Requirements To Refinance Mortgage

You can have a credit score as low as 500 up to 579 with a 10 down payment. Here are some strategies to help you find the best refinance mortgage rate for your circumstances.

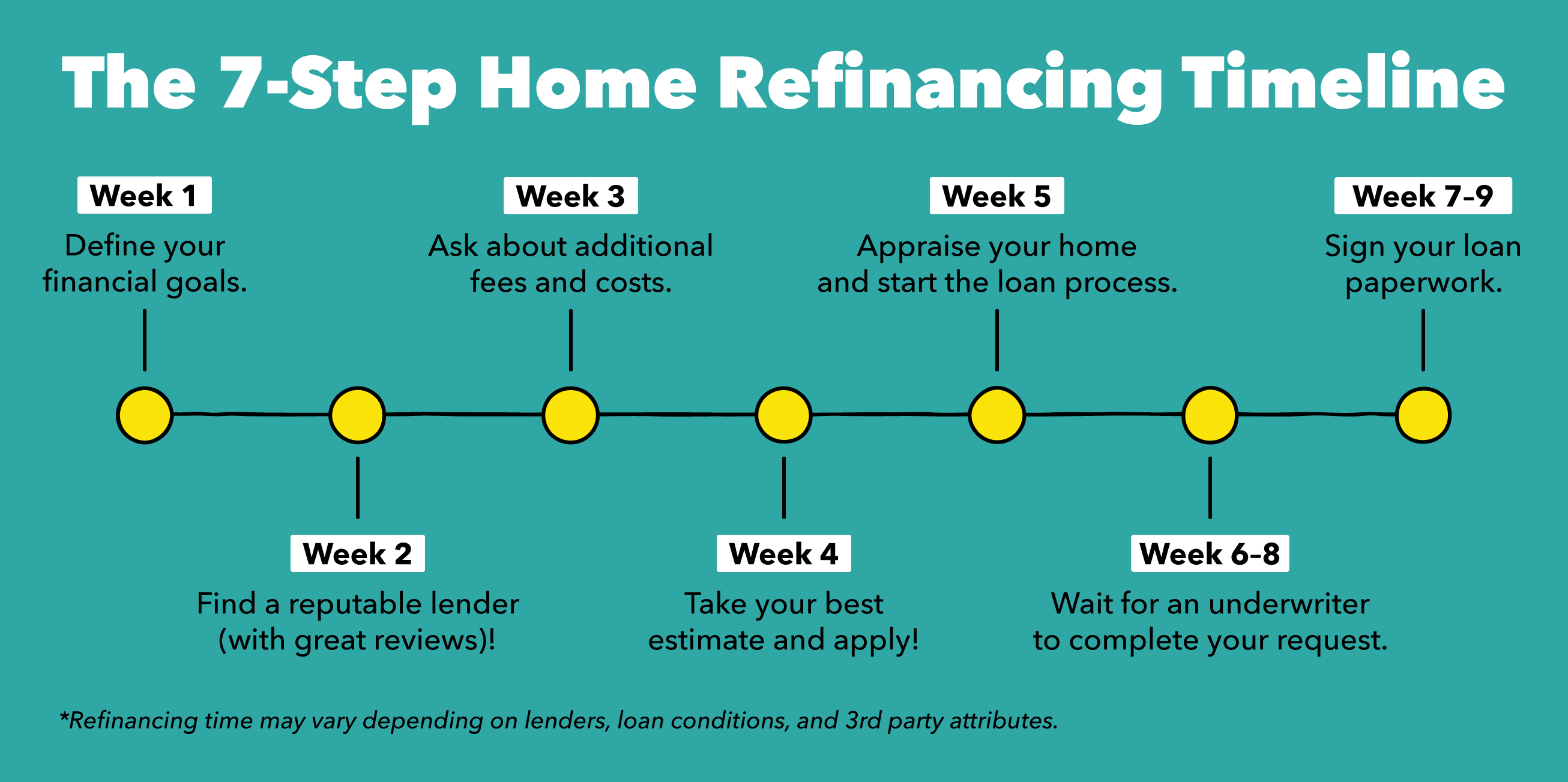

How Long Does It Take To Refinance A House 5 Ways To Speed Up The Process

How Long Does It Take To Refinance A House 5 Ways To Speed Up The Process

The minimum credit score required for a rate-and-term refinance on a home loan backed by the Federal Housing AdministrationFHA depends on your LTV ratio.

