Auto Loan Approval Odds

Best practice is to optimize your credit reports utilization before applying for a loan or credit. With a score of 778 your focus should be maintaining your credit status to make sure you get the best interest rates available.

What Are Your Auto Loan Approval Odds Auto Credit Express

What Are Your Auto Loan Approval Odds Auto Credit Express

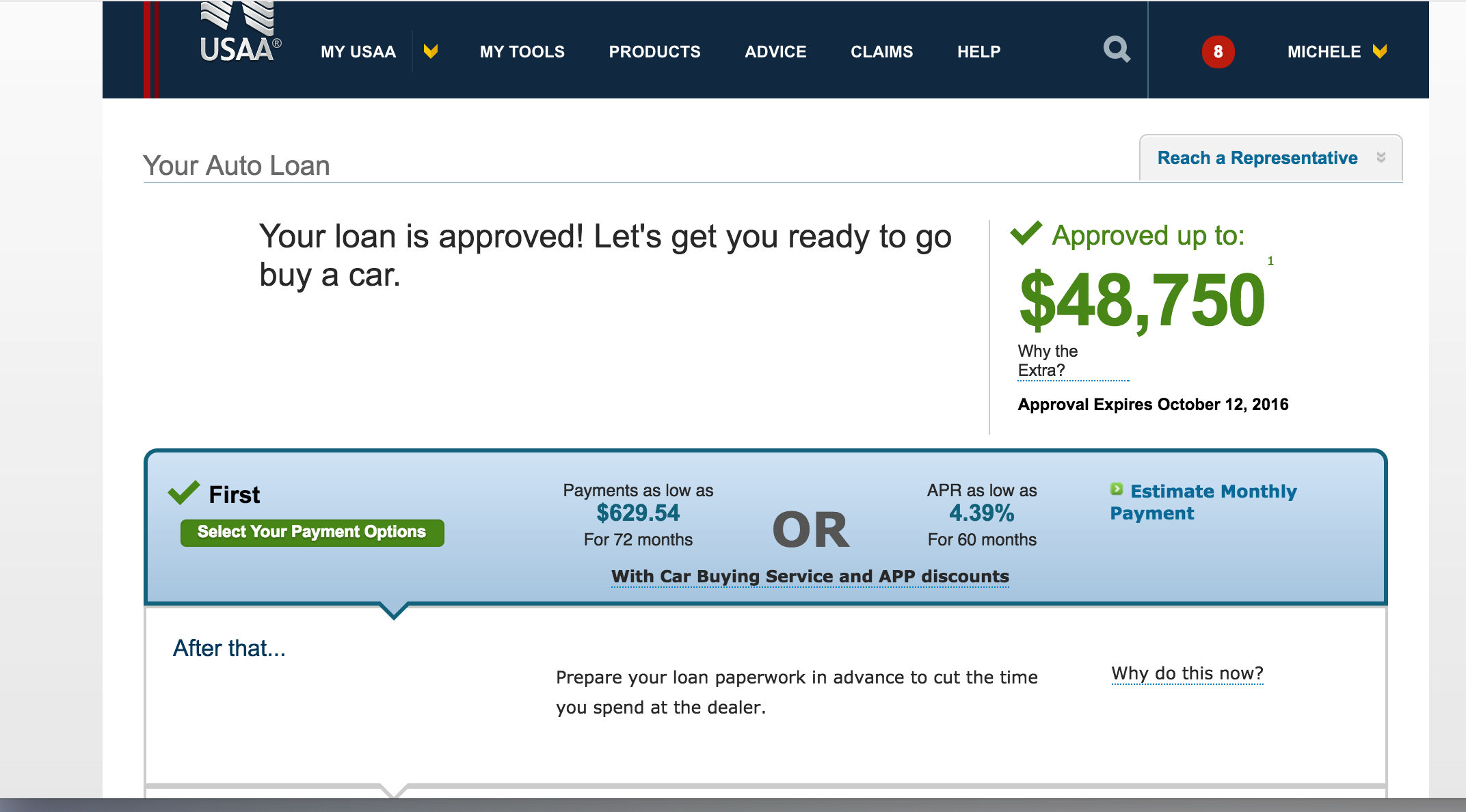

Youll also get an idea of what your interest rate and loan terms will be so you can calculate your monthly car payment and set your budget accordingly.

Auto loan approval odds. You may want to be at. Lenders like to see you contributing to the loan and the more you put down the higher your approval odds usually are. Your approval will depend on amount down amount of time you want to finance it your income your debt.

When you receive an auto loan preapproval the lender gives you a quote for the amount you can borrow and may include the car title taxes and additional fees. Your odds of auto loan approval will however of course rest with the lender you visit. This Auto Loan Options Calculator will show you what car loan.

