Is Credit Karma Savings Good

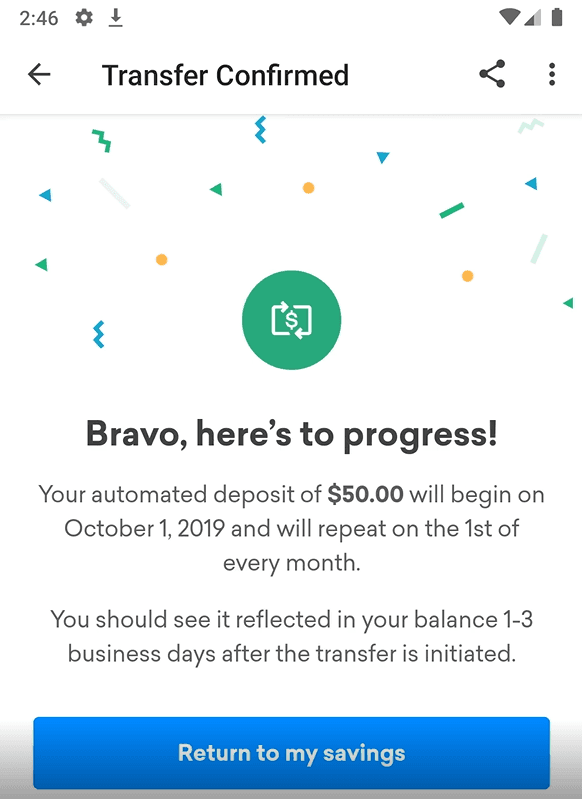

If you already have a Credit Karma account the convenience and ease of being able to open a Credit Karma Savings account isnt a bad perk either. Others required the full 9 digits if your records are harder to find.

Credit Karma Savings High Apy No Monthly Fees

Credit Karma Money Save is about as basic of a banking account as you can get.