Requirements to refinance mortgage. And you have to do the same for mortgage refinancing. Homebuyers making a minimum 35 down payment will need a score of at least 580. You dont need perfect credit to qualify to refinance a loan.

Thats the general rule though they may go to 41 percent. During the pandemic and who wouldnt have otherwise qualified for refinancing due to the companies underwriting requirements. You might pursue a refinance to save money on your monthly payment by refinancing to a different term or to a lower interest rate.

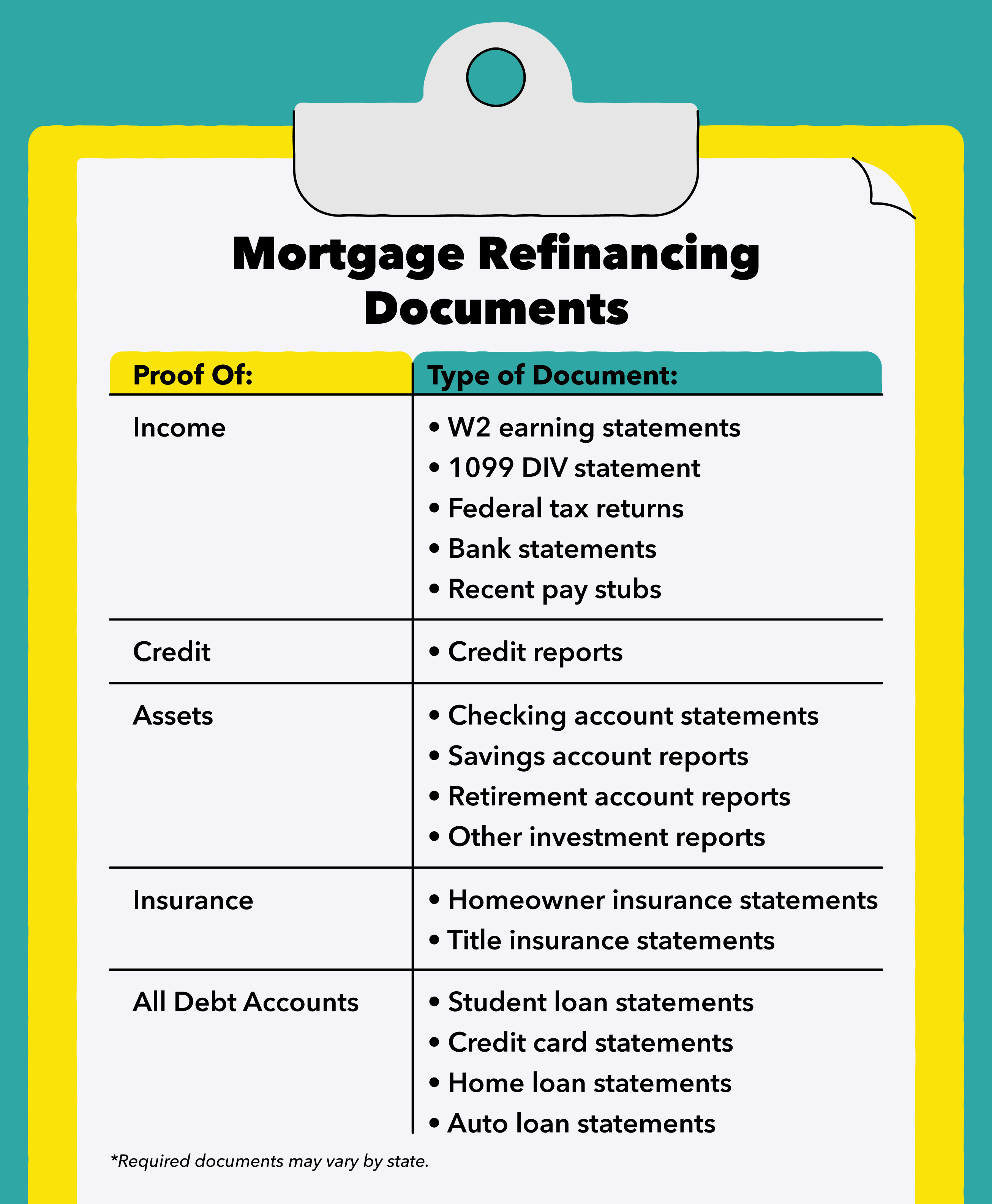

Your lender will consider your income and assets credit score other debts the current value of the property and the amount you want to borrow. You as the homeowner need to have a steady income good credit standing and at least 20 equity in your home. Get your credit score in the best shape possible before refinancing your mortgage.

Most banks and lenders will require borrowers to maintain their original mortgage for at least 12 months before they are able to refinance. Typically mortgage refinancing options are reserved for qualified borrowers. As a rule of thumb mortgage lenders dont want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations including the mortgage you are seeking.

2 days agoMortgage Refinancing Initiative to Help Lower-Income Borrowers. But you can generally expect to need. Although each lender and their terms are different.

Some government programs require a credit score of only 580 while other loans impose no minimums. But in many cases there are fewer requirements and the timeline is streamlined. What is a mortgage refinance.

