What Should My House Budget Be

The ratio measures housing expenses as a percentage of gross income income before Social Security Medicare and tax deductions. The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of your gross monthly income your income before taxes are taken out.

10 Easy Ways To Make Your House Look More Expensive Updating House Home Upgrades Interior Decorating Tips

10 Easy Ways To Make Your House Look More Expensive Updating House Home Upgrades Interior Decorating Tips

The housing expense ratio indicates a borrowers ability to make the payments on their mortgage loan.

What should my house budget be. Mortgage lenders have traditionally expected borrowers to have a housing expense ratio of 28 or less. The most basic guideline is that your house payment should not be more than 25 of your monthly income. 1 Work out how much you may be able to borrow via a mortgage based on your salaries and then.

Even your essentials section should be looked at closely. Before you use this however it makes sense. If you are spending more than that you should.

If you earn 5000 a month that means your monthly house payment should be no more than 1250. 2 However data from the Bureau of Labor Statistics show that most homeowners with children under the age of 6 in the United States actually spend 363 of their income on housing costs which includes mortgages. Our household budget calculator lets you track exactly where the money goes every month - the first step to cutting back.

Now there are several interpretations of the words housing costs At a. If that percentage is over 30 it tells you that your neighbors are struggling to keep up with housing costs. If youre a homeowner your housing costs will include your mortgage and home repairs too.

The concept is to create a custom budget for your household based on an after-tax percentage rather than a dollar amount. My more immediate plan is to look at the things you know are coming up for your house most of which a home inspector will tell you during that process and make a specific plan based on those things once you know them. Subscriptions to music services streaming services and online publications are frequently overlooked in household budgets so be sure to include them if you have them.

The calculator below will show you a ballpark figure for how much house you can afford based on your down payment amount and maximum house payment. 3 Will display the housing developments in your chosen postcode area you can afford to buy. For example food purchases should only take up 5 to 15 percent of your budget.

Begin your budget by figuring out how much you and your partner or co-buyer if applicable earn each month. Transportation Any and all transportation costs including public transportation car insurance oil changes car payment gas DMV fees and parking. Our budget calculator shows you the budget breakdown of people like you who live where you live.

The more you make the more house you can afford right. Income is the most obvious factor in how much house you can buy. 2 add this to your available deposit to produce your overall home-buying budget.

For example if you and your spouse have a combined annual income of 80000 your mortgage payment should not exceed 1866. For us that means a new roof in 2-3 years and some new kitchen appliances so were making a more specific plan but if you outline your budget based on 1 per. Your overall monthly payments which included household expenses mortgage payment home insurance property taxes auto loans and any other financial considerations How.

A 2010 article in Forbes magazine recommends percentage budgeting as the best way for people just starting out to form a budget. What measures determine home affordability. Housing costs Rent or mortgage payment along with property tax home or renters insurance home maintenance HOA fees and PMI.

Remember that you should also budget your phone and data usage to make sure your plan isnt too expensive for your. A home budget can be oriented around the 503020 guideline. As a general rule your housing costs shouldnt exceed 30 of your take-home income.

Include all revenue streams from alimony and investment profits to rental earnings. Regular expenditures should usually only take up so much of your income. According to the 503020 budget 50 of your monthly take-home income is devoted to needs 30 to.

How Much House Can You Afford Money Under 30

How Much House Can You Afford Money Under 30

How Much Should You Spend On Housing Car Groceries And Gifts Pete The Planner

How Much Should You Spend On Housing Car Groceries And Gifts Pete The Planner

10 Ways To Fine Tune Your Personal Budget Before Buying A House Mintlife Blog

10 Ways To Fine Tune Your Personal Budget Before Buying A House Mintlife Blog

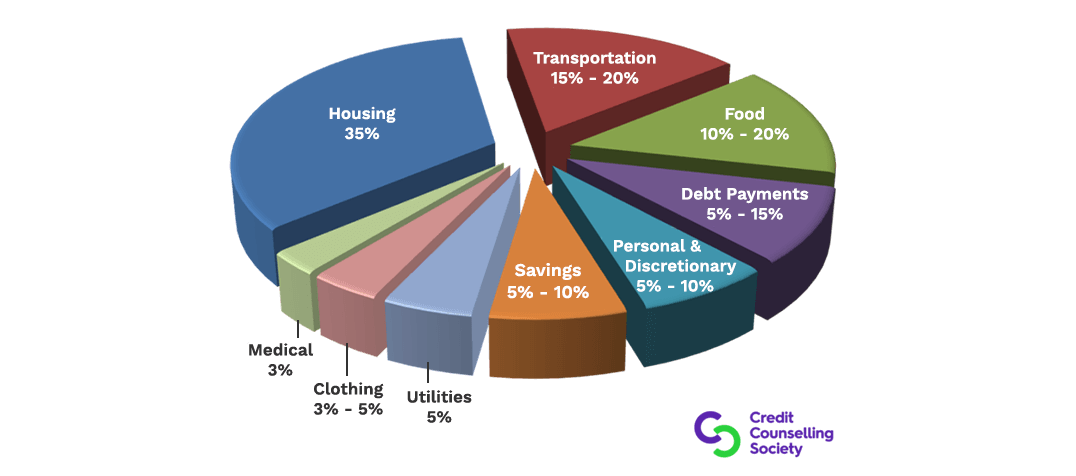

How Much Money You Should Spend On Living Expenses 2021 Budgeting Guidelines For Income Credit Counselling Society

How Much Money You Should Spend On Living Expenses 2021 Budgeting Guidelines For Income Credit Counselling Society

Affordability Calculator How Much House Can I Afford Zillow

Affordability Calculator How Much House Can I Afford Zillow

Budget Calculator Property Price Advice

Budget Calculator Property Price Advice

/luxury-modern-lounge-in-new-build-house-976167964-5b7d9b3446e0fb00824d509a.jpg) Checklist To Furnish Your Dream Home On A Budget

Checklist To Furnish Your Dream Home On A Budget

Low Budget Decorating Ideas For Living Rooms Decorate My House Cheap Cheap Diy Project Living Room On A Budget Diy Home Decor On A Budget Trendy Home Decor

Low Budget Decorating Ideas For Living Rooms Decorate My House Cheap Cheap Diy Project Living Room On A Budget Diy Home Decor On A Budget Trendy Home Decor

/GettyImages-92706711-5806f3813df78cbc28b068ed.jpg) How To Set A Budget For Buying Your First Home

How To Set A Budget For Buying Your First Home

/multi-ethnic-pregnant-couple-moving-into-new-house-726782995-5ab6c04dae9ab8003753e6a1.jpg) Determine How Much You Can Spend On A Home

Determine How Much You Can Spend On A Home

How To Make A Realistic Budget For Buying A House Homeflow

How To Make A Realistic Budget For Buying A House Homeflow

How To Budget For A New Home Money

How To Budget For A New Home Money

What Should My Budget Be For Buying A House Online

Comments

Post a Comment