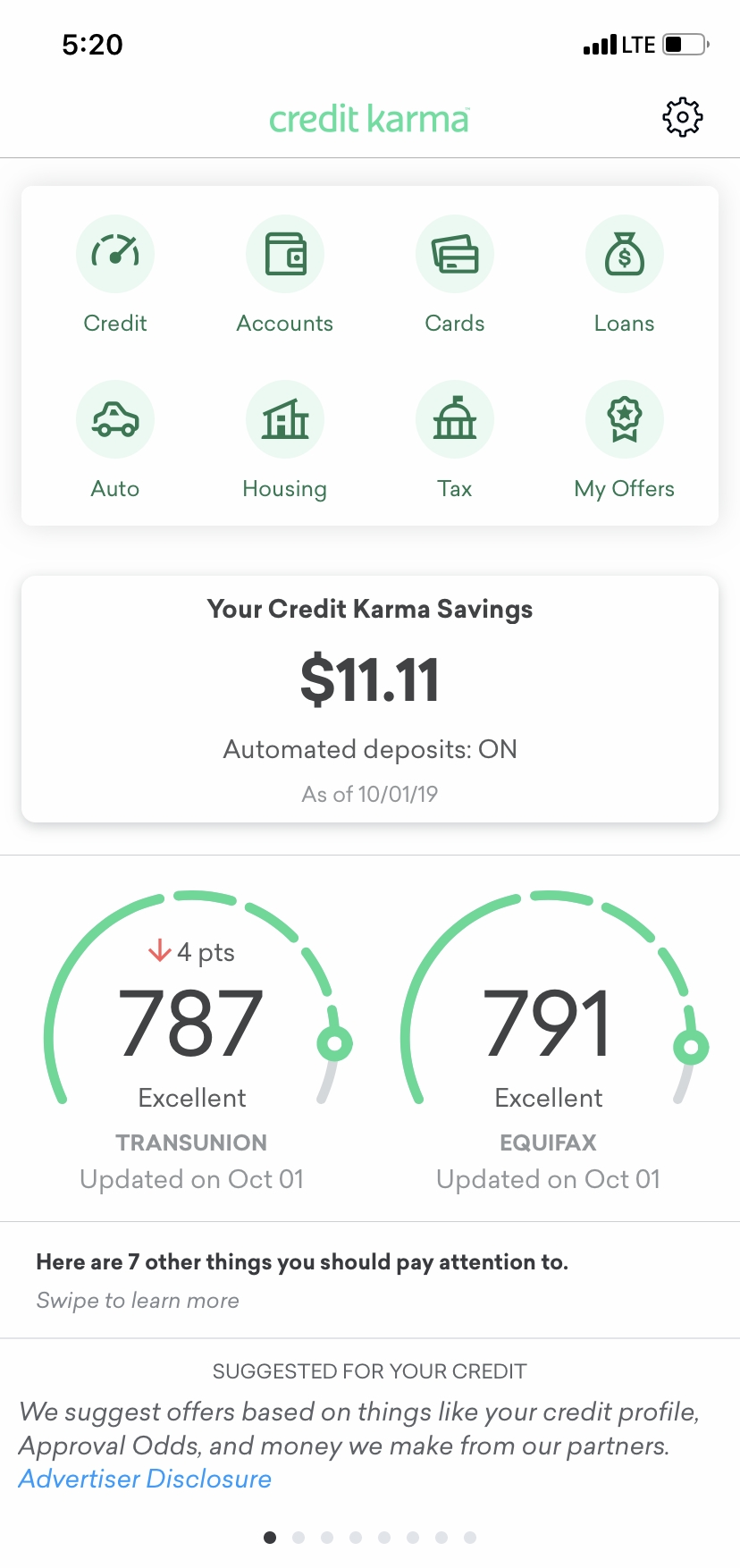

Is credit karma savings good. For example if you have crummy credit it can offer you cards for bad credit. Manage your account right in the Credit Karma app. If you want to earn more for every dollar stashed outside of stocks and bonds a high-yield savings account can be a great place to start.

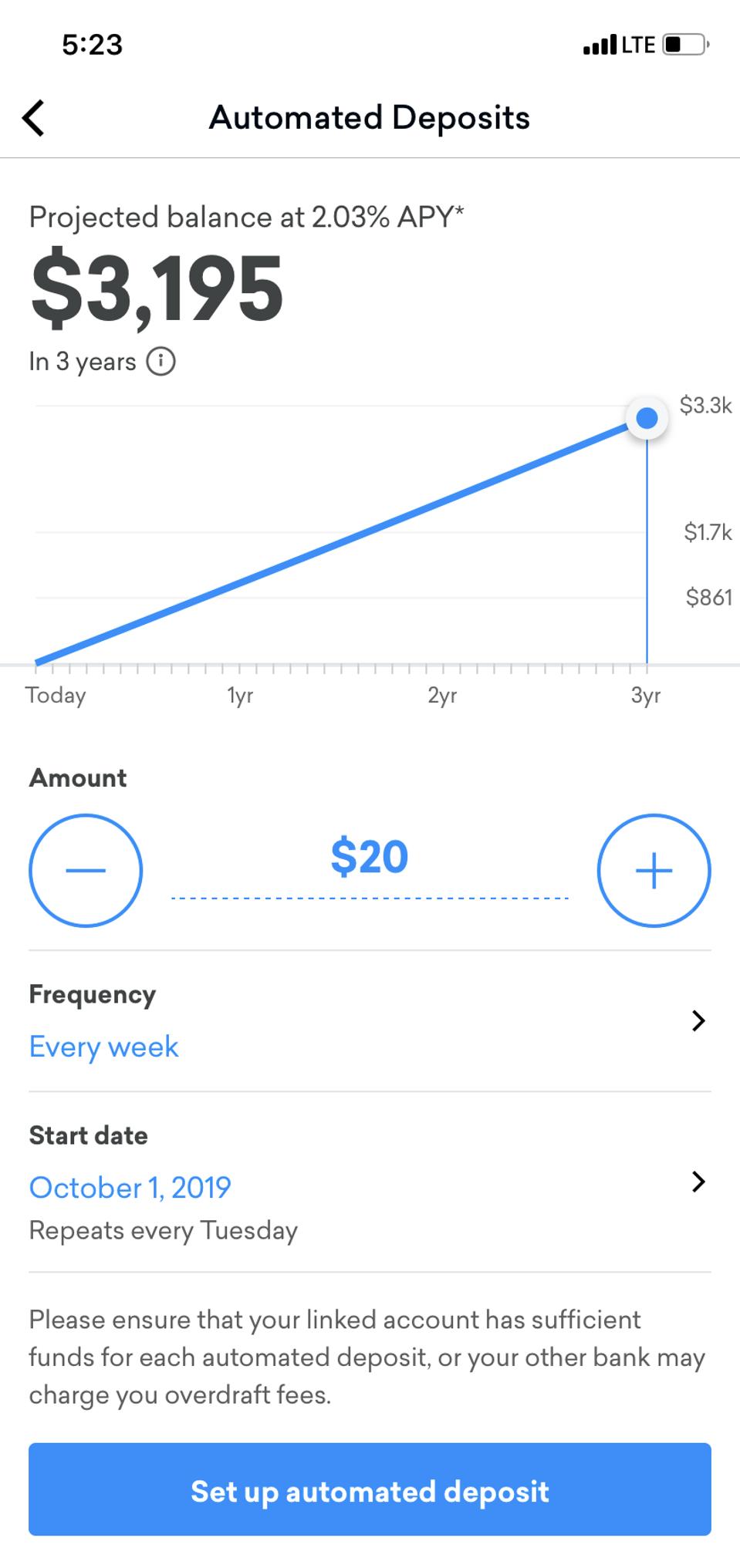

Credit Karma Savings is a high-yield savings account that may be a good fit for those looking to maximize their earnings. But to be fair thats likely by design. From my understanding Credit Karma moves funds in between these banks based on who has the best current.