At Auto Credit Express we work with special finance dealers across the country that have lenders available to. After receiving full approval from your lender you can generally expect to receive your funds within one to three business days. Most credit scores needed for an auto loan approval relies on your previous payment history.

The turnaround time for full approval differs as you can see from the table above. Any lates of 30 days on your auto loan. With a score of 687 your focus should be on raising your credit scores before applying for any loans to make sure you get the best interest rates available.

In general borrowers with higher credit scores will be able to qualify for lower interest rates. You would probably get approved the kicker would be. With good income 6200 equity in your trade and 10-13k down Id say you have a great chance at approval.

However you still have room for improvement. However even borrowers with less than stellar credit can qualify for loans that fit their budget. If youre unable to make a larger down payment adding a cosigner could help.

You can improve your application approval odds by. One important thing to note about pre-approval and quotes for auto loans is that the type of inquiry used will vary based on the lender. This is because lenders consider them a less risky investment.

Go here for data points. Some car loan providers will use a soft credit inquiry that wont impact your credit scores while other lenders will perform a full hard inquiry. Some lenders offer loans for up to 84 months.

The inclusion of a trade-in lowers your purchase price and increases your stake in the purchase. However its best to pay off a car loan quickly since cars depreciate rapidly. A lender like Cap1 with all these factors considered is likely to give you the best rate and not ding you as much for the lates and low credit score.

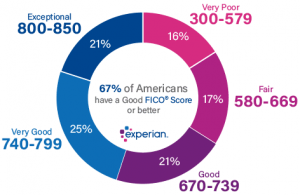

Generally most scores will range from the mid to low 300s through the mid 800s. But if your poor credit score falls at or below 400 you will likely struggle to find a lender willing to work with you. Cosigners can help bad credit borrowers increase their approval odds for a car loan.

Increasing Approval Odds for a Car Loan To improve your chances of getting approved by a car lender you may need to work with one that doesnt review your credit reports called a buy here pay here BHPH dealerships. BHPH dealers are different from traditional dealers since BHPH dealerships offer in-house financing. Thats why its important to go to a lender that can help with your specific credit situation.

The lower your price the less you need to borrow. For a cosigner to assist they must have a good credit score. Im unsure of which version PenFed will pull.

When building your credit with an auto loan it is important to know how much you can afford to repay. Most lenders will lend to borrowers with scores in the Good range. Most lenders will lend to borrowers with scores in the Very Good range.

Adding a trade-in vehicle. Cosigners lend you their good credit score and promise to pay for the auto loan if you cant so they must have enough income in their budget to cover the car payments as well. To increase your auto loan approval odds you may be required to make a larger down payment or add a cosigner to the loan.

While the majority of loans went to good credit borrowers there was an uptick of bad credit buyers getting approved for zero-percent financing with about 4 of borrowers with a credit score below 620 got approved for 0 financing for an 84-month auto loan. But that by no means that having a 500-600 score is considered having good credit.

What Credit Score Do You Need To Buy A Car Nerdwallet

What Credit Score Do You Need To Buy A Car Nerdwallet

/the-credit-score-car-dealers-really-use-3974683_final-84652120491b4ed6a279f7217213fec8.png) What Credit Score Do Car Dealers Use

What Credit Score Do Car Dealers Use

What Are The Credit Score Requirements For An Auto Loan Credit Sesame

What Are The Credit Score Requirements For An Auto Loan Credit Sesame

What Are Your Auto Loan Approval Odds Auto Credit Express

What Are Your Auto Loan Approval Odds Auto Credit Express

Can I Get A Car Loan With A 600 Credit Score Experian

Can I Get A Car Loan With A 600 Credit Score Experian

3 Things To Increase Your Car Loan Approval Odds Auto Credit Express

3 Things To Increase Your Car Loan Approval Odds Auto Credit Express

What Credit Score Do You Need For Car Loan

What Credit Score Do You Need For Car Loan

Will Getting A Car Loan Improve Your Credit Score Heck No

Will Getting A Car Loan Improve Your Credit Score Heck No

Credit Requirements For Auto Loans

Credit Requirements For Auto Loans

Bad Credit And Instant Car Loan Approvals

Bad Credit And Instant Car Loan Approvals

.jpg?sfvrsn=79728d83_0) 5 Steps To Take Before You Apply For An Auto Loan

5 Steps To Take Before You Apply For An Auto Loan

Check Out Average Auto Loan Rates According To Credit Score Roadloans

Check Out Average Auto Loan Rates According To Credit Score Roadloans

What Credit Score Do You Need For Car Loan

What Credit Score Do You Need For Car Loan

Comments

Post a Comment