1 day agoThis new refinance option is designed to help eligible borrowers who have not already refinanced save between 1200 and 3000 a year on their mortgage payment Calabria said. Refinancing simply means that you replace your existing mortgage with another one that. As a rule of thumb its worth considering a.

So how soon after you buy a home can you refinance. Requirements Explained An Understanding Of Refinancing. 2020 - 19 min read What is a mortgage refinance.

Refinancing Your Mortgage. You have to prove your creditworthiness to initially qualify for a mortgage loan approval. The best time to consider a mortgage refinance is when interest rates sink below the level they were when you closed on your original loan.

Requirements for cash-out refinancing vary by lender and loan type. Therefore it is in the best interest of the borrower to check with the specific lender for all restrictions and details. Refinance rates change daily and can vary widely depending on your location credit score loan amount and property value.

Improve your credit score. The minimum credit score is 580 for borrowers with a maximum 9775 LTV ratio. The minimum credit score is 500 for borrowers with a maximum 90 LTV ratio.

A mortgage refinance is when you use the money from a new home loan to pay off your existing one. Determining your eligibility for refinancing is similar to the approval process that you went through with your first mortgage. These costs include appraisal fees prepaid interest or points title search fees title insurance and loan application.

A refinanced loan requires the borrower to pay an array of closing costs. FHA loan income requirements look at the borrowers stability of. Youve Owned The House Long Enough.

