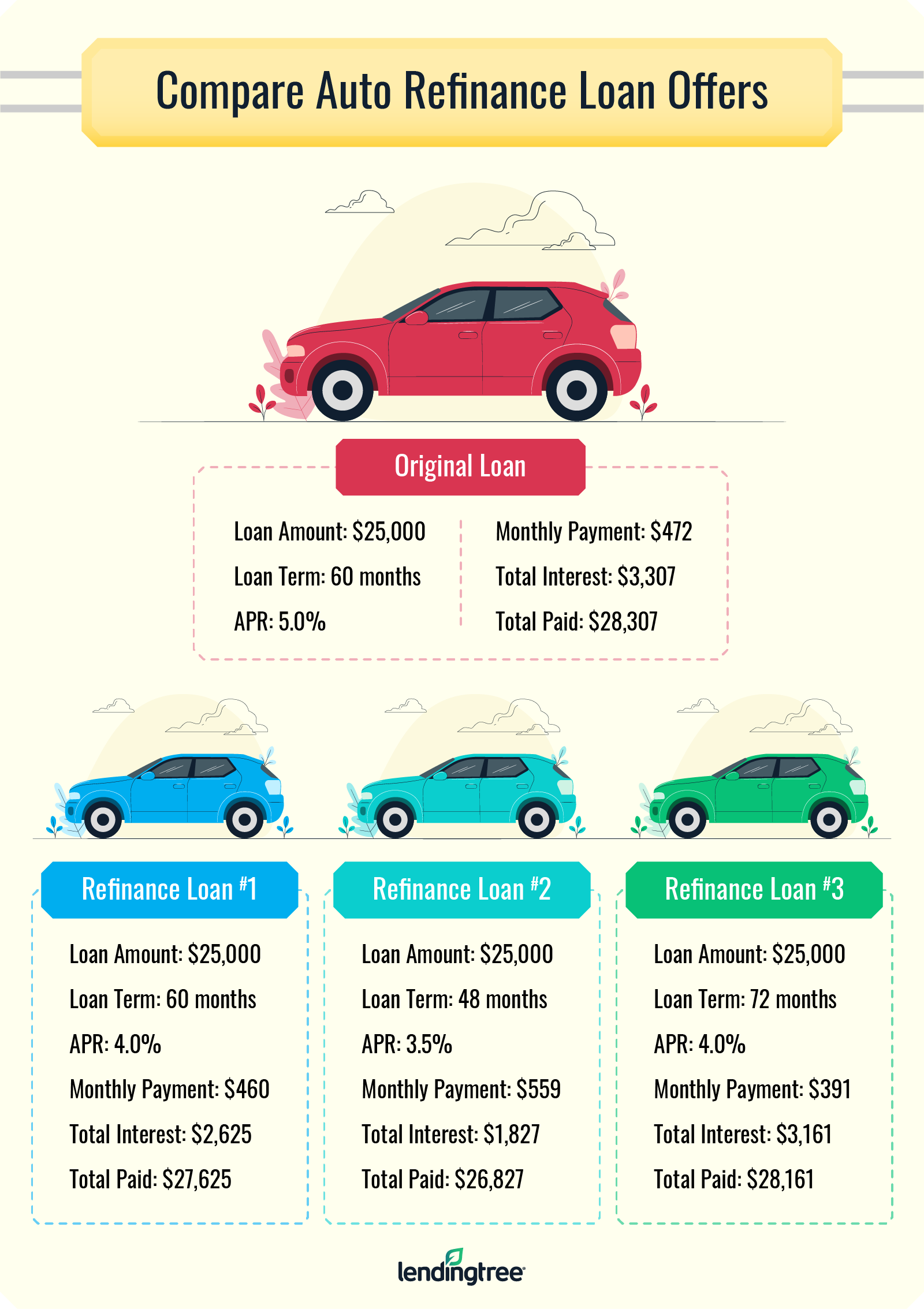

How To Refinance A Car Loan In 6 Steps Lendingtree

How To Refinance A Car Loan In 6 Steps Lendingtree

Car Loans Everything You Need To Know

Car Loans Everything You Need To Know

Car Loan 5 Things To Know Before Getting A Car Loan

Car Loan 5 Things To Know Before Getting A Car Loan

Car Loan For Sale Philippines Find New And Used Car Loan For Sale On Buyandsellph

Car Loan For Sale Philippines Find New And Used Car Loan For Sale On Buyandsellph

Is Psbank Auto Loan The Best Car Loan To Get Your Dream Ride

Is Psbank Auto Loan The Best Car Loan To Get Your Dream Ride

Comments

Post a Comment