What Is Home Insurance Premium

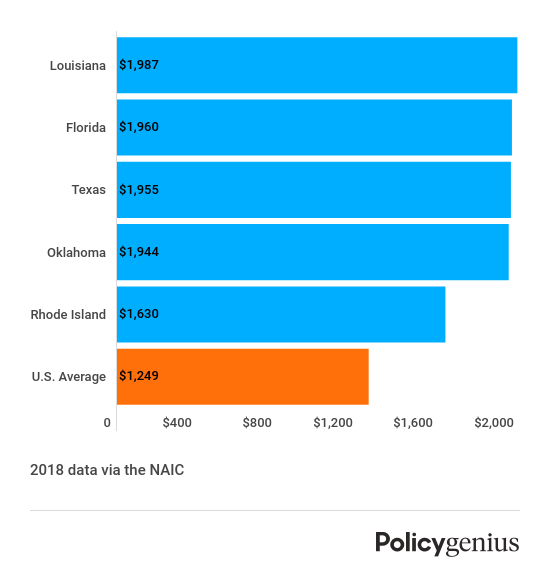

Most people pay their premium on a monthly basis but others choose to pay the. Location - Your insurance premiums are largely determined by location factors like your ZIP code and how at-risk your home is to being burglarized or damaged by a natural hazard like a hurricane or wildfire Coverage amounts - Insurance rates will vary depending on.

Insurance premiums are paid for policies that cover healthcare.

What is home insurance premium. It is tied to the value of your home and property. A premium is an amount an insurance company charges for health life auto or homeowners coverage. Homeowners insurance costs an average of 1445 annually but premiums vary greatly by state from 598 annually in the least expensive state to 2559 annually in the most expensive state.

26 Zeilen Your homeowners insurance premium is the amount you pay to keep your home insurance policy. Your homeowners insurance premium is the amount of money you pay every year to keep your insurance policy active. Unlike the requirement to buy PMI the requirement to buy homeowners insurance is not related to the amount of the down payment that you make on your home.

When you get a price quote an insurance agent will look at some personal factors and details about your home to calculate a specific rate. This puts the average monthly premium at around 120 but keep in mind that insurers adjust their pricing in response to some highly local factors such as your level of exposure to natural disasters. The following table shows our findings from the most.

When they go up on the roof they may find some issues but then claim the whole roof needs replacing. The sum a person pays in premiums also referred to as the rate is determined by several factors including age health and the area a person lives in. Insurance premiums will vary depending on the type of coverage you are seeking.

Homeowners insurance also known as home insurance is coverage that is required by all mortgage lenders for all borrowers. Some factors are completely out of your control and others you can change. According to the Insurance.

Tenure Duration of the home insurance policy affects the premium. According to the Insurance Information Institute most insurance companies will provide coverage for 50 to 70 of the amount of insurance you have on the structure of your home. Friedlander says this is allowed because of legal precedent.

Your home insurance premium is what you pay your insurance provider for covering your home under their home insurance policy. The insurance premium is the amount of money paid to the insurance company for the insurance policy you are purchasing. An insurance premium is the amount of money charged by a company for active coverage.

What Is an Insurance Premium. The premium for home buildings and household articles insurance is determined basis of the cost of your property and value of content. The premiums of this necessary insurance coverage like the property taxes charged by your local community are expenses that will continue as long as you own the structure.

Simply defined an insurance premium is the price of your insurance policy. Home insurance calculator state minimum homeowners insurance home insurance premium fee homeowners insurance quotes comparison 10 top homeowners insurance companies what is homeowners insurance premium home insurance premium calculator low cost home insurance Theosophical Society people accountable for years must obtain compensation. Your insurance history where you live and other factors are used as part of the calculation to determine the insurance premium price.

Purchasing a home can provide benefits to the owner but the investment must be protected with homeowners insurance. The average cost of homeowners insurance in the US. Your homeowners insurance premium is simply the cost of your insurance policy.

We collected thousands of homeowners insurance quotes and calculated the average premium for each state. When you buy home or auto insurance you sign a contract that says you agree to pay your premium in exchange for a certain amount of coverage from the insurance company. The insurance premium is higher in case of higher the value of property and content vice versa.

An insurance premium is the amount of money an individual or business pays for an insurance policy. It is calculated based on the type of coverage you choose for your home as well as any additional coverage you buy for either your possessions or specific incidents. Is 1445 per year based on a typical level of coverage.

Calameo Homeowner S Insurance Things You Should Know

Calameo Homeowner S Insurance Things You Should Know

5 Best Homeowners Insurance Companies Of 2021 Money

5 Best Homeowners Insurance Companies Of 2021 Money

Home Insurance Home Insurance Policy Online In India 2017

Home Insurance Home Insurance Policy Online In India 2017

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

Homeowners Insurance For Burst Pipes And Water Leaks Forbes Advisor

Homeowners Insurance For Burst Pipes And Water Leaks Forbes Advisor

5 Best Homeowners Insurance Companies Of 2021 Money

5 Best Homeowners Insurance Companies Of 2021 Money

Aarp Homeowner Insurance Insurancehomeowner Life Insurance Facts Homeowners Insurance Coverage Home Insurance Quotes

Aarp Homeowner Insurance Insurancehomeowner Life Insurance Facts Homeowners Insurance Coverage Home Insurance Quotes

What Is A Homeowners Insurance Premium Bankrate

What Is A Homeowners Insurance Premium Bankrate

.svg)

Average Cost Of Homeowners Insurance Quotewizard

Average Cost Of Homeowners Insurance Quotewizard

5 Best Homeowners Insurance Companies Of 2021 Money

5 Best Homeowners Insurance Companies Of 2021 Money

Comments

Post a Comment