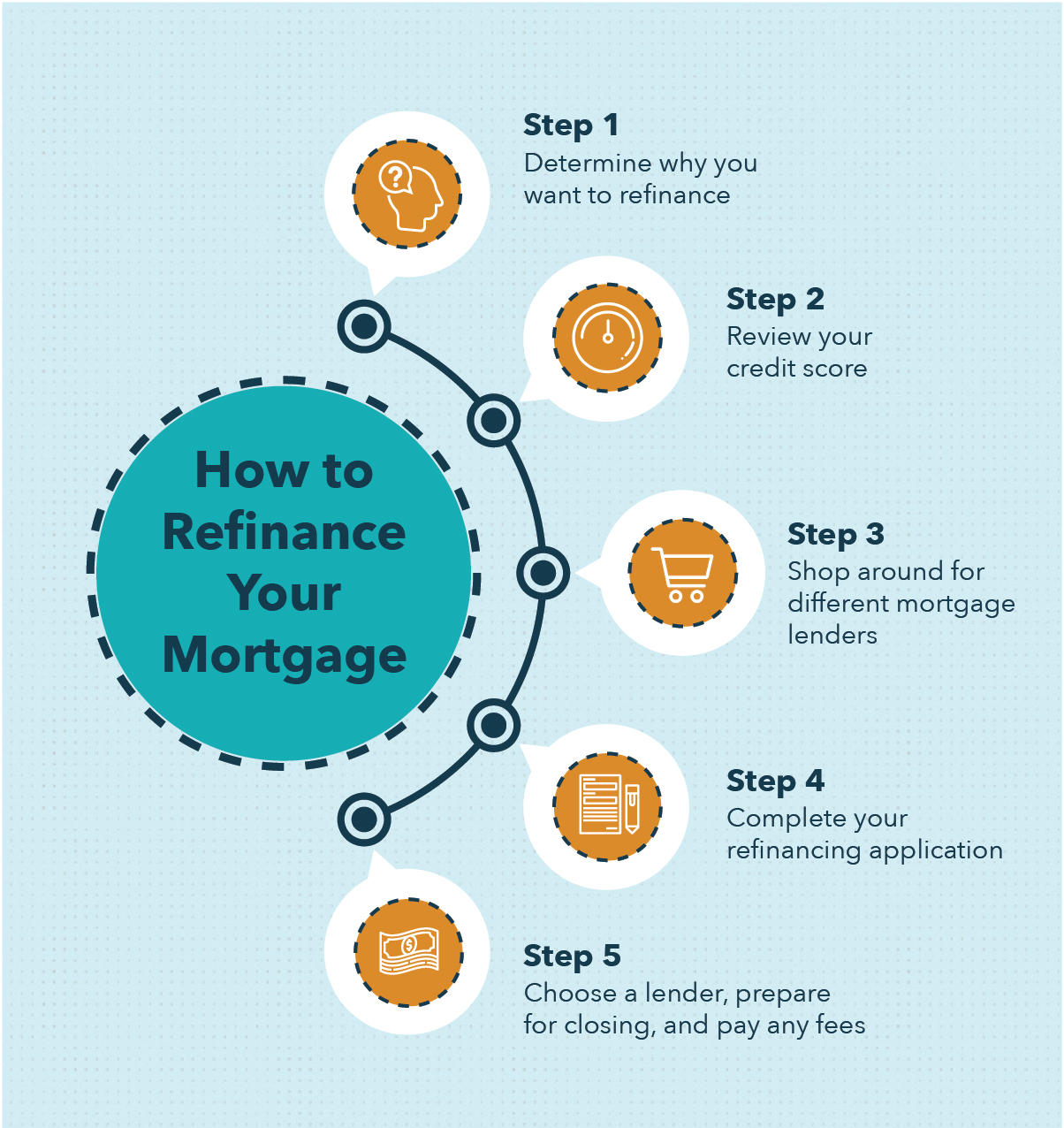

Mortgage refinancing requires you to qualify for the loan just as you had to meet the lenders requirements for the original mortgage. You file an application go through the underwriting. It varies by type of refinance.

To qualify for a standard mortgage refinancing however you generally need a credit score of at least 620.

2021 Fha Streamline Refinance Requirements Eligibility Guidelines

2021 Fha Streamline Refinance Requirements Eligibility Guidelines

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Mortgage Refinance Programs The Lenders Network

Mortgage Refinance Programs The Lenders Network

How A No Cost Refinance Loan Really Works The Truth About Mortgage

How A No Cost Refinance Loan Really Works The Truth About Mortgage

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

How Long Does It Take To Refinance A House 5 Ways To Speed Up The Process

How Long Does It Take To Refinance A House 5 Ways To Speed Up The Process

5 Biggest Myths About Mortgage Refinancing Bankrate Com

5 Biggest Myths About Mortgage Refinancing Bankrate Com

How Does Mortgage Refinancing Work The Truth About Mortgage

How Does Mortgage Refinancing Work The Truth About Mortgage

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

13 Things To Consider When Refinancing Your Mortgage Mid Penn Bank

13 Things To Consider When Refinancing Your Mortgage Mid Penn Bank

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Fha Streamline Refinance Rates Requirements For 2021

Fha Streamline Refinance Rates Requirements For 2021

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Comments

Post a Comment