This free account allows users to earn a healthy interest rate currently 130 APY as of March 11th 2020. After all the service isnt a bank but a general personal finance tool. Now it even offers a high-yield savings account which happens to be an attractive option for plenty of.

Credit Karma is completely free but you must have an existing account to open a Credit Karma Money Save account. This is managed through their banking partner MVB Bank Inc Member FDIC. Credit Karma is the latest fintech firm to launch a high-yield savings account.

Credit Karma Savings is a high-yield savings account that currently comes with a 030 APY as of February 2021 which is significantly higher than the national average of. Many people ask if getting your credit score from Credit Karma will damage your credit. Grow your savings at a rate more than 2x.

Most people sign up to Credit Karma just to enjoy the free credit score and credit report and free monitoring service. With some new account registrations you may only need to use the last 4 digits see image. Final Thoughts on Credit Karma Savings.

But keep in mind that you dont have to apply for any credit cards or loans. In Savings Accounts from Credit Karma. The new feature is the companys first venture into offering bank products to its members.

Its at 100 if everybody recommends the provider and at -100 when no one recommends. Credit Karma is known as a great resource for consumers to monitor their credit. This product is mostly recommended by SuperMoney users with a score of 30 equating to 36 on a 5 point rating scale.

Yes Credit Karma is extremely safe. The latest example of this is their Credit Karma Savings product. Recommendation score measures the loyalty between a provider and a consumer.

Credit Karma is hardly the first fintech to get into the high yield savings account game. The bottom line on Credit Karma Savings. While its higher than the national average of 004 youll find higher rates with other savings accounts like Chime or Axos High Yield savings.

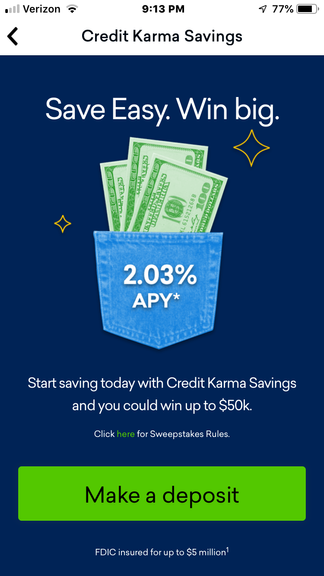

Easily do everything from the app. The answer is no. Credit Karma has launched a high yield savings account offering 19 APY.

Therefore its hard to be too upset about a feature that is merely a value-add to a larger ecosystem. If your main goal is to rack. Credit Karma receives compensation from third-party advertisers but that doesnt affect our editors opinions.

With any credit service you must be identified by your Social Security number. Credit Karma Money Save is always 100 free no matter your balance. Once it has your credit report it can use that information to match you with lenders.

Credit Karma Savings Over the years Credit Karma has expanded its offerings and ventured into other areas of personal finance. But with the Federal Reserve cutting interest rates high-yield savings rates are harder to find. Credit Karma offers you a free credit score so it can pull your credit report.

So in case you were wondering if Credit Karma is a safe legit and trustworthy company the answer is a resounding yes Credit Karma is safe. Credit Karma Savings offers a number of attractive incentives like a competitive APY no fees and a high maximum amount of 5 million thats eligible for FDIC insurance. In a Nutshell.

But its tens of. According to the press release this uses a network of more than 800 banks. There are lots of benefits to this account but you should be aware of the possible drawbacks to opening this account.

This account has no monthly fees.

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma Savings High Apy No Monthly Fees

![]() Credit Karma High Yield Savings Account Review 2020

Credit Karma High Yield Savings Account Review 2020

Credit Karma High Yield Savings Accounts Making Money Work For You

Credit Karma High Yield Savings Accounts Making Money Work For You

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma High Yield Savings Accounts Making Money Work For You

Credit Karma High Yield Savings Accounts Making Money Work For You

Credit Karma Unveils New High Yield Savings Accounts Finovate

Credit Karma Unveils New High Yield Savings Accounts Finovate

Credit Karma Simplifies Savings With High Yield Accounts1 In As Easy As Four Clicks To Get Started Business Wire

Credit Karma Simplifies Savings With High Yield Accounts1 In As Easy As Four Clicks To Get Started Business Wire

Credit Karma Review Get Your Free Credit Score Pt Money

Credit Karma Review Get Your Free Credit Score Pt Money

Credit Karma Savings High Apy No Monthly Fees

Credit Karma Launches High Yield Savings Account

Credit Karma Launches High Yield Savings Account

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Launches A New Savings Account With 1 90 Apy

Comments

Post a Comment